Nyc Commercial Rent Tax Instructions Form

Understanding the NYC Commercial Rent Tax Instructions

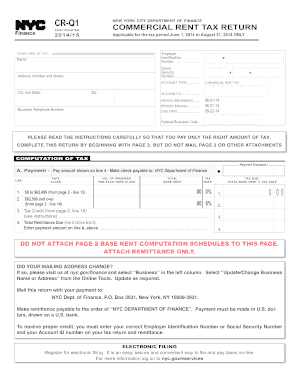

The NYC commercial rent tax instructions provide essential guidelines for landlords and tenants regarding the payment and filing of the commercial rent tax in New York City. This tax applies to businesses renting commercial space, and understanding these instructions is crucial for compliance. The instructions outline the necessary steps to calculate the tax owed, the forms required, and the filing procedures. It is important to familiarize yourself with the specific criteria that determine tax liability, including the location and size of the rented space.

Steps to Complete the NYC Commercial Rent Tax Instructions

Completing the NYC commercial rent tax instructions involves several key steps. First, gather all relevant information about your commercial lease, including the total rent amount and the duration of the lease. Next, determine if your business meets the criteria for the tax by checking the gross rent threshold. After confirming eligibility, fill out the NYC commercial rent tax form accurately, ensuring all figures are correct and supported by documentation. Finally, submit the completed form by the specified deadline to avoid penalties.

Required Documents for Filing the NYC Commercial Rent Tax

When filing the NYC commercial rent tax, certain documents are necessary to support your application. These include a copy of the commercial lease agreement, proof of rent payments, and any previous tax returns related to the commercial rent tax. It is advisable to keep records of all correspondence with the NYC Department of Finance and any receipts or confirmations of tax payments made. Having these documents ready will streamline the filing process and help ensure compliance.

Filing Deadlines for the NYC Commercial Rent Tax

Filing deadlines for the NYC commercial rent tax are crucial to avoid late fees and penalties. Typically, the tax is due quarterly, with specific dates set by the NYC Department of Finance. It is important to note these dates and plan ahead to ensure timely submission. Failure to file by the deadline can result in additional charges, so maintaining a calendar with these important dates can help keep your business compliant.

Legal Use of the NYC Commercial Rent Tax Instructions

The legal use of the NYC commercial rent tax instructions is governed by various regulations and laws. These instructions are designed to ensure that businesses comply with local tax obligations. Utilizing these guidelines correctly can protect businesses from potential legal issues related to tax evasion or misreporting. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of the commercial rent tax.

Penalties for Non-Compliance with the NYC Commercial Rent Tax

Non-compliance with the NYC commercial rent tax can lead to significant penalties. Businesses that fail to file their tax returns on time or underreport their rent may face fines and interest on unpaid taxes. The NYC Department of Finance actively enforces compliance, and repeated violations can result in more severe consequences, including audits. Understanding these penalties is vital for business owners to ensure they meet their tax obligations and avoid unnecessary financial burdens.

Quick guide on how to complete nyc commercial rent tax instructions

Complete Nyc Commercial Rent Tax Instructions effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without any delays. Manage Nyc Commercial Rent Tax Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Nyc Commercial Rent Tax Instructions with ease

- Find Nyc Commercial Rent Tax Instructions and then click Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate concerns of losing or misplacing documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Nyc Commercial Rent Tax Instructions and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc commercial rent tax instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC commercial rent tax?

The NYC commercial rent tax is a tax imposed on commercial tenants in New York City who rent spaces with an annual rent over a certain threshold. This tax is calculated as a percentage of the rent paid, and understanding it is crucial for businesses to manage their expenses effectively.

-

How does airSlate SignNow help with NYC commercial rent tax documentation?

AirSlate SignNow provides a streamlined solution for creating, sending, and signing documents related to the NYC commercial rent tax. By using our platform, businesses can efficiently manage their lease agreements and necessary tax paperwork, reducing administrative burdens and ensuring compliance.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with NYC commercial rent tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing model allows companies to save on administrative costs while ensuring they can manage their NYC commercial rent tax documents effortlessly, ultimately reducing overhead expenses.

-

What features does airSlate SignNow offer that are beneficial for handling NYC commercial rent tax?

AirSlate SignNow offers features like customizable templates, secure eSigning, and automated reminders, which are extremely beneficial for managing NYC commercial rent tax documents. These features help ensure that important tax documents are completed on time, improving compliance and reducing the risk of penalties.

-

Can airSlate SignNow integrate with other platforms to manage NYC commercial rent tax processes?

Absolutely! AirSlate SignNow integrates seamlessly with various business applications, helping streamline processes related to the NYC commercial rent tax. Whether it's accounting software or document management systems, our integrations enhance workflow efficiency and ensure all tax documents are easily accessible.

-

How can businesses ensure compliance with NYC commercial rent tax when using airSlate SignNow?

Businesses can ensure compliance with NYC commercial rent tax by utilizing airSlate SignNow's automated workflows and compliance tracking features. By keeping all documents organized and accessible, companies can easily meet tax deadlines and maintain necessary records for audits.

-

What support does airSlate SignNow provide for inquiries related to NYC commercial rent tax?

AirSlate SignNow offers dedicated support for users facing inquiries about NYC commercial rent tax. Our support team is well-versed in the intricacies of commercial documentation and is available to assist clients in navigating their tax obligations effectively.

Get more for Nyc Commercial Rent Tax Instructions

Find out other Nyc Commercial Rent Tax Instructions

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document