Future Generali Satisfaction Form

What is the Future Generali Satisfaction Form

The Future Generali Satisfaction Form is a document designed to gather feedback from policyholders regarding their experiences with Future Generali products and services. This form serves as a vital tool for the company to assess customer satisfaction and improve service delivery. It typically includes sections for personal information, policy details, and specific feedback questions that help identify areas for enhancement.

How to obtain the Future Generali Satisfaction Form

To obtain the Future Generali Satisfaction Form, individuals can visit the official Future Generali website or contact their customer service directly. The form is often available for download in a PDF format, which can be printed and filled out manually. Additionally, some versions of the form may be accessible through online account portals for existing customers, allowing for a more streamlined submission process.

Steps to complete the Future Generali Satisfaction Form

Completing the Future Generali Satisfaction Form involves several straightforward steps:

- Download the form from the official website or access it through your online account.

- Fill in your personal information, including your name, contact details, and policy number.

- Answer the feedback questions honestly, providing detailed responses where necessary.

- Review your responses to ensure all information is accurate and complete.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the Future Generali Satisfaction Form

The Future Generali Satisfaction Form is legally compliant when filled out accurately and submitted according to the company’s guidelines. It is important to provide truthful information, as false submissions can lead to legal repercussions. The data collected through this form is typically used to enhance customer service and may be subject to privacy regulations, ensuring that personal information is handled securely.

Key elements of the Future Generali Satisfaction Form

Key elements of the Future Generali Satisfaction Form include:

- Personal Information: Name, contact details, and policy number.

- Feedback Questions: Specific queries regarding customer experience and satisfaction levels.

- Suggestions for Improvement: An open section for customers to provide recommendations.

- Signature: A section for the customer to sign and date the form, confirming the authenticity of the feedback.

Form Submission Methods

The Future Generali Satisfaction Form can be submitted through various methods to accommodate customer preferences:

- Online Submission: If available, customers can submit the form directly through the Future Generali website.

- Mail: Customers may choose to print the completed form and send it to the designated address provided on the form.

- In-Person: Some customers may prefer to submit the form at a local Future Generali office, where staff can assist with the process.

Quick guide on how to complete future generali satisfaction form

Easily prepare Future Generali Satisfaction Form on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents quickly and without delays. Manage Future Generali Satisfaction Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly edit and eSign Future Generali Satisfaction Form

- Find Future Generali Satisfaction Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Future Generali Satisfaction Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the future generali satisfaction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

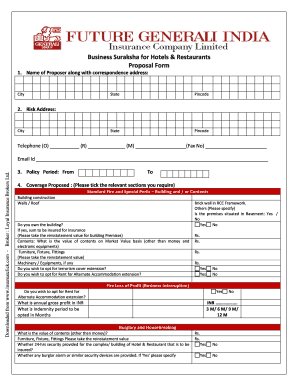

What is the future generali proposal form?

The future generali proposal form is a document that allows potential customers to express interest in Future Generali's insurance products. It captures essential information needed to generate tailored insurance solutions and helps streamline the application process.

-

How does airSlate SignNow facilitate the future generali proposal form process?

airSlate SignNow streamlines the completion and signing of the future generali proposal form through its user-friendly eSignature features. Users can easily fill out the form electronically, ensuring quick submission and enhanced security for sensitive data.

-

Can I integrate the future generali proposal form into my existing systems?

Yes, airSlate SignNow offers seamless integrations with various business tools, enabling you to incorporate the future generali proposal form into your existing workflows. This integration helps maintain efficiency and ensures that your team can manage proposals effortlessly.

-

What are the pricing options for using airSlate SignNow with the future generali proposal form?

AirSlate SignNow provides flexible pricing plans depending on your business needs and size. You can leverage cost-effective solutions to handle multiple future generali proposal forms while enjoying all the features necessary for efficient document management.

-

What features does airSlate SignNow offer for the future generali proposal form?

AirSlate SignNow offers features like customizable templates, real-time tracking, and secure cloud storage for the future generali proposal form. These tools enhance collaboration and ensure that your proposal-related documents are always accessible and organized.

-

How does eSigning the future generali proposal form benefit my business?

eSigning the future generali proposal form helps accelerate the approval process, reducing turnaround times signNowly. It provides added security and reduces the risk of document loss, giving your business peace of mind during transactions.

-

Is customer support available for help with the future generali proposal form?

Absolutely! AirSlate SignNow offers comprehensive customer support to assist you with any queries regarding the future generali proposal form. Our dedicated team is available to guide you and ensure a smooth user experience.

Get more for Future Generali Satisfaction Form

- Rlau form

- Ajax hotel reservation form pdf multinational finance society

- M007b acupuncture invoice m007b acupuncture invoice wcb ab form

- Gcse citizenship investigation portfolio gcse citizenship form

- Optima behavioral health provider credentialing packet form

- Fill fillable itravelinsured trip cancellation form

- Face to face progress note and home health orders form

- F 11 029 940 automated clearing house ach transfer authorization f 11 029 940 automated clearing house ach transfer form

Find out other Future Generali Satisfaction Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors