Instructions for Form 592 V California 2020

What is the Instructions For Form 592 V California

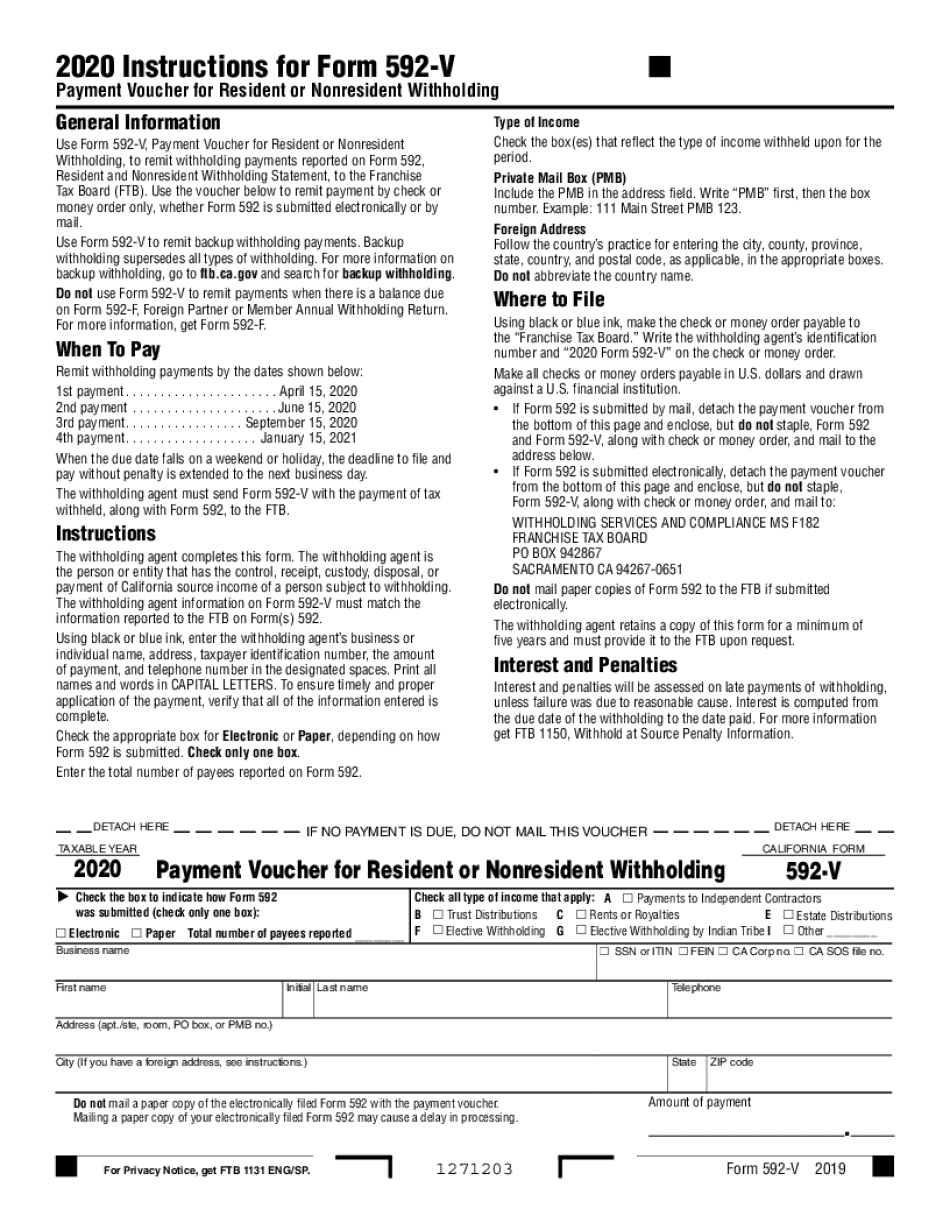

The Instructions for Form 592 V California provide essential guidelines for taxpayers who need to report California source income paid to non-residents. This form is specifically designed for withholding agents, such as businesses or individuals, who are responsible for withholding tax from payments made to non-residents. The instructions detail how to complete the form accurately, ensuring compliance with California tax laws. Understanding these instructions is crucial for avoiding penalties and ensuring that the correct amount of tax is withheld.

Steps to complete the Instructions For Form 592 V California

Completing the Instructions for Form 592 V involves several key steps:

- Gather necessary information about the payee, including their name, address, and taxpayer identification number.

- Determine the amount of California source income that is subject to withholding.

