What is 12931a Florida Form 2011

What is the What Is 12931a Florida Form

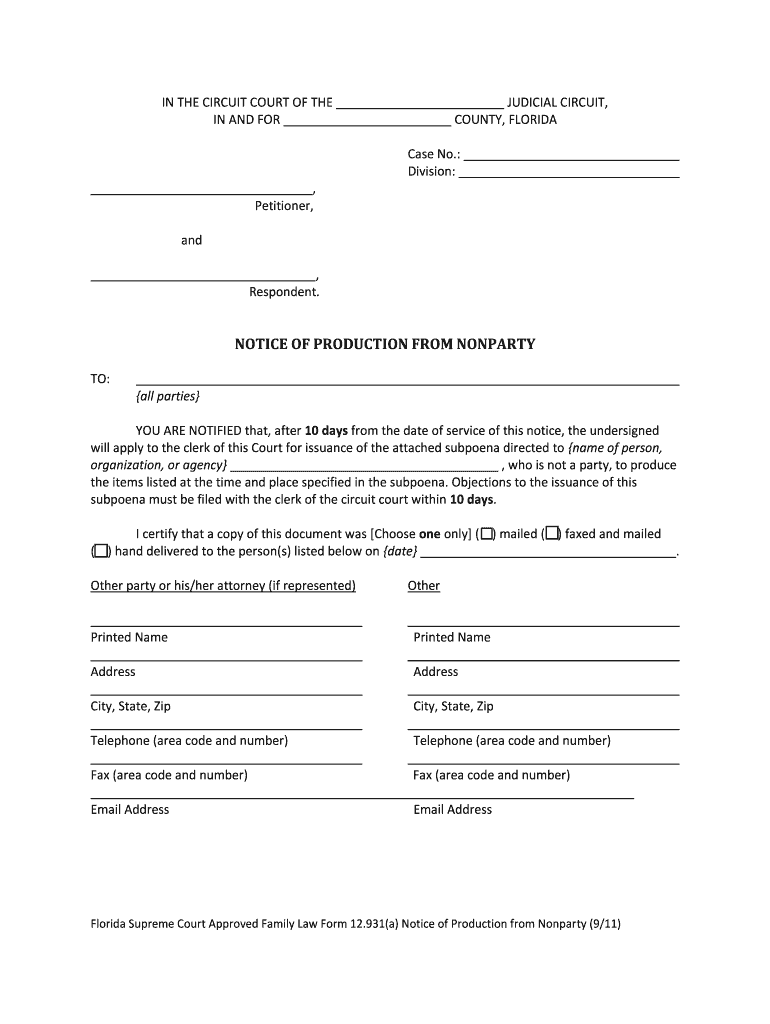

The What Is 12931a Florida Form is a specific document used in the state of Florida, primarily for reporting certain financial transactions or tax-related information. This form is essential for ensuring compliance with state regulations and may be required for various purposes, such as tax reporting or legal documentation. Understanding the purpose of this form is crucial for individuals and businesses to avoid potential penalties and ensure accurate reporting.

How to use the What Is 12931a Florida Form

Using the What Is 12931a Florida Form involves several steps. First, gather all necessary information required to complete the form. This may include personal identification details, financial data, and any relevant transaction specifics. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled, review it for any errors or omissions before submission. This will help prevent delays or issues with processing.

Steps to complete the What Is 12931a Florida Form

Completing the What Is 12931a Florida Form requires attention to detail. Follow these steps:

- Obtain the latest version of the form, ensuring it is the correct one for your needs.

- Read the instructions carefully to understand each section of the form.

- Fill in your personal information, including name, address, and identification numbers.

- Provide any required financial details or transaction information as specified.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated.

Legal use of the What Is 12931a Florida Form

The legal use of the What Is 12931a Florida Form is critical for compliance with state laws. This form must be filled out accurately and submitted by the designated deadline to avoid legal repercussions. Failure to submit this form or providing false information can result in penalties, including fines or legal action. It is advisable to consult with a legal expert if there are any uncertainties regarding the form's requirements.

Required Documents

When preparing to complete the What Is 12931a Florida Form, certain documents may be required. These often include:

- Identification documents, such as a driver's license or Social Security number.

- Financial statements or records related to the reporting requirements.

- Any previous forms or documentation that may be relevant to the current submission.

Having these documents on hand will streamline the process and ensure that all necessary information is included.

Form Submission Methods

The What Is 12931a Florida Form can typically be submitted through various methods. These methods may include:

- Online submission via the official state website or designated electronic filing system.

- Mailing the completed form to the appropriate state agency.

