IA 1040 Schedule a 41004 2021

What is the IA 1040 Schedule A?

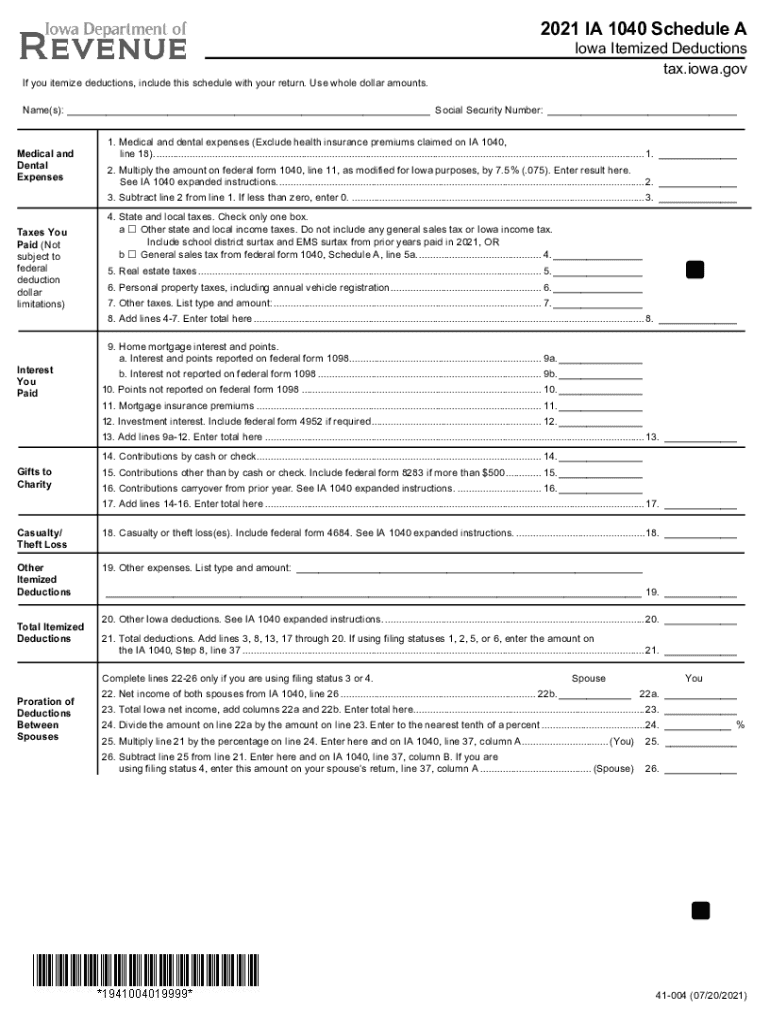

The IA 1040 Schedule A is a form used by Iowa residents to report itemized deductions when filing their state income tax return. This schedule allows taxpayers to detail specific expenses that can reduce their taxable income, such as medical expenses, mortgage interest, and charitable contributions. By utilizing the IA 1040 Schedule A, individuals can potentially lower their overall tax liability compared to taking the standard deduction.

How to use the IA 1040 Schedule A

To effectively use the IA 1040 Schedule A, taxpayers should first gather all relevant documentation regarding their itemized deductions. This includes receipts, statements, and any other records that substantiate the expenses claimed. Once the necessary information is compiled, individuals can fill out the form by entering each applicable deduction in the designated sections. It is essential to ensure accuracy in reporting to avoid any discrepancies that could lead to issues with the Iowa Department of Revenue.

Steps to complete the IA 1040 Schedule A

Completing the IA 1040 Schedule A involves several key steps:

- Gather Documentation: Collect all necessary documents that support your itemized deductions.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- List Deductions: Carefully input each deduction in the appropriate section, ensuring all figures are accurate.

