Deduction Iowa Department of Revenue Iowa Gov 2014

What is the Deduction Iowa Department Of Revenue Iowa gov

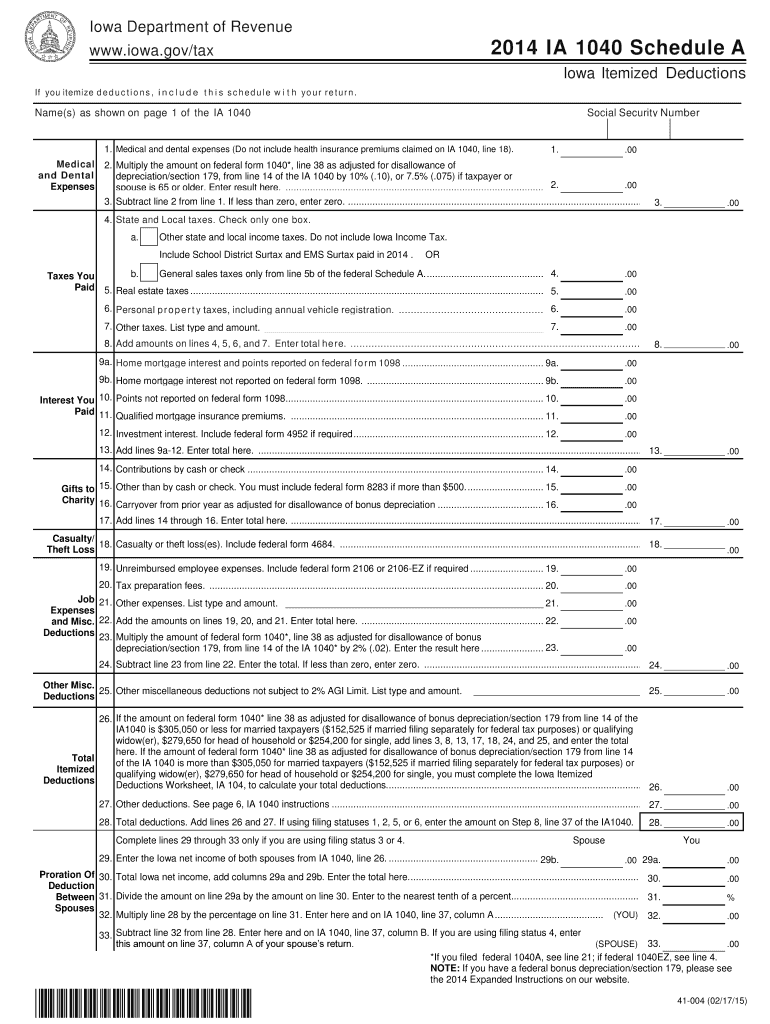

The Deduction Iowa Department Of Revenue Iowa gov form is a crucial document used by Iowa taxpayers to report specific deductions on their state income tax returns. This form allows individuals to claim various deductions that can reduce their taxable income, ultimately lowering their tax liability. Understanding the purpose and details of this form is essential for accurate tax filing and compliance with state regulations.

Steps to complete the Deduction Iowa Department Of Revenue Iowa gov

Completing the Deduction Iowa Department Of Revenue Iowa gov form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and receipts for deductible expenses. Next, carefully fill out the form, ensuring that all required fields are completed accurately. It is important to double-check calculations and verify that all deductions claimed are eligible under Iowa tax laws. Finally, sign the form and submit it according to the specified submission methods.

Legal use of the Deduction Iowa Department Of Revenue Iowa gov

The legal use of the Deduction Iowa Department Of Revenue Iowa gov form is governed by Iowa state tax laws. Taxpayers must adhere to the regulations set forth by the Iowa Department of Revenue to ensure that all deductions claimed are legitimate and substantiated by appropriate documentation. Misuse of the form or claiming ineligible deductions can result in penalties or audits, making it crucial for taxpayers to understand the legal implications of their claims.

Eligibility Criteria

To qualify for deductions on the Deduction Iowa Department Of Revenue Iowa gov form, taxpayers must meet specific eligibility criteria outlined by the Iowa Department of Revenue. Generally, eligibility may depend on factors such as filing status, income level, and the nature of the expenses for which deductions are being claimed. It is essential for taxpayers to review these criteria carefully to ensure they qualify for the deductions they intend to claim.

Filing Deadlines / Important Dates

Filing deadlines for the Deduction Iowa Department Of Revenue Iowa gov form are critical for taxpayers to observe. Typically, the deadline aligns with the state income tax return filing date, which is generally April 30 for most taxpayers. However, extensions may be available under certain circumstances. Staying informed about these important dates helps ensure timely submission and compliance with Iowa tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Deduction Iowa Department Of Revenue Iowa gov form. The form can often be submitted online through the Iowa Department of Revenue's official website, providing a convenient and efficient option. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address or submit them in person at designated state offices. Each submission method has its own guidelines and requirements, so it is important to follow the instructions carefully.

Quick guide on how to complete deduction iowa department of revenue iowagov

Your assistance manual on how to prepare your Deduction Iowa Department Of Revenue Iowa gov

If you’re interested in learning how to create and submit your Deduction Iowa Department Of Revenue Iowa gov, here are a few brief instructions on how to simplify the tax processing procedure.

