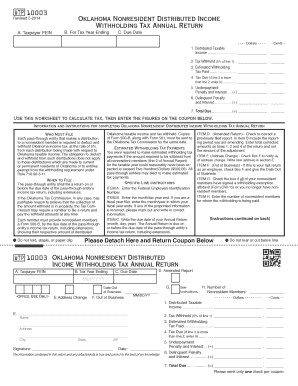

Oklahoma Form Wtp 10003

What is the Oklahoma Form Wtp 10003

The Oklahoma Form Wtp 10003 is a state-specific document used primarily for tax purposes. This form is essential for individuals and businesses in Oklahoma to report specific information to the state tax authorities. It serves as a declaration of certain financial activities and is crucial for ensuring compliance with state regulations. Understanding the purpose and requirements of the Wtp 10003 is vital for accurate tax reporting and avoiding potential penalties.

Steps to complete the Oklahoma Form Wtp 10003

Completing the Oklahoma Form Wtp 10003 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents and information related to your income and deductions. Follow these steps:

- Review the form instructions carefully to understand the required information.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Provide specific financial information as requested, ensuring all figures are accurate.

- Double-check your entries for any errors or omissions.

- Sign and date the form before submission.

Taking these steps will help ensure that your form is completed correctly and submitted on time.

Legal use of the Oklahoma Form Wtp 10003

The Oklahoma Form Wtp 10003 is legally binding when filled out and submitted according to state regulations. It is essential to understand that any inaccuracies or fraudulent information can lead to legal consequences, including fines or audits. Compliance with the instructions and guidelines set forth by the Oklahoma tax authorities ensures that the form is used appropriately. By adhering to these legal standards, taxpayers can protect themselves from potential legal issues.

How to obtain the Oklahoma Form Wtp 10003

The Oklahoma Form Wtp 10003 can be obtained through various means. It is available for download from the official Oklahoma tax authority website, where you can find the most current version of the form. Additionally, physical copies may be available at local tax offices or government buildings. Ensure that you are using the latest version of the form to avoid any compliance issues.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Oklahoma Form Wtp 10003 can be done through several methods, providing flexibility for taxpayers. You can choose to submit the form online through the Oklahoma tax authority's electronic filing system, which is often the quickest option. Alternatively, you may mail the completed form to the designated address provided in the instructions. For those who prefer face-to-face interaction, in-person submissions can be made at local tax offices. Each method has its own processing times, so consider your timeline when choosing how to submit.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Form Wtp 10003 are crucial to ensure compliance and avoid penalties. Typically, the form must be submitted by the state tax deadline, which usually aligns with federal tax deadlines. It is important to verify the specific dates each year, as they may vary. Mark these deadlines on your calendar to ensure timely submission and avoid any complications.

Quick guide on how to complete oklahoma form wtp 10003

Complete Oklahoma Form Wtp 10003 effortlessly on any device

Digital document handling has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage Oklahoma Form Wtp 10003 on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Oklahoma Form Wtp 10003 without any hassle

- Obtain Oklahoma Form Wtp 10003 and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Oklahoma Form Wtp 10003 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form wtp 10003

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform in 2023?

The airSlate SignNow platform offers a range of features designed to streamline document management, including eSignature capabilities, customizable templates, and real-time collaboration. Understanding the ok wtp 10003 instructions 2023 will help users fully leverage these features to improve operational efficiency.

-

How does airSlate SignNow compare in pricing to other eSignature solutions?

AirSlate SignNow provides a cost-effective solution for businesses of all sizes, with competitive pricing options that cater to diverse needs. By following the ok wtp 10003 instructions 2023, potential customers can find the best plan that optimally serves their organization without breaking the budget.

-

Can airSlate SignNow be integrated with other software tools?

Yes, airSlate SignNow offers seamless integrations with various platforms such as CRM systems, cloud storage solutions, and project management tools. For detailed guidance on setting up these integrations, refer to the ok wtp 10003 instructions 2023.

-

What benefits does airSlate SignNow provide to businesses?

Using airSlate SignNow can drastically reduce turnaround times for document approvals, enhance security with encrypted signatures, and improve overall document workflow efficiency. Adhering to the ok wtp 10003 instructions 2023 can maximize these benefits for your business.

-

What is the learning curve for new users of airSlate SignNow?

New users will find airSlate SignNow's interface intuitive and user-friendly, with a minimal learning curve. The ok wtp 10003 instructions 2023 will help guide users through the essential functions and features, enabling them to operate the platform effectively from day one.

-

Are there mobile options available for using airSlate SignNow?

Yes, airSlate SignNow provides mobile applications that allow users to send and sign documents on the go. The ok wtp 10003 instructions 2023 can assist in navigating mobile functionalities to ensure users can handle tasks anytime, anywhere.

-

What is the customer support like for airSlate SignNow users?

AirSlate SignNow offers robust customer support options, including live chat, email assistance, and an extensive knowledge base. Following the ok wtp 10003 instructions 2023 will lead users to resources that can quickly resolve any issues they encounter.

Get more for Oklahoma Form Wtp 10003

Find out other Oklahoma Form Wtp 10003

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will