990 Pf Form 2017

What is the 990 Pf Form

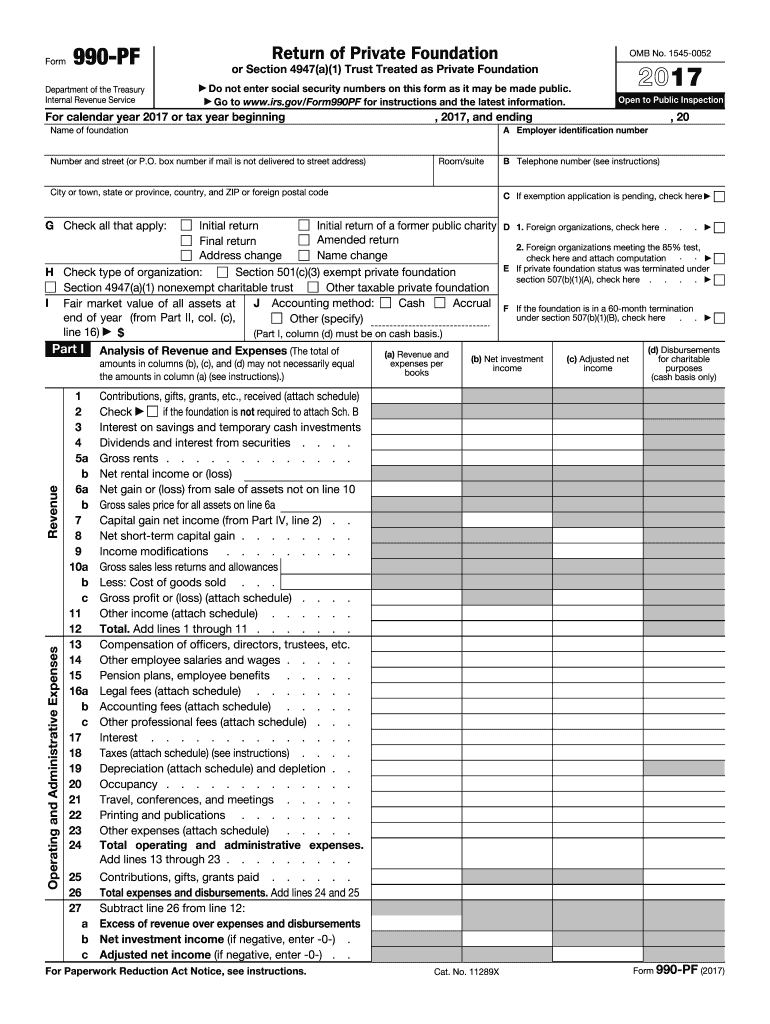

The 990 Pf Form is a tax document required by the Internal Revenue Service (IRS) for private foundations in the United States. This form provides a comprehensive overview of a foundation's financial activities, including income, expenses, and distributions made to charitable organizations. It is crucial for maintaining transparency and ensuring compliance with federal regulations governing charitable entities. The information reported on the 990 Pf Form helps the IRS and the public understand how foundations allocate their resources and fulfill their charitable missions.

How to use the 990 Pf Form

Using the 990 Pf Form involves several key steps. First, gather all necessary financial records, including income statements, balance sheets, and details of charitable distributions. Next, carefully fill out each section of the form, ensuring that all required information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the foundation's preference and IRS guidelines. Accurate completion and timely submission are essential to avoid penalties and ensure compliance with tax regulations.

Steps to complete the 990 Pf Form

Completing the 990 Pf Form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather financial documents: Collect all necessary financial statements, including income and expense reports.

- Fill out the form: Complete each section of the form, including revenue, expenses, and charitable distributions.

- Review for accuracy: Double-check all entries for correctness and completeness.

- Submit the form: Choose your submission method, either electronically or by mail, and send the form to the IRS.

Legal use of the 990 Pf Form

The legal use of the 990 Pf Form is essential for private foundations to maintain their tax-exempt status. This form must be filed annually with the IRS, providing a detailed account of the foundation's financial activities. Failure to file the form or submitting inaccurate information can lead to penalties, including fines and potential loss of tax-exempt status. It is crucial for foundations to adhere to all IRS guidelines and deadlines to ensure compliance and uphold their legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Pf Form are critical for private foundations. Typically, the form is due on the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if a foundation's fiscal year ends on December thirty-first, the form would be due on May fifteenth of the following year. It is important to note that extensions may be available, but foundations must apply for these extensions before the original due date. Keeping track of these deadlines helps avoid penalties and ensures timely compliance.

Examples of using the 990 Pf Form

The 990 Pf Form is utilized by private foundations to report their financial activities and compliance with IRS regulations. For instance, a foundation that provides grants to educational institutions would detail its income, expenses, and the amounts distributed to those institutions on the form. This transparency allows stakeholders, including donors and the public, to understand the foundation's impact and financial health. Additionally, other foundations may use the form to demonstrate their commitment to charitable activities and compliance with federal laws.

Quick guide on how to complete 990 pf 2017 form

Discover the easiest method to complete and endorse your 990 Pf Form

Are you still spending time organizing your official documents on paper instead of online? airSlate SignNow offers a superior way to finalize and endorse your 990 Pf Form and associated forms for public services. Our advanced electronic signature solution equips you with all the necessary tools to handle paperwork swiftly and meet official standards - robust PDF editing, management, security, signing, and sharing features are all conveniently available in a user-friendly interface.

