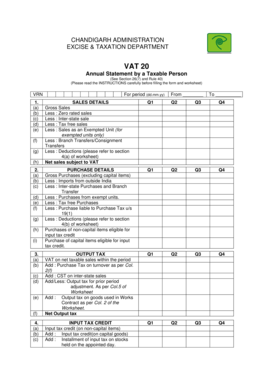

Vat 20 Chandigarh Gov Form

What is the VAT 20 form?

The VAT 20 form is a document used for reporting Value Added Tax (VAT) in specific jurisdictions. It is essential for businesses that are registered for VAT to accurately complete this form to ensure compliance with tax regulations. The form captures details about sales, purchases, and the amount of VAT owed or refundable. Understanding the purpose and requirements of the VAT 20 form is crucial for maintaining proper tax records and fulfilling legal obligations.

Steps to complete the VAT 20 form

Completing the VAT 20 form involves several key steps to ensure accuracy and compliance. Here are the main steps:

- Gather necessary documents, such as sales invoices and purchase receipts, to provide accurate figures.

- Fill in the business information, including the name, address, and VAT registration number.

- Report total sales and purchases, ensuring to separate taxable and exempt items.

- Calculate the VAT due based on the reported sales and purchases.

- Review the completed form for accuracy before submission.

Legal use of the VAT 20 form

The VAT 20 form is legally binding when completed and submitted according to the relevant tax laws. It serves as an official record of a business's VAT transactions. Compliance with the guidelines set forth by tax authorities is essential to avoid penalties. The form must be submitted by the specified deadlines to maintain good standing and avoid interest charges on unpaid VAT.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 20 form vary by jurisdiction but typically occur quarterly or annually. It is important for businesses to be aware of these deadlines to ensure timely submission. Missing a deadline can result in penalties or interest charges. Keeping a calendar of important dates related to VAT filings can help businesses stay organized and compliant.

Required Documents

To complete the VAT 20 form accurately, businesses must gather specific documents. These include:

- Sales invoices that detail the amount of VAT charged.

- Purchase receipts that show the VAT paid on business expenses.

- Previous VAT returns for reference and reconciliation.

Having these documents on hand will facilitate a smoother completion process and ensure all figures are accurate.

Form Submission Methods

The VAT 20 form can typically be submitted through various methods, including:

- Online submission through the tax authority's website, which is often the fastest option.

- Mailing a paper copy of the form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can depend on the business's preference and the specific requirements of the tax authority.

Quick guide on how to complete vat 20 chandigarh gov

Simplify Vat 20 Chandigarh Gov effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Vat 20 Chandigarh Gov on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Vat 20 Chandigarh Gov seamlessly

- Find Vat 20 Chandigarh Gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vat 20 Chandigarh Gov and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 20 chandigarh gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the last date for VAT return?

VAT Return Filing Due Date 30th Day after end of the Month if Vat Payable Less than Rs. 5000 and 40th Day after end of the Month if Vat Payable more than Rs. 5000. For Quarterly dealer 45 th Day after the end of the Quarter.

-

What is the due date for VAT return?

VAT Return Filing Due Date 30th Day after end of the Month if Vat Payable Less than Rs. 5000 and 40th Day after end of the Month if Vat Payable more than Rs. 5000. For Quarterly dealer 45 th Day after the end of the Quarter.

-

What is the deadline for submitting a VAT return?

The deadline for submitting VAT returns and making payment is usually one calendar month and seven days after the end of your VAT 'accounting period'. The accounting period is the period covered by the VAT return and is ordinarily three months in length.

-

How to file VAT return online?

Listed below are all the steps that you should follow for VAT return e-filing: Step 1: Log in. ... Step 2: Password Change. ... Step 3: Form 14D. ... Step 4: Complete the Form. ... Step 5:Generating XML. ... Step 6:Upload. ... Step 7:Correct Mistakes If Any. ... Step 8: Acknowledgement.

Get more for Vat 20 Chandigarh Gov

Find out other Vat 20 Chandigarh Gov

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now