St 123 Form

What is the St 123

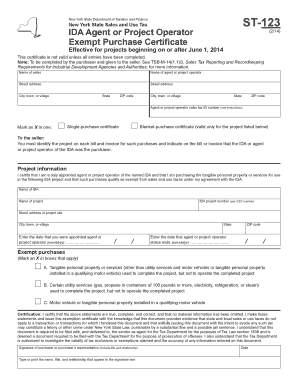

The NYS ST-123 form is a sales tax exemption certificate used in New York State. It allows certain purchasers to buy goods and services without paying sales tax, provided they meet specific criteria. This form is particularly relevant for organizations such as non-profits, government entities, and other exempt organizations that qualify for sales tax exemption under New York law. By presenting the ST-123 form to vendors, eligible purchasers can ensure compliance with state tax regulations while avoiding unnecessary tax expenses.

How to use the St 123

Using the NYS ST-123 form involves several straightforward steps. First, ensure that your organization qualifies for a sales tax exemption. Next, complete the form accurately, providing all necessary information, including the purchaser's name, address, and the nature of the exempt use. Once the form is filled out, present it to the vendor from whom you are purchasing goods or services. The vendor will retain the form for their records, demonstrating that the sale was exempt from sales tax.

Steps to complete the St 123

Completing the NYS ST-123 form requires careful attention to detail. Follow these steps:

- Obtain the ST-123 form from the New York State Department of Taxation and Finance website or through your organization’s resources.

- Fill in the purchaser's name and address accurately.

- Specify the type of exemption being claimed, such as for use in a specific exempt activity.

- Provide the vendor's name and address where the purchase will be made.

- Sign and date the form to certify that the information is correct and that the exemption applies.

Legal use of the St 123

The legal use of the NYS ST-123 form is governed by New York State tax laws. It is essential to understand that misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties. The form must only be used for transactions that genuinely qualify for exemption. Vendors are required to keep the ST-123 on file to substantiate the tax-exempt sale, so accuracy and honesty in its completion are crucial for compliance with state regulations.

Who Issues the Form

The NYS ST-123 form is issued by the New York State Department of Taxation and Finance. This state agency is responsible for administering tax laws and ensuring compliance among businesses and organizations. The form is available on their official website, where users can access additional resources and information regarding sales tax exemptions and related topics.

Form Submission Methods (Online / Mail / In-Person)

The NYS ST-123 form does not require formal submission to the state; instead, it is presented directly to the vendor at the time of purchase. Vendors must retain the form for their records. However, if a vendor needs to verify the exemption status, they may contact the New York State Department of Taxation and Finance for guidance. It is important for both purchasers and vendors to maintain accurate records of all transactions involving the ST-123 form to ensure compliance with tax regulations.

Quick guide on how to complete st 123

Easily Prepare St 123 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and safely archive it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage St 123 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign St 123 Effortlessly

- Obtain St 123 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign St 123 to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 123

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys st 123 fillable form?

The nys st 123 fillable form is a tax form used in New York State for reporting specific financial information. With airSlate SignNow, you can easily fill out and sign this form online, ensuring that you complete it correctly and efficiently. Our platform makes it simple to submit your nys st 123 fillable form without the hassle of paperwork.

-

How can I fill out the nys st 123 fillable form using airSlate SignNow?

To fill out the nys st 123 fillable form using airSlate SignNow, simply upload the document to our platform, where you can enter your information directly into the form fields. The interface is user-friendly, allowing you to navigate easily and ensure all necessary fields are completed. Once finished, you can eSign the form before submission.

-

Is there a cost to use the airSlate SignNow for the nys st 123 fillable form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including a cost-effective solution for businesses needing to manage forms like the nys st 123 fillable form. You can choose a plan that best fits your requirements, whether you are looking for basic functionality or advanced features. Our pricing model ensures flexibility for both individuals and organizations.

-

What are the benefits of using the airSlate SignNow for the nys st 123 fillable form?

Using airSlate SignNow for the nys st 123 fillable form streamlines the process, allowing you to save time and reduce errors associated with manual filling. Our platform enhances collaboration by enabling multiple parties to access and eSign the document easily. Overall, it simplifies compliance and keeps you organized.

-

Can I integrate airSlate SignNow with other software for filing the nys st 123 fillable form?

Yes, airSlate SignNow can be integrated with various software applications, boosting your productivity when handling the nys st 123 fillable form. This includes popular CRM systems, cloud storage solutions, and productivity tools. Such integrations help you manage documents seamlessly across platforms.

-

Is the nys st 123 fillable form secure in airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect your data while you fill out the nys st 123 fillable form. With encryption, secure data storage, and compliance with privacy regulations, you can rest assured that your information is safe and confidential during the signing process.

-

Can I access the nys st 123 fillable form on mobile devices?

Yes, airSlate SignNow's platform is fully compatible with mobile devices, allowing you to access the nys st 123 fillable form anywhere and anytime. The mobile app provides a seamless experience for filling out and signing documents on the go. It’s designed for convenience, giving you flexibility in managing your paperwork.

Get more for St 123

- Registration form northwood technical college

- Uwa print out application admission form

- Ref formdoc linux savannahstate

- Career counselling form 523068725

- Application filled form

- Marital status form parent jccc edu

- Www midland eduacademicsmediaassociate degree nursing program form

- Who would be the primary contact person seller verification form

Find out other St 123

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document