Get Your Used Vehicle Appraised for Tax Purposes during a Private Form

What is the Get Your Used Vehicle Appraised For Tax Purposes During A Private

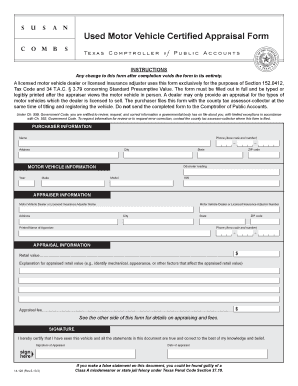

The form to get your used vehicle appraised for tax purposes during a private sale is a crucial document for individuals looking to determine the fair market value of their vehicle. This appraisal is often necessary for tax deductions or when reporting the sale of the vehicle to tax authorities. Accurately assessing the value helps ensure compliance with IRS regulations and can affect the amount of tax owed or refund received. The appraisal typically involves evaluating the vehicle's condition, mileage, and market trends.

Steps to Complete the Get Your Used Vehicle Appraised For Tax Purposes During A Private

Completing the appraisal form involves several important steps:

- Gather necessary information about the vehicle, including make, model, year, and VIN.

- Assess the vehicle's condition by inspecting its exterior, interior, and mechanical aspects.

- Research comparable sales in your area to establish a fair market value.

- Complete the appraisal form with accurate details and your calculated value.

- Sign and date the form to validate the appraisal.

Legal Use of the Get Your Used Vehicle Appraised For Tax Purposes During A Private

The legal use of this appraisal form is significant in ensuring compliance with tax laws. It serves as documentation to support the vehicle's value when filing taxes or during audits. The appraisal must be conducted by a qualified individual or entity to enhance its credibility. Properly executed, it can protect taxpayers from penalties associated with underreporting income or overstating deductions.

IRS Guidelines

The IRS provides specific guidelines regarding vehicle appraisals for tax purposes. Taxpayers must ensure that the appraisal reflects the fair market value at the time of the sale. Additionally, the IRS requires that any deductions taken for vehicle sales must be substantiated with appropriate documentation, including the appraisal form. Understanding these guidelines helps taxpayers navigate the complexities of tax reporting and compliance.

Required Documents

To complete the appraisal form accurately, certain documents are essential:

- Title of the vehicle, proving ownership.

- Service records that demonstrate maintenance and repairs.

- Previous tax returns that may include vehicle-related deductions.

- Any documentation related to the vehicle's purchase price or previous appraisals.

State-Specific Rules for the Get Your Used Vehicle Appraised For Tax Purposes During A Private

Each state may have its own regulations regarding vehicle appraisals for tax purposes. It is important to check local laws to ensure compliance. Some states may require specific forms or additional documentation to be submitted along with the appraisal. Understanding these state-specific rules can help avoid legal issues and ensure that the appraisal is recognized by local tax authorities.

Quick guide on how to complete get your used vehicle appraised for tax purposes during a private

Effortlessly Prepare Get Your Used Vehicle Appraised For Tax Purposes During A Private on Any Device

Managing documents online has gained traction with businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Get Your Used Vehicle Appraised For Tax Purposes During A Private on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Get Your Used Vehicle Appraised For Tax Purposes During A Private with Ease

- Obtain Get Your Used Vehicle Appraised For Tax Purposes During A Private and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that require reprinting new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Alter and eSign Get Your Used Vehicle Appraised For Tax Purposes During A Private to ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get your used vehicle appraised for tax purposes during a private

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to get your used vehicle appraised for tax purposes during a private sale?

To get your used vehicle appraised for tax purposes during a private sale, you can begin by gathering your vehicle’s records and details. Next, use an online appraisal tool or consult a certified appraiser. This ensures a fair market value is established, which is crucial for tax reporting.

-

How much does it cost to get your used vehicle appraised for tax purposes during a private transaction?

The cost to get your used vehicle appraised for tax purposes during a private transaction can vary depending on the appraisal service you choose. Typically, you can expect to pay anywhere from $50 to $300. Investing in a professional appraisal ensures accuracy and helps avoid potential tax issues.

-

What documents do I need to get my used vehicle appraised for tax purposes during a private sale?

To get your used vehicle appraised for tax purposes during a private sale, you should have your vehicle’s title, maintenance records, and any inspection reports. Additionally, vehicle identification numbers (VIN) and photographs of the vehicle can be helpful in assessing its condition during the appraisal process.

-

How do appraisers determine the value for tax purposes?

Appraisers use several factors to determine a vehicle’s value for tax purposes, including the make, model, year, mileage, and overall condition. They also evaluate the current market trends and recent sales of similar vehicles. This comprehensive approach ensures that you get your used vehicle appraised for tax purposes during a private sale correctly.

-

Are there any benefits to getting my used vehicle appraised for tax purposes during a private sale?

Yes, getting your used vehicle appraised for tax purposes during a private sale offers multiple benefits. It provides a clear, documented value that can help substantiate your tax returns. Additionally, a professional appraisal can protect you in case of any disputes or audits from tax authorities.

-

Can I use online tools to get my used vehicle appraised for tax purposes during a private sale?

Absolutely! There are numerous online tools available that can help you get your used vehicle appraised for tax purposes during a private sale quickly. These tools often use data from similar sales and current market trends to give you an estimated value, although they may not replace a professional appraisal.

-

How often should I get my vehicle appraised for tax purposes?

It’s advisable to get your vehicle appraised for tax purposes whenever you plan to transfer ownership or make signNow modifications. Regular appraisals keep you informed of your vehicle's value, ensuring you're prepared for private sales or reporting tax accurately.

Get more for Get Your Used Vehicle Appraised For Tax Purposes During A Private

- Printable dmv forms nevadas

- Code of conduct sign off form

- Nhics form 201 incident briefing amp operational log

- Print guest waiver spring lake community fitness and aquatic form

- Dog adoption application form preston county commission

- Mobile home sale agreement template form

- Dog stud fee contract template form

- Negotiation email contract template form

Find out other Get Your Used Vehicle Appraised For Tax Purposes During A Private

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word