De1326e 2021-2026

What is the De1326e

The De1326e is a specific form used within various administrative and legal contexts in the United States. It serves as a crucial document for individuals and businesses, ensuring compliance with specific regulations. This form is often required for various applications, including tax filings and legal documentation. Understanding its purpose and requirements is essential for effective completion and submission.

How to use the De1326e

Using the De1326e involves several steps to ensure accurate completion. First, gather all necessary information and documents required for the form. Next, fill out the form carefully, ensuring all fields are completed accurately. It is important to review the form for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the specific requirements associated with the De1326e.

Steps to complete the De1326e

Completing the De1326e requires a systematic approach:

- Collect necessary personal and financial information.

- Download or access the De1326e form from the relevant authority.

- Fill out the form, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Submit the form through the designated method.

Legal use of the De1326e

The legal use of the De1326e is governed by specific regulations that ensure its validity. When filled out correctly, the De1326e can serve as a legally binding document, provided it meets all necessary requirements. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to complications or penalties.

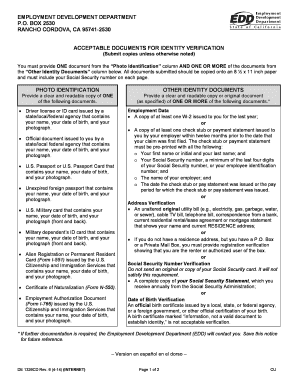

Required Documents

To complete the De1326e, certain documents may be required. These documents typically include identification, proof of residency, and any other relevant financial information. Having these documents ready can streamline the process and help avoid delays in submission.

Form Submission Methods

The De1326e can be submitted through various methods, depending on the specific requirements of the issuing authority. Common submission methods include:

- Online submission via the official website.

- Mailing the completed form to the designated address.

- In-person submission at the relevant office.

IRS Guidelines

When dealing with tax-related matters, it is crucial to adhere to IRS guidelines regarding the De1326e. These guidelines outline the necessary steps for filing, deadlines, and any additional requirements that must be met to ensure compliance. Familiarizing oneself with these guidelines can help prevent errors and ensure timely processing of the form.

Quick guide on how to complete de1326e

Complete De1326e effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without interruptions. Manage De1326e on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related task today.

How to modify and eSign De1326e effortlessly

- Obtain De1326e and click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal weight as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign De1326e to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de1326e

Create this form in 5 minutes!

How to create an eSignature for the de1326e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is de1326cd and how does it relate to airSlate SignNow?

The term de1326cd refers to a specific feature or identifier within the airSlate SignNow platform. It is designed to streamline document signing processes and enhance user experience. Understanding how de1326cd works can help you maximize your efficiency while using airSlate SignNow.

-

What pricing plans does airSlate SignNow offer for the de1326cd solution?

airSlate SignNow provides various pricing tiers, accommodating businesses of all sizes. Each plan includes the benefits of the de1326cd feature, which enhances document signing capabilities. You can choose a plan that best fits your budget and needs.

-

What are the key features of airSlate SignNow related to de1326cd?

The de1326cd feature encompasses a range of functionalities, such as customizable templates, robust security measures, and seamless collaboration tools. These features are designed to improve the efficiency of document workflows. By utilizing de1326cd, users can streamline their signing processes signNowly.

-

How does de1326cd benefit businesses using airSlate SignNow?

Businesses leveraging the de1326cd feature can experience reduced turnaround times for document signing, leading to faster business transactions. The user-friendly interface of airSlate SignNow encourages productivity and helps organizations save time and resources. Ultimately, the de1326cd solution enhances overall operational efficiency.

-

Can I integrate de1326cd with other software applications?

Yes, airSlate SignNow supports various integrations for the de1326cd feature with popular software applications such as CRMs and document management systems. This interoperability allows you to enhance your workflow and maintain a seamless digital ecosystem. You can leverage these integrations to boost productivity across your organization.

-

What industries can benefit from using de1326cd with airSlate SignNow?

The de1326cd feature is beneficial for a variety of industries, including healthcare, real estate, and finance. These sectors often require efficient document signing solutions to manage contracts and agreements. By utilizing airSlate SignNow’s de1326cd functionality, businesses can enhance compliance and streamline operations.

-

Is training available for using the de1326cd feature in airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive training resources and customer support to help users understand and utilize the de1326cd feature effectively. Whether through tutorials, webinars, or personalized support, you'll have the tools needed to maximize your use of airSlate SignNow.

Get more for De1326e

- Personal estimated tax form

- Yes bank personal loan agreement pdf 267333 form

- Printable insurance verification form 15064261

- Body check form 56712962

- Da form 7631

- Psb lpn judgement and comprehension form

- Stop 6525 sp cis form

- Instructions for form 1120 f instructions for form 1120 f u s income tax return of a foreign corporation 732269227

Find out other De1326e

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application