Et 117 Form

What is the Et 117

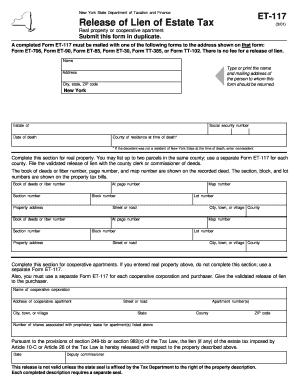

The Et 117 is a specific form utilized in the United States for tax-related purposes. It is primarily associated with the state of New York and is used to report certain financial information to the state tax authorities. Understanding the purpose of the Et 117 is essential for individuals and businesses who need to comply with state tax regulations. The form helps ensure accurate reporting and compliance, which is crucial for avoiding penalties and maintaining good standing with tax authorities.

How to use the Et 117

Using the Et 117 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents and records that pertain to the reporting period. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to double-check the information for accuracy, as errors can lead to delays or penalties. Once completed, the form can be submitted according to the specified guidelines, either electronically or by mail.

Steps to complete the Et 117

Completing the Et 117 requires a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense records.

- Obtain the latest version of the Et 117 form from the appropriate state tax authority.

- Fill out the form, ensuring all required fields are completed, including personal and financial information.

- Review the form for any errors or omissions, as accuracy is crucial.

- Submit the form according to the instructions provided, either electronically or via mail.

Legal use of the Et 117

The legal use of the Et 117 is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the specified deadlines. Compliance with state regulations is essential to avoid potential penalties. The Et 117 serves as an official document that may be required for audits or other legal inquiries, making its proper use vital for individuals and businesses alike.

Key elements of the Et 117

Several key elements are essential to understand when working with the Et 117. These include:

- Identification Information: This includes the taxpayer's name, address, and identification number.

- Financial Data: Accurate reporting of income, deductions, and other relevant financial information is crucial.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate its contents.

- Submission Method: Understanding how to submit the form, whether electronically or by mail, is important for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Et 117 can vary depending on the specific tax year and the individual's or business's circumstances. It is important to be aware of these deadlines to avoid late fees or penalties. Typically, the form must be filed by a certain date following the end of the tax year. Keeping track of these important dates is essential for timely compliance with state tax regulations.

Quick guide on how to complete et 117

Complete Et 117 effortlessly on any device

Digital document management has become increasingly sought after by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Et 117 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Et 117 without hassle

- Find Et 117 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically available through airSlate SignNow for that purpose.

- Produce your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and hit the Done button to finalize your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form hunts, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Et 117 to ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the et 117

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 117 and how does it benefit businesses?

The et 117 is a powerful feature of airSlate SignNow that enables businesses to streamline their document signing processes. By integrating this functionality, companies can reduce turnaround times and improve efficiency, ensuring that important contracts and agreements are signed quickly and securely.

-

How much does the et 117 feature cost?

Pricing for the et 117 feature in airSlate SignNow varies based on the selected subscription plan. We offer flexible pricing options designed to fit different business sizes and needs, allowing you to choose the best plan that includes the powerful et 117 capabilities.

-

Can I integrate et 117 with other software applications?

Yes, the et 117 feature seamlessly integrates with various popular software applications, enhancing your workflow. Whether you are using CRM platforms, project management tools, or cloud storage solutions, airSlate SignNow ensures that the et 117 functionality complements your existing systems.

-

What security measures are in place for documents signed using et 117?

When using the et 117 feature, airSlate SignNow employs industry-leading security measures to protect your documents. This includes encryption, secure access controls, and compliance with regulations, ensuring that your documents are signed securely and confidentially.

-

Is the et 117 feature suitable for small businesses?

Absolutely! The et 117 feature is designed with ease of use and cost-effectiveness in mind, making it ideal for small businesses. With its intuitive interface and powerful capabilities, even teams with limited resources can efficiently manage their document signing processes.

-

What types of documents can I eSign using the et 117 feature?

With the et 117 feature, you can eSign a wide range of documents including contracts, agreements, and forms. airSlate SignNow supports various file formats, allowing you to handle virtually any document that requires signatures efficiently.

-

Can multiple users collaborate on documents using et 117?

Yes, the et 117 functionality allows for multiple users to collaborate on documents simultaneously. This enhances teamwork and ensures that all relevant stakeholders can provide their input and signatures, making the signing process smoother and faster.

Get more for Et 117

Find out other Et 117

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe