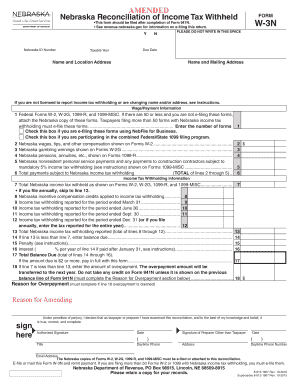

W 3n Form

What is the W-3N?

The W-3N form is a critical document used in the United States for reporting income and tax information for non-profit organizations. It serves as a summary of all W-2 forms issued by an organization, detailing the total wages paid and taxes withheld for employees. This form is essential for ensuring compliance with federal tax regulations and for reporting to the Internal Revenue Service (IRS).

How to use the W-3N

To effectively use the W-3N form, organizations must first gather all relevant W-2 forms issued during the tax year. The W-3N consolidates this information, allowing for a streamlined reporting process. Organizations should accurately fill out the form, ensuring that all totals match the individual W-2 forms. Once completed, the W-3N is submitted to the IRS along with the W-2 forms, either electronically or via mail.

Steps to complete the W-3N

Completing the W-3N involves several key steps:

- Collect all W-2 forms issued during the tax year.

- Ensure that the totals for wages and taxes withheld on the W-3N match those reported on the W-2 forms.

- Fill out the W-3N form accurately, including the organization’s name, address, and Employer Identification Number (EIN).

- Review the form for any errors or omissions.

- Submit the completed W-3N along with the W-2 forms to the IRS by the designated deadline.

Legal use of the W-3N

The W-3N form is legally required for non-profit organizations to report employee wages and taxes to the IRS. Proper completion and timely submission of this form help ensure compliance with federal tax laws. Failure to submit the W-3N can result in penalties, including fines and increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing the W-3N. Typically, the form must be submitted to the IRS by the end of January following the tax year. If filing electronically, organizations may have until the end of March to submit. It is crucial to be aware of these dates to avoid penalties and ensure compliance.

IRS Guidelines

The IRS provides detailed guidelines for completing and submitting the W-3N form. Organizations should refer to the IRS instructions for the W-3N to ensure they meet all requirements. This includes understanding the necessary information to report and how to handle any discrepancies between the W-2 and W-3N forms.

Quick guide on how to complete w 3n

Finish W 3n effortlessly on any gadget

Web-based document management has become favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle W 3n on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign W 3n without any hassle

- Obtain W 3n and click Get Form to initiate.

- Utilize the tools we provide to finish your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device of your choice. Edit and eSign W 3n and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 3n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with w 3n?

airSlate SignNow is a versatile eSignature solution designed to streamline document workflows, including those involving w 3n. With its user-friendly interface, businesses can easily send and electronically sign documents, saving time and reducing paperwork. This solution enhances efficiency while ensuring compliance with legal standards.

-

How does airSlate SignNow pricing work for w 3n solutions?

airSlate SignNow offers flexible pricing plans tailored to meet diverse business needs regarding w 3n. Whether you're a small business or a large enterprise, you can find a plan that fits your budget. Each plan provides access to essential features, ensuring you get the most value for your investment.

-

What features does airSlate SignNow offer for w 3n document management?

airSlate SignNow includes powerful features like document templates, reminders, and workflows specifically designed for w 3n needs. Users can automate repetitive tasks and ensure that all documents are handled efficiently. This set of features not only saves time but also enhances productivity across teams.

-

Can I integrate airSlate SignNow with other tools for w 3n processes?

Yes, airSlate SignNow offers seamless integrations with popular tools and platforms to enhance your w 3n experience. Integrate effortlessly with CRM systems, cloud storage, and productivity apps to centralize your document management process. This connectivity allows for a more streamlined workflow and better collaboration.

-

What are the benefits of using airSlate SignNow for w 3n?

Using airSlate SignNow for w 3n brings numerous benefits, including improved efficiency, reduced costs, and enhanced security. The platform enables real-time document tracking and offers audit trails, ensuring compliance and accountability. These advantages help businesses to not only save time but also build trust with their clients.

-

How secure is airSlate SignNow for w 3n eSignatures?

Security is a top priority for airSlate SignNow, especially for w 3n eSignatures. The platform utilizes advanced encryption protocols and complies with industry standards to protect your documents. You can confidently send and sign documents knowing that your sensitive information is safeguarded throughout the process.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides comprehensive customer support for users dealing with w 3n. Our dedicated support team is available via chat, email, and phone to assist you with any questions or issues you may encounter. We aim to ensure a smooth experience for all our customers.

Get more for W 3n

Find out other W 3n

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template