Annuity 1035 Exchange and TransferRollover Form

What is the Annuity 1035 Exchange and Transfer Rollover Form

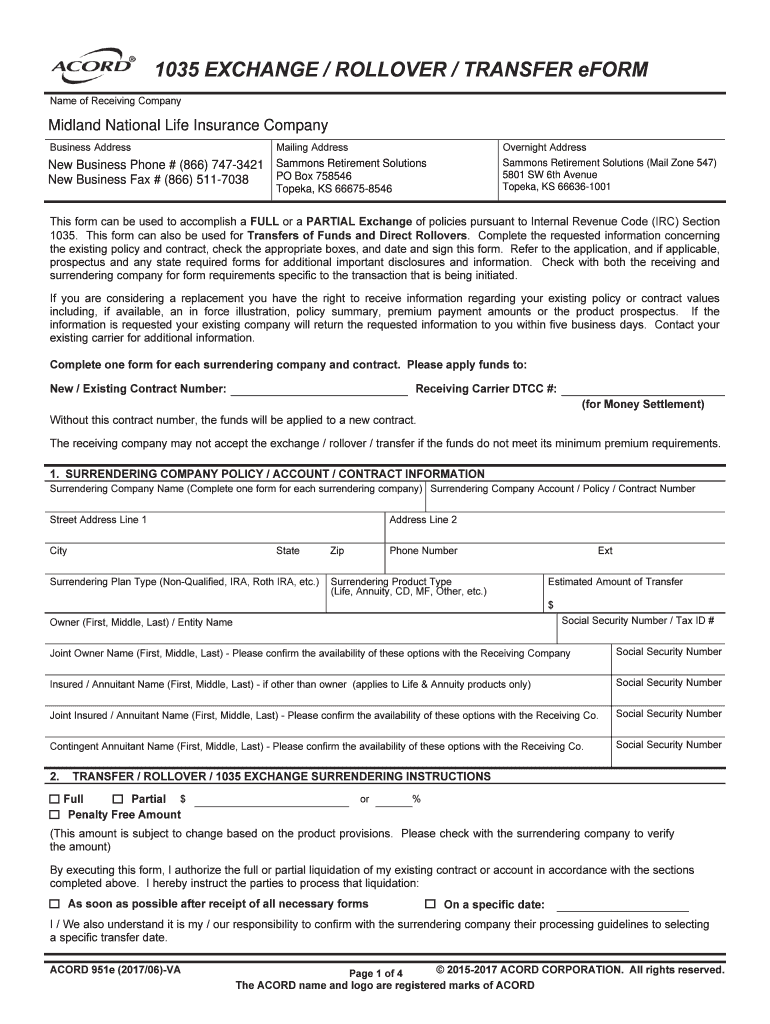

The Annuity 1035 Exchange and Transfer Rollover Form, commonly referred to as the 1035 form, is a crucial document used in the transfer of funds between annuity contracts. This form allows policyholders to move their investment from one annuity to another without incurring immediate tax liabilities. The 1035 exchange is particularly beneficial for individuals looking to consolidate their retirement savings or to switch to a more favorable annuity product. By using this form, individuals can maintain the tax-deferred status of their investments during the transfer process.

Steps to Complete the Annuity 1035 Exchange and Transfer Rollover Form

Completing the 1035 form involves several key steps to ensure a smooth and compliant transfer process. First, gather all necessary information about the existing annuity and the new annuity you wish to purchase. This includes details such as policy numbers, the issuing company, and contract values. Next, fill out the form accurately, providing personal information and specifying the amount to be transferred. It is essential to review the form for any errors before submission. Finally, submit the completed form to the new insurance company, which will handle the transfer process on your behalf.

Legal Use of the Annuity 1035 Exchange and Transfer Rollover Form

The 1035 form is legally recognized under U.S. tax law, allowing for tax-free exchanges between annuities. To ensure compliance, it is important to adhere to the guidelines set forth by the Internal Revenue Service (IRS). The form must be used strictly for qualifying exchanges, such as transferring funds from one annuity to another or from a life insurance policy to an annuity. Misuse of the form, such as attempting to cash out an annuity instead of transferring it, could result in tax penalties. Understanding these legal parameters is crucial for maintaining the tax-deferred status of your investments.