Only a few steps are needed to fill out and endorse your 990 Pf Form:

- Load the editable template into the editor by clicking the Get Form button.

- Identify the information you are required to input in your 990 Pf Form.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the gaps with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Blackout irrelevant sections.

- Press Sign to generate a legally binding electronic signature via your preferred method.

- Insert the Date beside your signature and finish your task by clicking the Done button.

Store your completed 990 Pf Form in the Documents folder in your profile, download it, or transfer it to your desired cloud storage. Our service also supports versatile file sharing. There's no need to print your forms when you can submit them to the correct public office - use email, fax, or arrange for USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 990 pf 2017 form

FAQs

-

How can I fill out my PF form when I am currently working abroad?

Try to withdraw onlineMore info comment or check contacts info

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

Can I fill out the PF form online?

Yes you can go to EPFO members home click claim form 10c and 19 c

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

To withdraw PF, how to fill form 15G? Specifically the field numbered "23"

Greeting …I will explain PART 1 of form 15G point wise.Name : write name as per pan card.PAN : write your PAN number.Assessment year: For current year , it is assessment year 2016-17. Don’t make mistake in writing it. It is next to the current financial year. ( No matter about your year of PF withdrawal, assessment year is 2016-17 because you are submitting form for current year ( 2015-16’s estimated income)Flat/ Door/ Block no. : Current Address details .Name of premises: Current Address details.Status : Individual/ HUF/ AOP as applicability to you.Assessed in which ward circle : Details about your income tax ward you were assessed last time. You can know your income tax ward and circle from this link- know your juridictional AO. Just enter your PAN no. and you can find the details.Road : current address details.Area : current address details.AO code : write as per link provided in point 7.Town : current address.State : Current state.PIN : pin code number.Last assessed year in which assessed : Last year generally if you were assessed in last year. 2015-16EmailTelephone NO.Present ward circle : Same if no change after issue of pan card. ( as per point 7)Residential status: Resident.Name of business/ occupation : Your business or job details.Present AO code : as per point 7 if no change in ward/ circle of income tax.Juridictional chief commissioner of income tax ( if not assessed of income tax earlier) : leave it blank.Estimated total income: You are required to enter estimated total income of current year. Do sum of the total income from all sources and tick the relevant boxes.The amount should be from following sources: Interest on securities , Interest on sum other than securities ( interest on FD etc.), Interest on mutual fund units., withdrawals of NSC.Dividend on shares,Estimated total income of the current year should be entered. The income mentioned in column 22 should be included in it .PF income ( if taxable) and other income (business, salary etc.). The amount is taxable income means total income less deductions available.In this column, you are required to give details of investment you have made. For different form of investment different schedules are given.Be Peaceful !!!

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the 990 pf 2017 form

How to generate an eSignature for the 990 Pf 2017 Form online

How to create an electronic signature for your 990 Pf 2017 Form in Chrome

How to make an electronic signature for signing the 990 Pf 2017 Form in Gmail

How to generate an eSignature for the 990 Pf 2017 Form straight from your smartphone

How to make an eSignature for the 990 Pf 2017 Form on iOS devices

How to create an electronic signature for the 990 Pf 2017 Form on Android devices

People also ask

-

What is the 990 Pf Form, and why is it important?

The 990 Pf Form is a crucial document used by organizations to report their financial activities to the IRS. It provides transparency and helps ensure compliance with federal regulations. Understanding the 990 Pf Form is essential for nonprofits to maintain their tax-exempt status.

-

How can airSlate SignNow help with the 990 Pf Form?

AirSlate SignNow simplifies the process of preparing and submitting the 990 Pf Form by allowing you to electronically sign and send documents securely. With its user-friendly interface, you can efficiently manage your paperwork and ensure timely submission of the form, reducing the risk of delays.

-

Is there a cost associated with using airSlate SignNow for the 990 Pf Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to features that can streamline the preparation and signing of the 990 Pf Form, making it a cost-effective solution for organizations looking to manage their documentation efficiently.

-

What features does airSlate SignNow offer for managing the 990 Pf Form?

AirSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage, which are all valuable for managing the 990 Pf Form. These tools help ensure that your documents are completed accurately and stored securely, facilitating easier access and compliance.

-

Can airSlate SignNow integrate with other software for the 990 Pf Form?

Yes, airSlate SignNow integrates seamlessly with various accounting and document management software, enhancing your ability to handle the 990 Pf Form. This integration allows for streamlined workflows, ensuring that all relevant financial data is easily accessible and correctly formatted for submission.

-

What are the benefits of using airSlate SignNow for nonprofit organizations filing the 990 Pf Form?

Using airSlate SignNow provides numerous benefits for nonprofits, including time savings and increased accuracy when filing the 990 Pf Form. The platform's electronic signature capabilities and document management features help organizations maintain compliance while reducing administrative burdens.

-

How secure is airSlate SignNow when handling the 990 Pf Form?

AirSlate SignNow prioritizes security, employing advanced encryption and secure storage solutions to protect sensitive information, including the 990 Pf Form. You can trust that your documents are safe from unauthorized access, ensuring compliance with regulatory standards.

Get more for 990 Pf Form

- Employment application skywheel form

- Ri unemployment 1099 form

- Babysitters list form

- Active reading section 2 the ozone shield form

- Georgia realtors rental application form

- Fillable online pdf only fincen gov fax email print form

- Virginia quilting bedding work order form 100 s main st p o box 99 la crosse va

- Monthly car payment contract template form

Find out other 990 Pf Form

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe