Ia Schedule a 2018

What is the Iowa Schedule A?

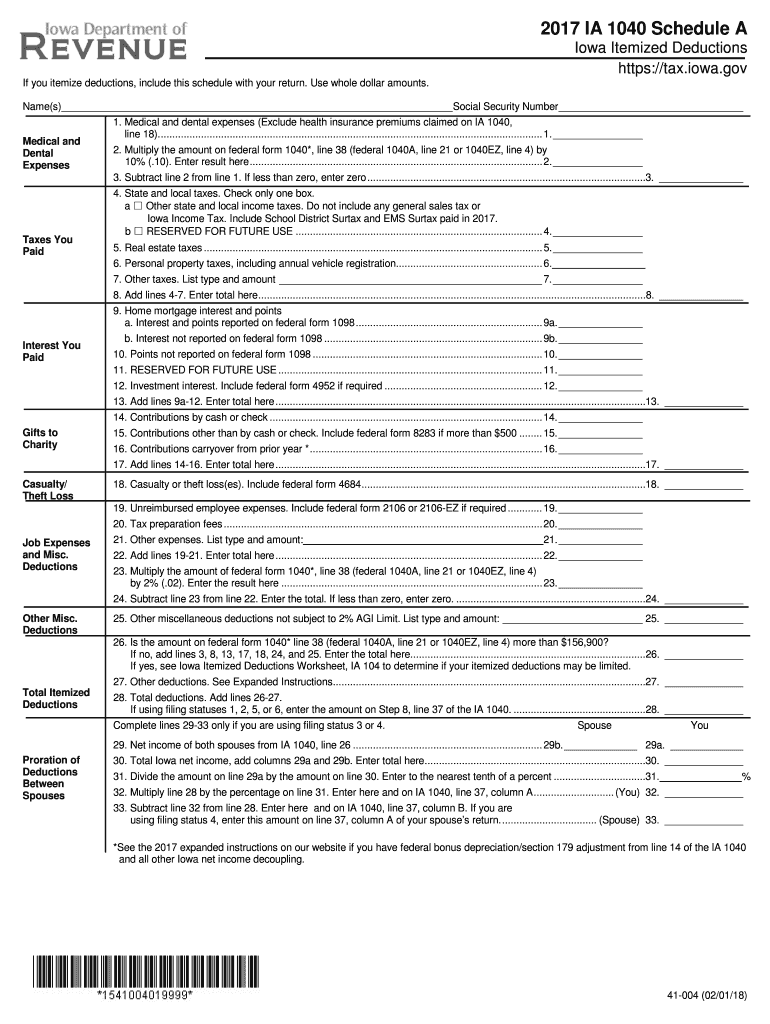

The Iowa Schedule A is a tax form used by residents of Iowa to itemize deductions on their state income tax return. This form allows taxpayers to claim specific expenses that can reduce their taxable income, ultimately lowering the amount of tax owed. Common deductions include medical expenses, mortgage interest, property taxes, and charitable contributions. Understanding the Iowa Schedule A is essential for taxpayers looking to maximize their deductions and minimize their tax liability.

Steps to Complete the Iowa Schedule A

Completing the Iowa Schedule A involves several key steps:

- Gather necessary documentation, such as receipts and statements for deductible expenses.

- Fill out the personal information section at the top of the form, including your name, address, and Social Security number.

- List all eligible itemized deductions in the appropriate sections of the form. Ensure that you provide accurate amounts for each deduction.

- Calculate the total deductions by summing all entered amounts. This total will be used to adjust your taxable income.

- Review the completed form for accuracy before submitting it with your Iowa income tax return.

Legal Use of the Iowa Schedule A

The Iowa Schedule A must be used in accordance with state tax laws to ensure compliance and legality. Taxpayers are required to accurately report their deductions and maintain documentation to support their claims. The Iowa Department of Revenue provides guidelines on what qualifies as a deductible expense. Failure to comply with these regulations may result in penalties or audits. It is advisable to consult a tax professional if there are any uncertainties regarding the legal use of the Iowa Schedule A.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines associated with the Iowa Schedule A. Typically, the deadline for filing Iowa state income tax returns is April 30th of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension to file their return, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these dates is crucial for timely and compliant tax filing.

Required Documents

To complete the Iowa Schedule A, taxpayers need to gather several documents:

- W-2 forms from employers reporting wages and tax withholdings.