- Calculate the appropriate withholding amount based on the applicable tax rate.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors before submission.

Following these steps helps ensure that the form is filled out correctly and that all required information is provided.

Legal use of the Instructions For Form 592 V California

The legal use of the Instructions for Form 592 V is critical for compliance with California tax regulations. By adhering to these instructions, withholding agents can ensure that they fulfill their obligations under California law. This includes accurately reporting income and withholding the correct amount of tax. Failure to comply with these legal requirements can result in penalties, interest, and other legal repercussions. Therefore, it is essential to understand the legal implications of using this form and to follow the instructions closely.

Who Issues the Form

The California Franchise Tax Board (FTB) is the authority responsible for issuing Form 592 V. This agency oversees the administration of California tax laws and ensures that withholding agents comply with state regulations. The FTB provides the necessary forms and instructions to facilitate the proper reporting of income and withholding taxes. Understanding the role of the FTB is important for taxpayers and withholding agents when navigating the requirements associated with Form 592 V.

Filing Deadlines / Important Dates

Filing deadlines for Form 592 V are crucial for withholding agents to note. Typically, the form must be submitted to the California Franchise Tax Board by the end of the month following the payment to the non-resident. For example, if a payment is made in January, the form must be submitted by the end of February. It is important to stay informed about any changes to these deadlines, as they can affect compliance and potentially lead to penalties for late filing.

Required Documents

To complete Form 592 V, several documents may be required. These include:

- The payee's taxpayer identification number (TIN) or Social Security number (SSN).

- Documentation of the payment made to the non-resident, including invoices or contracts.

- Any relevant tax withholding agreements or exemptions that may apply.

Having these documents ready can streamline the process of completing and submitting Form 592 V, ensuring that all necessary information is included.

Examples of using the Instructions For Form 592 V California

Examples of using the Instructions for Form 592 V can help clarify common scenarios. For instance, a business that hires a contractor from out of state must withhold California taxes on payments made for services rendered within California. By following the instructions, the business can accurately report the income and withhold the appropriate amount of tax. Another example might involve a rental property owner who pays a non-resident for property management services. In both cases, the instructions provide guidance on how to complete the form correctly, ensuring compliance with California tax laws.

Quick guide on how to complete instructions for form 592 v california

Complete Instructions For Form 592 V California effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Instructions For Form 592 V California on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Instructions For Form 592 V California with ease

- Find Instructions For Form 592 V California and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Update and electronically sign Instructions For Form 592 V California and guarantee effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 592 v california

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 592 v california

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the No Download Needed form 592v 2019 and how does it work?

The No Download Needed form 592v 2019 is an online document that can be easily accessed and completed without any software installation. Utilizing airSlate SignNow’s platform, users can fill out the form and electronically sign it within minutes, streamlining the process and eliminating the hassle of physical paperwork.

-

Is the No Download Needed form 592v 2019 free to use?

While the airSlate SignNow platform offers a free trial, access to the No Download Needed form 592v 2019 may vary depending on your subscription plan. Affordable pricing options are available, ensuring that businesses of all sizes can benefit from this efficient document management solution.

-

What are the key features of the No Download Needed form 592v 2019?

The No Download Needed form 592v 2019 provides features such as electronic signing, secure document storage, and real-time tracking. These functionalities not only enhance document security but also improve efficiency by allowing users to manage their forms and signatures all in one place.

-

How can the No Download Needed form 592v 2019 benefit my business?

Using the No Download Needed form 592v 2019 enables businesses to save time and reduce costs associated with printing and mailing documents. The efficiency gained through airSlate SignNow’s eSigning capabilities allows teams to focus on what truly matters, accelerating overall operations.

-

Can I integrate the No Download Needed form 592v 2019 with other software?

Yes, the No Download Needed form 592v 2019 can seamlessly integrate with various software applications, improving workflow connectivity. This integration capability allows businesses to synchronize documents across platforms, enabling a smoother and more efficient document management process.

-

What security measures are in place for the No Download Needed form 592v 2019?

The No Download Needed form 592v 2019 is backed by advanced security features including encryption and secure storage protocols. airSlate SignNow prioritizes user data protection, ensuring that all forms and electronic signatures remain confidential and secure.

-

Is technical support available for the No Download Needed form 592v 2019?

Absolutely! Users of the No Download Needed form 592v 2019 have access to dedicated technical support through airSlate SignNow. Our support team is available to assist with any questions or issues, ensuring that your experience remains seamless and hassle-free.

Get more for Instructions For Form 592 V California

Find out other Instructions For Form 592 V California

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form