Required Documents for the Annuity 1035 Exchange and Transfer Rollover Form

To successfully complete the 1035 form, certain documents are typically required. These may include:

- Current annuity contract details, including policy numbers and values

- Identification documents, such as a driver's license or Social Security number

- Information about the new annuity product, including the name of the issuing company

- Any additional forms required by the new insurance company

Having these documents ready will facilitate a smoother completion of the 1035 exchange process.

Examples of Using the Annuity 1035 Exchange and Transfer Rollover Form

There are various scenarios in which individuals might utilize the 1035 form. For instance, a retiree may wish to exchange an older annuity with lower interest rates for a new product offering better returns. Alternatively, someone may want to consolidate multiple annuities into a single contract for easier management. Each of these examples illustrates the flexibility of the 1035 exchange, allowing individuals to adapt their retirement strategies to changing financial needs.

Eligibility Criteria for the Annuity 1035 Exchange and Transfer Rollover Form

Eligibility for using the 1035 form generally requires that the annuity contracts involved are both issued by licensed insurance companies. Additionally, the policyholder must be the same individual on both the existing and new contracts. It is also important that the exchange qualifies under IRS guidelines to maintain tax-deferred status. Individuals should verify their eligibility before initiating the exchange to avoid potential tax implications.

Quick guide on how to complete annuity 1035 exchange and transferrollover form

Complete Annuity 1035 Exchange And TransferRollover Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and without hassle. Manage Annuity 1035 Exchange And TransferRollover Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

The simplest method to alter and eSign Annuity 1035 Exchange And TransferRollover Form with ease

- Obtain Annuity 1035 Exchange And TransferRollover Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign Annuity 1035 Exchange And TransferRollover Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annuity 1035 exchange and transferrollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1035 exchange form?

A 1035 exchange form is a legal document that allows for the tax-free transfer of funds from one life insurance policy or annuity to another. This process helps individuals to maintain their investment growth without incurring tax liabilities. Utilizing a 1035 exchange form can enhance your financial strategy when dealing with insurance products.

-

How does airSlate SignNow assist with the 1035 exchange form?

airSlate SignNow offers a seamless platform for safely signing and sending your 1035 exchange form. With our user-friendly interface, you can quickly complete and submit the necessary documentation electronically, ensuring a smooth and efficient process. Our solution streamlines the workflow associated with managing such important financial documents.

-

Is there a cost associated with using airSlate SignNow for the 1035 exchange form?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By investing in our cost-effective solution, you can efficiently manage multiple 1035 exchange forms without sacrificing quality or accessibility. Explore our pricing page for detailed information on plans that suit your business needs.

-

What features does airSlate SignNow offer for eSigning a 1035 exchange form?

With airSlate SignNow, you can easily eSign your 1035 exchange form using our secure and legally binding platform. Key features include customizable templates, document tracking, and the ability to gather signatures from multiple parties quickly. Our tools ensure that your signing process remains efficient and straightforward.

-

Can I integrate airSlate SignNow with other financial software for managing the 1035 exchange form?

Absolutely! airSlate SignNow offers integrations with numerous third-party applications, enabling you to synchronize data efficiently when handling the 1035 exchange form. This interoperability enhances your overall workflow and ensures that all relevant data is streamlined across platforms.

-

What benefits does airSlate SignNow provide for handling the 1035 exchange form?

Using airSlate SignNow for your 1035 exchange form enhances document security, reduces processing time, and minimizes human errors. The platform's electronic solutions allow for quicker turnaround times, which can be crucial when dealing with time-sensitive financial documents. Enjoy greater efficiency and peace of mind with our comprehensive eSigning solution.

-

Is airSlate SignNow compliant with regulations for processing a 1035 exchange form?

Yes, airSlate SignNow adheres to stringent legal and regulatory standards for electronic signatures and document processing. This compliance ensures that your 1035 exchange form is handled securely and in accordance with industry regulations. You can trust our platform to maintain the integrity of your important financial transactions.

Get more for Annuity 1035 Exchange And TransferRollover Form

- Dl7 form

- Peripheral vascular diagnostic intervention coding sheet form

- Va form 26 6705e

- Florida marriage license application pdf 380430766 form

- Revised 92412 used by chaparral mhc llc form

- Pre civil partnership agreement template form

- Project partnership agreement template form

- Property partnership agreement template form

Find out other Annuity 1035 Exchange And TransferRollover Form

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online