Schedule E Worksheet Form

What is the Schedule E Worksheet

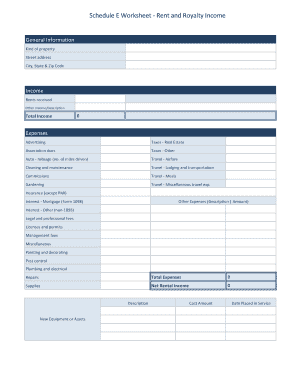

The Schedule E worksheet is a crucial tax form used by individuals and entities in the United States to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. This form allows taxpayers to detail their rental income and associated expenses, helping to determine their taxable income. The Schedule E is typically filed alongside Form 1040, the individual income tax return, making it an essential part of the tax filing process for those involved in rental property management or other relevant activities.

How to Use the Schedule E Worksheet

Using the Schedule E worksheet involves several steps to ensure accurate reporting of rental income and expenses. Start by gathering all necessary documents, including rental agreements, receipts for expenses, and any relevant financial statements. Next, fill out the worksheet by entering your rental income in the designated section. Be sure to list all allowable expenses, such as repairs, maintenance, property management fees, and mortgage interest. After completing the worksheet, transfer the totals to your Form 1040, ensuring that all calculations are accurate to avoid potential issues with the IRS.

Steps to Complete the Schedule E Worksheet

Completing the Schedule E worksheet requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents related to your rental properties.

- Enter your total rental income from all properties on the worksheet.

- List all allowable expenses, including repairs, utilities, and property management fees.

- Calculate your net rental income or loss by subtracting total expenses from total income.

- Transfer the net amount to your Form 1040.

Ensure that you keep copies of all documents for your records, as they may be needed for future reference or in case of an audit.

Legal Use of the Schedule E Worksheet

The Schedule E worksheet is legally recognized as a valid method for reporting rental income and expenses to the IRS. To ensure compliance, it is essential to follow IRS guidelines regarding allowable deductions and accurate reporting of income. Properly completing the Schedule E not only helps in maintaining legal compliance but also maximizes potential tax benefits. It is advisable to consult with a tax professional if you have questions about specific deductions or legal requirements related to your rental properties.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule E worksheet, which are essential for accurate tax reporting. These guidelines detail what constitutes rental income, allowable expenses, and the process for reporting losses. Taxpayers should refer to the IRS instructions for Schedule E to understand the nuances of reporting income from different sources, such as partnerships or S corporations. Staying informed about these guidelines helps prevent errors that could lead to penalties or audits.

Required Documents

To complete the Schedule E worksheet accurately, several documents are necessary. These include:

- Rental agreements or leases that outline the terms of rental income.

- Receipts and invoices for all expenses related to property maintenance and management.

- Financial statements that provide an overview of income and expenses.

- Any documentation related to depreciation of the property.

Having these documents organized and readily available will streamline the process of filling out the Schedule E worksheet and ensure compliance with IRS requirements.

Quick guide on how to complete schedule e worksheet

Effortlessly Prepare Schedule E Worksheet on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate format and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Schedule E Worksheet on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Schedule E Worksheet with ease

- Find Schedule E Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically made available by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then press the Done button to save your changes.

- Choose how you prefer to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and eSign Schedule E Worksheet to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule e worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule E worksheet and how can it benefit my business?

A schedule E worksheet is a document used to report income or loss from rental real estate and other sources on your tax return. Utilizing a schedule E worksheet can simplify your bookkeeping and ensure accurate reporting, maximizing potential deductions and minimizing errors. By integrating this tool into your financial documentation process, you can streamline tax preparation.

-

How does airSlate SignNow help with completing a schedule E worksheet?

airSlate SignNow offers a seamless eSignature solution that allows you to fill out and sign your schedule E worksheet digitally. This not only saves time but also ensures that your documents are secure and easily accessible. Our platform simplifies collaboration, letting multiple parties sign and share the worksheet efficiently.

-

Is airSlate SignNow affordable for small businesses needing a schedule E worksheet?

Yes, airSlate SignNow is designed with cost-effectiveness in mind, making it affordable for small businesses. Our pricing plans are competitive, offering excellent value for features like eSigning and document management, which includes support for a schedule E worksheet. This means you get top-notch service without stretching your budget.

-

What features do airSlate SignNow provide that assist with a schedule E worksheet?

With airSlate SignNow, you can create, edit, and send your schedule E worksheet with custom templates and workflows. Key features include electronic signatures, secure document storage, and real-time tracking, all of which enhance the efficiency of managing your worksheets. These tools help ensure compliance and reduce the risk of discrepancies.

-

Can I integrate airSlate SignNow with other accounting software for managing my schedule E worksheet?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to manage your schedule E worksheet and other financial documents seamlessly. This connectivity makes it easier to pull in data and ensures that your worksheet is consistent with your overall financial records. The integrations help in streamlining your accounting processes.

-

How can I ensure my schedule E worksheet is secure when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your schedule E worksheet and all documents during transmission and storage. Additionally, features like two-factor authentication and access controls ensure that only authorized users can view or edit your sensitive information.

-

What support does airSlate SignNow offer if I have questions about my schedule E worksheet?

We offer comprehensive support for all users needing assistance with their schedule E worksheet or any other feature. Our customer service team is available through multiple channels, including live chat, email, and phone support. We also provide a robust knowledge base filled with helpful articles and tutorials to guide you through any inquiries.

Get more for Schedule E Worksheet

- Borang ssm 53842444 form

- Apria wound vac form

- Gtbank atm card request form

- Merchant navy joining letter download form

- Section 47 and 48 notice template form

- Annexure 2 bonafide certificate for pms scholarship from college form

- Parenting education and mediation services form

- Order for index cd rom form

Find out other Schedule E Worksheet

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template