Fha Appendix B Form

What is the FHA Appendix B

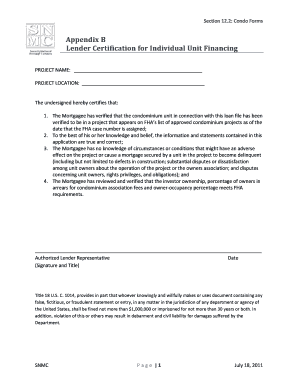

The FHA Appendix B is a crucial document used in the context of the FHA certification for individual unit financing. It outlines specific requirements and guidelines that must be adhered to when seeking financing for individual units within a multi-family property. This appendix serves as a supplement to the main FHA loan application, ensuring that all necessary criteria are met for compliance with federal regulations.

How to Use the FHA Appendix B

Using the FHA Appendix B involves carefully reviewing the document to understand the requirements for individual unit financing. Applicants must fill out the form accurately, providing all requested information about the property and the financing terms. It is essential to follow the guidelines outlined in the appendix to ensure that the application is processed smoothly and efficiently.

Steps to Complete the FHA Appendix B

Completing the FHA Appendix B requires a systematic approach. Here are the key steps:

- Gather necessary documentation, including property details and financial information.

- Review the specific requirements outlined in the FHA Appendix B.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form along with any required supporting documents.

Legal Use of the FHA Appendix B

The FHA Appendix B must be used in compliance with federal regulations governing FHA loans. This document is legally binding and must be filled out correctly to ensure that the financing process adheres to all legal standards. Understanding the legal implications of the FHA Appendix B is vital for both lenders and borrowers to avoid potential issues during the financing process.

Key Elements of the FHA Appendix B

Several key elements are essential in the FHA Appendix B. These include:

- Property information, including location and type.

- Borrower details, such as credit history and financial status.

- Specific financing terms and conditions.

- Compliance statements confirming adherence to FHA guidelines.

Eligibility Criteria

To utilize the FHA Appendix B effectively, applicants must meet certain eligibility criteria. These criteria often include:

- Proof of income and financial stability.

- A satisfactory credit score as determined by FHA standards.

- Compliance with local housing regulations.

Form Submission Methods

The FHA Appendix B can be submitted through various methods, ensuring flexibility for applicants. These methods include:

- Online submission through approved FHA platforms.

- Mailing the completed form to the designated FHA office.

- In-person submission at local FHA offices or approved lenders.

Quick guide on how to complete fha appendix b

Prepare Fha Appendix B effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Fha Appendix B on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Fha Appendix B with ease

- Obtain Fha Appendix B and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools available specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Fha Appendix B and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha appendix b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FHA Appendix B and why is it important?

The FHA Appendix B is a document that provides essential information regarding the guidelines and requirements set forth by the Federal Housing Administration for housing market participants. Understanding the FHA Appendix B is crucial for mortgage professionals as it ensures compliance and promotes transparency in transactions.

-

How does airSlate SignNow streamline the FHA Appendix B signing process?

With airSlate SignNow, you can easily send and eSign the FHA Appendix B online, reducing the time spent on paperwork. Our platform features a user-friendly interface that helps you navigate document signing seamlessly, allowing for quick approvals and compliance with FHA regulations.

-

What are the pricing options for using airSlate SignNow for FHA Appendix B transactions?

airSlate SignNow offers competitive pricing plans that cater to various business needs, whether you are an individual or part of a larger enterprise. Our pricing includes options that cover the electronic signing of the FHA Appendix B and various features designed to enhance your document workflow.

-

Are there specific features in airSlate SignNow that assist with FHA Appendix B?

Yes, airSlate SignNow includes several features aimed at simplifying the signing of FHA Appendix B documents. These features include document templates, automatic reminders for signers, and audit trails that help track every step of the document process, ensuring secure and efficient handling.

-

Can airSlate SignNow integrate with other tools to assist with FHA Appendix B documentation?

Absolutely! airSlate SignNow offers integrations with popular business applications that are commonly used alongside the FHA Appendix B, such as CRM systems and accounting software. These integrations enhance workflow efficiency by centralizing document management and facilitating easy access to critical information.

-

What are the benefits of using airSlate SignNow for FHA Appendix B?

Using airSlate SignNow for FHA Appendix B offers numerous benefits, including faster signing processes, improved document security, and enhanced compliance with FHA requirements. It allows businesses to manage their document workflows effectively, ensuring that all team members can collaborate in real time.

-

Is airSlate SignNow compliant with FHA regulations for Appendix B?

Yes, airSlate SignNow is designed to comply with FHA regulations, including those pertaining to the FHA Appendix B. Our platform adheres to industry standards for electronic signatures and document security, ensuring that your transactions remain within legal frameworks.

Get more for Fha Appendix B

- Educational objective north country community college nccc form

- Specialty referral form specialty referral form for dmo

- Medicare annual wellness visit questionnaire form

- 601 form

- My zones during the day form

- Form 8949 instructions 2017

- 990 pf 2017 form

- Notice of entry of judgment or order civ130 california judicial council court forms

Find out other Fha Appendix B

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors