IA 1040 Schedules a and B 41 004 Iowa Department of Revenue Iowa 2013

What is the IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

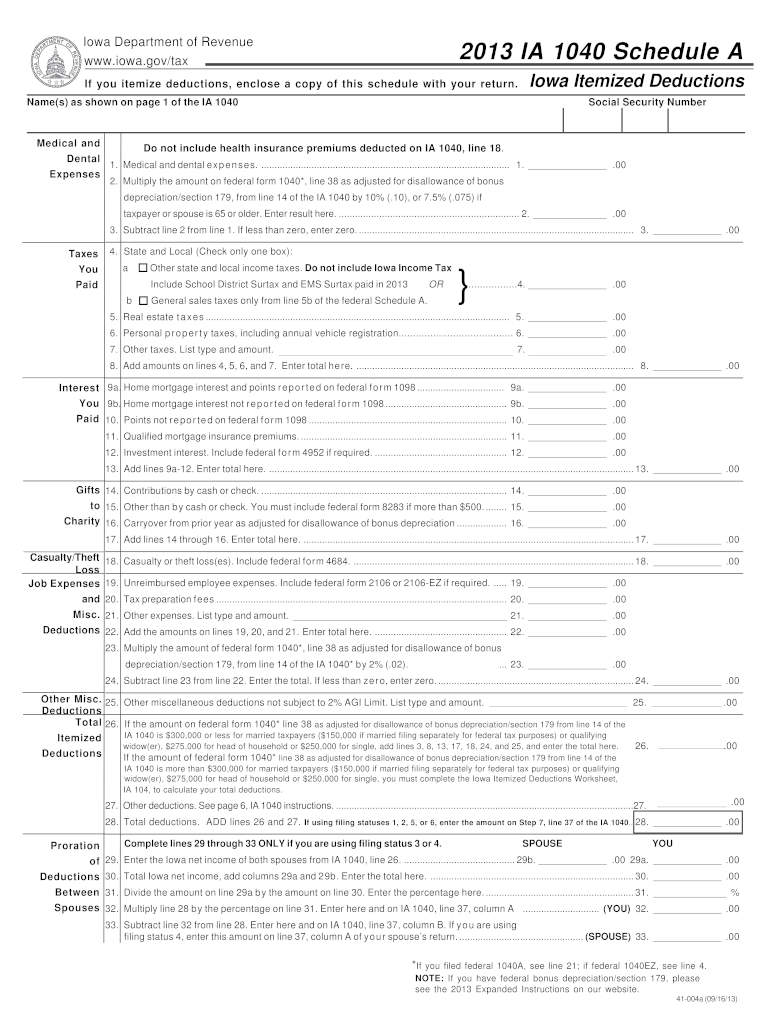

The IA 1040 Schedules A and B 41 004 is a tax form issued by the Iowa Department of Revenue. This form is used by Iowa residents to report their itemized deductions and interest and dividend income on their state income tax returns. Schedules A and B are essential for taxpayers who wish to detail specific deductions beyond the standard deduction, allowing for potentially greater tax savings. Understanding this form is crucial for ensuring compliance with state tax laws and optimizing tax liabilities.

Steps to complete the IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

Completing the IA 1040 Schedules A and B requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including W-2s, 1099s, and records of deductible expenses.

- Fill out Schedule A by listing all eligible itemized deductions, such as medical expenses, state taxes, and mortgage interest.

- Complete Schedule B by reporting any interest and dividend income received during the tax year.

- Ensure all calculations are accurate and double-check entries for completeness.

- Sign and date the form, ensuring that any additional required signatures are included.

How to obtain the IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

The IA 1040 Schedules A and B can be obtained through the Iowa Department of Revenue's official website. The forms are available for download in a printable format. Additionally, taxpayers can request physical copies by contacting the department directly. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Legal use of the IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

The IA 1040 Schedules A and B must be used in accordance with Iowa tax laws. This includes accurately reporting all income and deductions as required by state regulations. Failure to comply with these requirements may result in penalties or audits by the Iowa Department of Revenue. It is crucial to keep all supporting documentation for at least three years in case of an audit or review.

State-specific rules for the IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

Iowa has specific rules governing the use of Schedules A and B. For instance, certain deductions may be limited based on income levels or specific eligibility criteria. Additionally, taxpayers must adhere to deadlines for submitting these forms to avoid late penalties. Understanding these state-specific rules is essential for accurate tax reporting and compliance.

Form Submission Methods (Online / Mail / In-Person)

The IA 1040 Schedules A and B can be submitted through various methods. Taxpayers have the option to file online through the Iowa Department of Revenue's e-filing system, which is secure and efficient. Alternatively, forms can be mailed to the appropriate address provided by the department. In-person submissions may also be possible at designated tax offices, although this option may vary based on local regulations and availability.

Quick guide on how to complete ia 1040 schedules a and b 41 004 iowa department of revenue iowa

Your assistance manual on how to prepare your IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

If you’re interested in learning how to generate and submit your IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa, here are some brief recommendations on how to facilitate tax submissions.

Initially, you just need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that empowers you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to amend details if necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to complete your IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa in our editor.

- Complete the mandatory fillable fields with your data (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes digitally with airSlate SignNow. Please be aware that filing on paper can increase the likelihood of errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for reporting guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ia 1040 schedules a and b 41 004 iowa department of revenue iowa

Create this form in 5 minutes!

How to create an eSignature for the ia 1040 schedules a and b 41 004 iowa department of revenue iowa

How to generate an electronic signature for your Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa online

How to create an eSignature for the Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa in Chrome

How to generate an eSignature for signing the Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa in Gmail

How to generate an electronic signature for the Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa straight from your mobile device

How to make an electronic signature for the Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa on iOS devices

How to make an eSignature for the Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa on Android OS

People also ask

-

What are IA 1040 Schedules A and B 41 004 forms?

IA 1040 Schedules A and B 41 004 are specific forms required by the Iowa Department of Revenue for individuals filing their state income tax returns. Schedule A is used for itemizing deductions while Schedule B reports interest and dividend income. Understanding these forms is crucial for accurate tax reporting.

-

How does airSlate SignNow assist with IA 1040 Schedules A and B 41 004 for the Iowa Department of Revenue?

airSlate SignNow streamlines the process of filling out and eSigning IA 1040 Schedules A and B 41 004 forms, making it simple and efficient for users. Our platform allows you to securely send these documents for signature, ensuring compliance with all necessary requirements from the Iowa Department of Revenue.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans, allowing businesses to choose the one that best fits their needs. These plans provide different features and usage limits, ensuring you can easily manage your IA 1040 Schedules A and B 41 004 forms without overspending.

-

Can I integrate airSlate SignNow with other software for filing IA 1040 Schedules A and B 41 004?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easy to manage your IA 1040 Schedules A and B 41 004 alongside your existing tools. These integrations enhance productivity by allowing for seamless data transfer and document management.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features such as secure eSigning, document templates, and tracking tools specifically designed for efficient tax document management. These features can help you complete your IA 1040 Schedules A and B 41 004 accurately and on time, meeting Iowa Department of Revenue requirements.

-

How secure is airSlate SignNow for handling sensitive tax documents like IA 1040 Schedules A and B 41 004?

Security is a top priority at airSlate SignNow. Our platform uses robust encryption and authentication measures to ensure that your IA 1040 Schedules A and B 41 004 and other sensitive documents are protected throughout the signing process, complying with the highest security standards.

-

Can multiple users collaborate on IA 1040 Schedules A and B 41 004 forms using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on IA 1040 Schedules A and B 41 004 forms, making it easy to gather necessary input and approvals. This functionality enhances efficiency and accuracy in completing your tax forms for submission to the Iowa Department of Revenue.

Get more for IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

Find out other IA 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template