- 1099 forms for other income sources, such as freelance work or interest income.

- Receipts for deductible expenses, including medical bills, property taxes, and charitable donations.

- Mortgage statements showing interest paid on home loans.

Having these documents organized and readily available will streamline the process of filling out the Iowa Schedule A.

Examples of Using the Iowa Schedule A

Taxpayers can benefit from using the Iowa Schedule A in various scenarios. For instance, a homeowner who pays significant mortgage interest may find that itemizing deductions leads to a lower taxable income. Additionally, individuals with high medical expenses that exceed the threshold set by the state can also benefit from itemization. Charitable donations made throughout the year can provide further deductions. Each taxpayer's situation is unique, and evaluating whether to itemize using the Iowa Schedule A can lead to substantial tax savings.

Quick guide on how to complete forms individual income taxiowa department of revenue

Your assistance manual on how to prepare your Ia Schedule A

If you’re looking to understand how to complete and submit your Ia Schedule A, here are some brief instructions to simplify the tax process.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to edit, create, and finalize your tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to modify responses as needed. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Ia Schedule A in just a few minutes:

- Establish your account and start editing PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Ia Schedule A in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any errors.

- Save updates, print your version, send it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Please be aware that filing on paper can increase return mistakes and delay refunds. Of course, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct forms individual income taxiowa department of revenue

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

Create this form in 5 minutes!

How to create an eSignature for the forms individual income taxiowa department of revenue

How to create an eSignature for the Forms Individual Income Taxiowa Department Of Revenue online

How to create an eSignature for the Forms Individual Income Taxiowa Department Of Revenue in Chrome

How to create an eSignature for signing the Forms Individual Income Taxiowa Department Of Revenue in Gmail

How to generate an electronic signature for the Forms Individual Income Taxiowa Department Of Revenue right from your smartphone

How to generate an electronic signature for the Forms Individual Income Taxiowa Department Of Revenue on iOS

How to make an eSignature for the Forms Individual Income Taxiowa Department Of Revenue on Android OS

People also ask

-

What is the 2018 IA schedule?

The 2018 IA schedule refers to the specific tax forms and schedules that need to be filled out for income tax filing in Iowa for the year 2018. It includes details on income, deductions, and credits applicable for that tax year. Knowing the 2018 IA schedule is essential for accurate tax submission.

-

How can airSlate SignNow help with the 2018 IA schedule documentation?

With airSlate SignNow, businesses can easily send, eSign, and manage documents related to the 2018 IA schedule hassle-free. Our platform simplifies the process by allowing users to create, edit, and securely send their tax documents electronically. This ensures timely and efficient filing.

-

Are there any costs associated with using airSlate SignNow for the 2018 IA schedule?

Yes, airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. Depending on the features you need for managing your 2018 IA schedule documents, you can choose from different subscriptions. Our cost-effective solution ensures you get great value for your investment.

-

What features does airSlate SignNow offer for managing the 2018 IA schedule?

AirSlate SignNow offers features such as easy document creation, customizable templates, and eSignature capabilities to facilitate the management of your 2018 IA schedule. Additionally, it supports secure storage and tracking of documents to enhance compliance and organization during tax season.

-

Can I integrate airSlate SignNow with other software for the 2018 IA schedule?

Absolutely! airSlate SignNow seamlessly integrates with various platforms that may assist with your 2018 IA schedule, such as CRM systems and accounting software. This integration helps streamline your workflow and keeps your tax documents organized and accessible.

-

Is airSlate SignNow user-friendly for filing the 2018 IA schedule?

Yes, airSlate SignNow is designed with an intuitive interface, making it easy for users to navigate the platform while preparing their 2018 IA schedule. Whether you're tech-savvy or not, our straightforward features ensure that everyone can efficiently eSign and manage documents with ease.

-

What are the benefits of using airSlate SignNow for the 2018 IA schedule?

Using airSlate SignNow for your 2018 IA schedule allows for an improved workflow, faster document turnaround, and enhanced security. You can also minimize errors in your tax filings and ensure compliance, reducing the stress often associated with tax season.

Get more for Ia Schedule A

- The lds group form

- The civil war lesson 1 texas joins the confederacy form

- Skip to formprint information sheetinformation she

- Loan payment contract template form

- Loan repayment contract template form

- Loan with collateral contract template form

- Lodger contract template form

- Football manager contract template form

Find out other Ia Schedule A

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now