- In-person submission at designated offices or agencies.

Choosing the right submission method depends on personal preference and the specific requirements outlined for the form.

Quick guide on how to complete what is 12931a florida form

Complete and submit your What Is 12931a Florida Form effortlessly

Powerful tools for digital document exchange and authorization are essential for enhancing processes and the ongoing improvement of your forms. When handling legal documents and signing a What Is 12931a Florida Form, the right signature solution can save you a signNow amount of time and resources with every submission.

Search, fill out, modify, sign, and distribute your legal documents with airSlate SignNow. This platform provides everything you need to create streamlined paper submission workflows. Its extensive collection of legal forms and user-friendly interface will assist you in locating your What Is 12931a Florida Form promptly, and the editor that includes our signature feature will enable you to complete and approve it instantly.

Sign your What Is 12931a Florida Form in a few straightforward steps

- Locate the What Is 12931a Florida Form you require in our library using search or catalog pages.

- Examine the form details and preview it to confirm it meets your needs and regulatory requirements.

- Click Obtain form to access it for modifications.

- Fill in the form using the extensive toolbar.

- Check the information you entered and click the Sign tool to validate your document.

- Select one of three options to affix your signature.

- Complete any further changes and save the document in your records, then download it to your device or share it right away.

Optimize each phase of your document preparation and authorization with airSlate SignNow. Experience a more effective online solution that encompasses all aspects of managing your paperwork.

Create this form in 5 minutes or less

Find and fill out the correct what is 12931a florida form

FAQs

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

Create this form in 5 minutes!

How to create an eSignature for the what is 12931a florida form

How to create an eSignature for your What Is 12931a Florida Form in the online mode

How to make an electronic signature for your What Is 12931a Florida Form in Chrome

How to make an electronic signature for putting it on the What Is 12931a Florida Form in Gmail

How to make an electronic signature for the What Is 12931a Florida Form from your smart phone

How to generate an eSignature for the What Is 12931a Florida Form on iOS devices

How to create an electronic signature for the What Is 12931a Florida Form on Android devices

People also ask

-

What Is 12931a Florida Form?

The 12931a Florida Form is a specific document required by the state of Florida for certain tax filings. Understanding 'What Is 12931a Florida Form' is essential for ensuring compliance with Florida tax regulations. It typically involves details relevant to your business or personal tax obligations, and submitting it correctly can prevent costly penalties.

-

How can airSlate SignNow help with the 12931a Florida Form?

airSlate SignNow provides an efficient way to eSign and send the 12931a Florida Form. Utilizing our platform, businesses can simplify their document management processes, ensuring that this important tax form is completed and submitted promptly. Our user-friendly interface streamlines the e-signature process, making it a breeze to handle your paperwork.

-

Is there a cost associated with using airSlate SignNow for the 12931a Florida Form?

Yes, there are different pricing plans available for airSlate SignNow that cater to various business needs. The cost can vary depending on the features you choose and your usage frequency. Investing in our solution for handling the 12931a Florida Form can save time and reduce the risk of errors.

-

What features does airSlate SignNow offer for eSigning the 12931a Florida Form?

airSlate SignNow offers a range of features for eSigning the 12931a Florida Form, including in-person signing, mobile access, and customizable workflows. Additionally, our platform allows you to easily track the eSignature process in real-time. These features help ensure that your documents are signed securely and on time.

-

Can I integrate airSlate SignNow with other software to manage the 12931a Florida Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like CRM systems and cloud storage services. This means you can streamline your document management and easily handle the 12931a Florida Form alongside your existing tools. Our integrations enhance efficiency and simplify workflows.

-

What are the benefits of using airSlate SignNow for my business when handling the 12931a Florida Form?

Using airSlate SignNow for the 12931a Florida Form provides numerous benefits, including increased efficiency and reduced turnaround times. Our platform minimizes the chances of document errors and enhances security. Businesses can also enjoy better compliance with regulations, making the entire process less stressful.

-

How secure is airSlate SignNow when dealing with documents like the 12931a Florida Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to ensure that your documents, including the 12931a Florida Form, are protected. Our platform adheres to industry standards, giving you peace of mind when managing sensitive information.

Get more for What Is 12931a Florida Form

- Laurel acres park birthday party form

- First watch menu pdf form

- Uttara ewallet form

- Opinion writing checklist grade 4 form

- Ftb 3561c form

- Womens health screening checklist pdf form

- Evaluation form for oral presentation saint mary school saintmary ed

- Medical examination report marineacademy edu pk marineacademy edu form

Find out other What Is 12931a Florida Form

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template