- Calculate Total Deductions: Sum all itemized deductions to determine your total.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

Legal use of the IA 1040 Schedule A

The IA 1040 Schedule A is legally binding when completed and submitted in accordance with Iowa tax laws. To ensure compliance, taxpayers must adhere to the regulations set forth by the Iowa Department of Revenue regarding what qualifies as an itemized deduction. Additionally, all information provided on the form must be truthful and accurate, as any false claims can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

For the IA 1040 Schedule A, the filing deadline typically aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should remain aware of any changes in deadlines announced by the Iowa Department of Revenue, especially in light of any special circumstances or extensions that may apply.

Required Documents

When completing the IA 1040 Schedule A, several documents are necessary to substantiate your itemized deductions. These may include:

- Receipts for medical expenses

- Mortgage interest statements (Form 1098)

- Charitable contribution receipts

- Property tax statements

- Records of unreimbursed business expenses

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete ia 1040 schedule a 41004

Effortlessly Prepare IA 1040 Schedule A 41004 on Any Device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage IA 1040 Schedule A 41004 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

Easily Modify and eSign IA 1040 Schedule A 41004 Without Stress

- Obtain IA 1040 Schedule A 41004 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you choose. Modify and eSign IA 1040 Schedule A 41004 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 1040 schedule a 41004

Create this form in 5 minutes!

How to create an eSignature for the ia 1040 schedule a 41004

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the ia 1040 a form?

The ia 1040 a form is a simplified income tax return for individuals in the state of Iowa. It allows taxpayers to report their income and claim certain deductions and credits easily. Using airSlate SignNow, you can quickly sign and send your ia 1040 a form digitally.

-

How much does it cost to file the ia 1040 a using airSlate SignNow?

Filing your ia 1040 a form with airSlate SignNow is cost-effective, with plans starting at an affordable monthly rate. Our pricing includes unlimited document signing and options for various business needs. This helps ensure you can complete your ia 1040 a filing without breaking the bank.

-

What features does airSlate SignNow offer for the ia 1040 a?

airSlate SignNow provides a host of features for the ia 1040 a, including customizable templates, secure electronic signatures, and document tracking. These features streamline the tax filing process, allowing you to complete your ia 1040 a efficiently and securely. You can also collaborate with others directly within the platform.

-

Can I integrate airSlate SignNow with other tax software for the ia 1040 a?

Yes, airSlate SignNow seamlessly integrates with various tax software that supports the ia 1040 a form. This allows you to enhance your workflow by combining eSignature capabilities with your preferred tax filing tools. Integration saves time and ensures a smoother experience while preparing your ia 1040 a form.

-

Is airSlate SignNow compliant with IRS regulations for the ia 1040 a?

Absolutely! airSlate SignNow is designed to meet all IRS regulations, ensuring that your ia 1040 a form submission is secure and compliant. Our platform uses advanced encryption and authentication methods to protect your data while filing your tax forms electronically.

-

What are the benefits of using airSlate SignNow for the ia 1040 a?

Using airSlate SignNow for your ia 1040 a form offers several benefits, including speed, convenience, and security. You can complete and sign your forms from anywhere at any time, eliminating the need for printing and mailing. This enhances your overall efficiency during tax season.

-

How do I get started with airSlate SignNow for the ia 1040 a?

Getting started with airSlate SignNow for the ia 1040 a is simple! Sign up for an account, choose the appropriate plan, and begin creating or uploading your ia 1040 a form. Our user-friendly interface guides you through the process of signing and managing your documents.

Get more for IA 1040 Schedule A 41004

- Quitclaim deed from corporation to individual kentucky form

- Kentucky warranty deed form

- Quitclaim deed from corporation to llc kentucky form

- Quitclaim deed from corporation to corporation kentucky form

- Quitclaim deed from corporation to two individuals kentucky form

- Warranty deed from corporation to two individuals kentucky form

- Warranty deed from individual to a trust kentucky form

- Warranty deed from husband and wife to a trust kentucky form

Find out other IA 1040 Schedule A 41004

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document