To begin, you just need to sign up for your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to modify, generate, and finalize your income tax forms with ease. Through its editor, you can alternate between text, checkboxes, and eSignatures, as well as go back to amend responses when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finish your Deduction Iowa Department Of Revenue Iowa gov in a few minutes:

- Create your account and start editing PDFs within moments.

- Utilize our directory to access any IRS tax form; explore different versions and schedules.

- Click Obtain form to launch your Deduction Iowa Department Of Revenue Iowa gov in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in paper format can lead to filing errors and delay refunds. Furthermore, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct deduction iowa department of revenue iowagov

FAQs

-

How important was the art department at the University of Iowa to the development of regionalism in the United States; particularly during the 1940s and 1950s?

Well, regionalism, by its nature is pretty well confined to a particular spot, so talking about regionalism on a national scale really makes no sense when you think about it. Grant Wood was a well-known painter during his tenure at Iowa and was active in promoting farmers, horses, and plowed fields as noble subject matter. He was chafing against the art world focus on Europe, particularly on the the different schools of painting that spread there, but not in America. My take on the matter is that color photography made a huge difference in how people perceived art, but it really wasn't an affordable choice for art mags during the 40's and 50's. Consequently no one could really see what was happening in the tiny murky black and white photos that got published. I know something about this since I spent many fascinated hours in The School of Art and Art History's fine library thumbing through the theses of The Famous. Those who roamed off into abstraction during this period did weird stuff indeed: tiny water colors that made me wish biomorphic forms had never been invented, America didn't really take off as Art Central until the Surrealists came to New York.

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

How long does it take a standard mail which was sent out on the 22 of June from Baltimore to Mason city, Iowa?

Id guesstimate 2 days maybe 3. It takes longer goibg from East to West then West to East in general mail shipping etc due to time zones

-

How can rural states with sparse and spread out populations like Dakotas, Iowa have commute times of only 16 to 20 minutes?

Most people are probably within 15 miles of their place of work. In rural Minnesota where I live (or Iowa or the Dakotas) you can go 15 miles in 15–20 minutes. If you count farmers, and there a lots of farmers here, the commute from home to his field is not more than a mile. A lot of farmers rent land.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

Create this form in 5 minutes!

How to create an eSignature for the deduction iowa department of revenue iowagov

How to make an eSignature for the Deduction Iowa Department Of Revenue Iowagov online

How to make an electronic signature for the Deduction Iowa Department Of Revenue Iowagov in Chrome

How to generate an electronic signature for putting it on the Deduction Iowa Department Of Revenue Iowagov in Gmail

How to create an eSignature for the Deduction Iowa Department Of Revenue Iowagov right from your smart phone

How to generate an electronic signature for the Deduction Iowa Department Of Revenue Iowagov on iOS

How to make an electronic signature for the Deduction Iowa Department Of Revenue Iowagov on Android devices

People also ask

-

What is the Deduction Iowa Department Of Revenue Iowa gov?

The Deduction Iowa Department Of Revenue Iowa gov refers to specific tax deductions available to Iowa taxpayers. Understanding these deductions is crucial for maximizing your tax refund and ensuring compliance with state regulations. By using a reliable platform, you can easily manage your deductions and stay updated on any changes.

-

How can airSlate SignNow help with the Deduction Iowa Department Of Revenue Iowa gov?

airSlate SignNow simplifies the process of signing and managing tax documents related to the Deduction Iowa Department Of Revenue Iowa gov. With our electronic signature capabilities, you can quickly send, sign, and store your important tax documents securely. This efficiency helps streamline your tax preparation process.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their tax documents, including those related to the Deduction Iowa Department Of Revenue Iowa gov. Our pricing plans cater to businesses of all sizes, ensuring you receive outstanding value without compromising on features or quality.

-

What features does airSlate SignNow offer that support tax deduction management?

airSlate SignNow offers features such as customizable templates, secure document sharing, and real-time tracking that support effective tax deduction management. These tools make it easy to comply with regulations connected to the Deduction Iowa Department Of Revenue Iowa gov while ensuring your documents are handled with utmost security.

-

Are there integrations available for airSlate SignNow with accounting software?

Yes, airSlate SignNow integrates seamlessly with popular accounting software that can assist with filings related to the Deduction Iowa Department Of Revenue Iowa gov. This integration allows for streamlined document management and improved productivity, as you can synchronize data easily between both platforms.

-

How does airSlate SignNow enhance document security for tax-related files?

airSlate SignNow prioritizes document security, utilizing robust encryption and secure cloud storage to protect your tax-related files, including those related to the Deduction Iowa Department Of Revenue Iowa gov. This ensures that sensitive information remains confidential and meets compliance standards.

-

Can I use airSlate SignNow on mobile devices for managing tax documents?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your tax documents related to the Deduction Iowa Department Of Revenue Iowa gov on-the-go. This flexibility ensures that you can access, sign, and share important documents whenever you need to, enhancing convenience and efficiency.

Get more for Deduction Iowa Department Of Revenue Iowa gov

- 6 2 comparing animals and flames worksheet answer key form

- Illinois health connect provider referral fax form

- 2 5 practice parallel and perpendicular lines worksheet answer key form

- Cibc bank statement fill online printable fillable blank form

- Form annex 5 pm05 seychelles public service government of luh gov

- Standard form of apartment lease 364197533

- Articles of incorporation california example form

- Adult sports team roster form

Find out other Deduction Iowa Department Of Revenue Iowa gov

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile