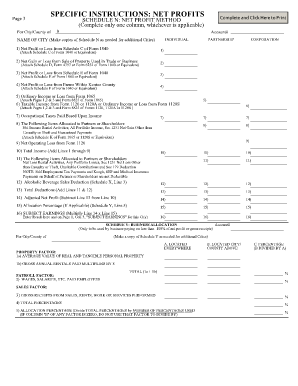

Kenton County Net Profit Return Form

What is the Kenton County Net Profit Return

The Kenton County net profit return is a tax form used by businesses operating within Kenton County, Kentucky, to report their net profits for the year. This form is essential for ensuring compliance with local tax regulations and contributes to the county's revenue. It is typically required for various business entities, including corporations, partnerships, and sole proprietorships, to accurately declare their earnings and pay the corresponding local taxes.

How to use the Kenton County Net Profit Return

To effectively use the Kenton County net profit return, businesses must first gather relevant financial information, including total revenue, expenses, and any applicable deductions. The form requires detailed reporting of these figures to calculate the net profit. Once completed, the return must be submitted to the appropriate local tax authority, either electronically or via mail, depending on the filing options available. Ensuring accuracy in this process is crucial to avoid penalties and ensure compliance with local tax laws.

Steps to complete the Kenton County Net Profit Return

Completing the Kenton County net profit return involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate figures for total revenue, allowable deductions, and expenses.

- Calculate the net profit by subtracting total expenses from total revenue.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or by mail.

Legal use of the Kenton County Net Profit Return

The Kenton County net profit return is legally binding when completed and submitted in accordance with local tax laws. To ensure its validity, businesses must adhere to the requirements set forth by the Kenton County tax authority, including accurate reporting of financial data and timely submission. Electronic submissions are considered legally binding if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Kenton County net profit return typically align with the federal tax deadlines. Businesses should be aware of the specific due dates to avoid late fees and penalties. It is advisable to check with the Kenton County tax authority for any updates or changes to the filing schedule, as local regulations may vary.

Required Documents

To complete the Kenton County net profit return, businesses must have several documents on hand, including:

- Income statements that detail total revenue.

- Expense reports outlining all business-related costs.

- Any supporting documentation for deductions claimed.

- Previous year’s tax returns for reference, if applicable.

Penalties for Non-Compliance

Failure to file the Kenton County net profit return on time or inaccuracies in reporting can lead to penalties. These may include fines, interest on unpaid taxes, and potential legal action by the tax authority. Businesses are encouraged to maintain accurate records and file their returns promptly to avoid these consequences.

Quick guide on how to complete kenton county net profit return

Effortlessly manage Kenton County Net Profit Return on any device

Cloud-based document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any holdups. Engage with Kenton County Net Profit Return on any device using airSlate SignNow's Android or iOS applications and enhance your document-oriented procedures today.

The easiest way to edit and electronically sign Kenton County Net Profit Return effortlessly

- Obtain Kenton County Net Profit Return and click Get Form to begin.

- Utilize the functionalities we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes requiring reprinting of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Kenton County Net Profit Return to ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kenton county net profit return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kenton County net profit return, and why is it important?

The Kenton County net profit return is a financial report that businesses in Kenton County must file to summarize their net profits. This return is crucial for ensuring compliance with local tax regulations and for assessing the financial health of your business within the community.

-

How can airSlate SignNow assist with filing the Kenton County net profit return?

airSlate SignNow provides a seamless way to prepare and eSign your Kenton County net profit return documents. With our user-friendly interface, you can quickly create, edit, and finalize your returns, ensuring compliance and accuracy with ease.

-

What are the pricing options for using airSlate SignNow for the Kenton County net profit return?

airSlate SignNow offers various pricing plans that cater to different business needs, making it accessible to file your Kenton County net profit return. From basic plans to more comprehensive options, you can choose a solution that fits your budget while providing all necessary features for your return.

-

Are there any specific features in airSlate SignNow that help with the Kenton County net profit return?

Yes, airSlate SignNow includes features such as customizable templates and cloud storage that streamline the process of preparing your Kenton County net profit return. Additionally, document tracking and reminders ensure you never miss a filing deadline.

-

What are the benefits of using airSlate SignNow for Kenton County businesses?

Using airSlate SignNow for the Kenton County net profit return provides numerous benefits, including time-saving eSigning capabilities and enhanced compliance. Businesses can operate with more efficiency, allowing them to focus on growth rather than paperwork.

-

Can I integrate airSlate SignNow with other tools for managing my Kenton County net profit return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage your Kenton County net profit return in a streamlined manner. This integration ensures that all financial data is accurate and readily available for filing.

-

Is airSlate SignNow secure for submitting the Kenton County net profit return?

Yes, airSlate SignNow prioritizes security with bank-level encryption to protect your sensitive information when submitting the Kenton County net profit return. You can feel confident that your documents and data are safe from unauthorized access.

Get more for Kenton County Net Profit Return

- An overview of chapter 1301 management trusts form

- Coast guard auxiliary id card form

- Dbr smiley face form standard behaviors direct behavior

- 8 medicare surtax on investment income form

- Updating market participants on fannie maes multifamily issuance and form

- Mobile app development agreement template form

- Mobile app endr license agreement template form

- Mobile application development agreement template form

Find out other Kenton County Net Profit Return

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast