69624 Federal Register Vol 71, No 231Friday, December 2020

IRS Guidelines

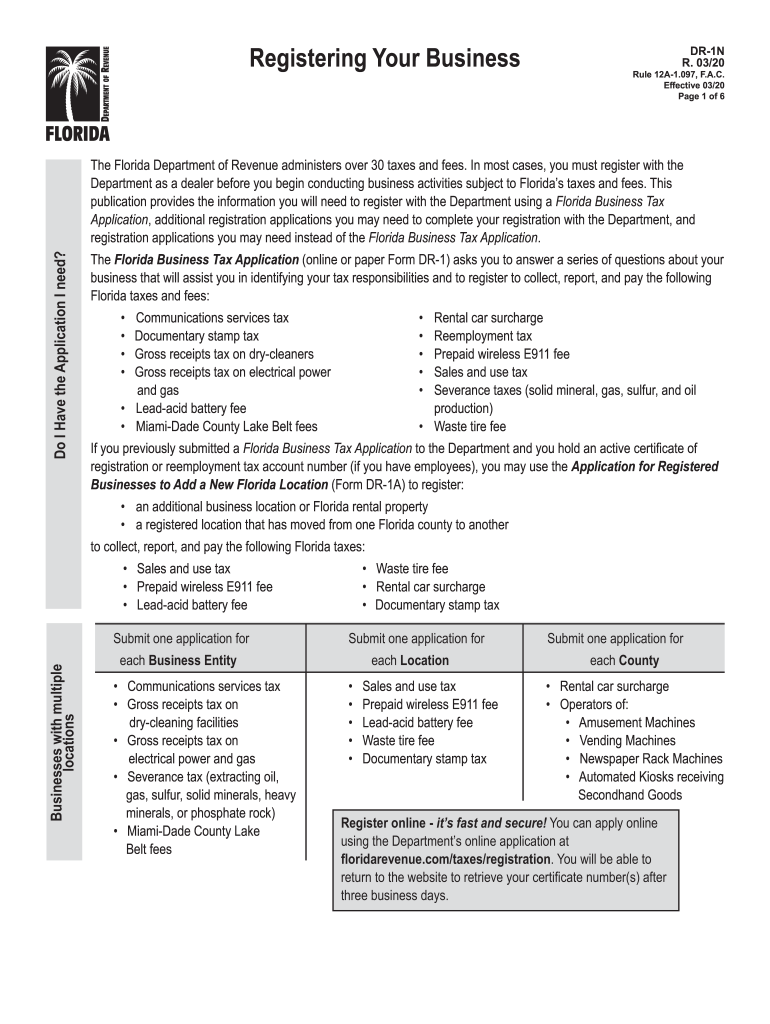

The 2011 Florida tax DR-1N application is governed by specific guidelines set forth by the Internal Revenue Service (IRS). These guidelines outline the necessary steps and requirements for completing the form accurately. Understanding these regulations is crucial for ensuring compliance and avoiding potential penalties. Key aspects include eligibility criteria, required documentation, and filing procedures. Taxpayers must familiarize themselves with these elements to navigate the application process effectively.

Filing Deadlines / Important Dates

Timely submission of the 2011 tax DR-1N application is essential to avoid late fees and penalties. The IRS establishes specific deadlines for filing tax forms, which can vary based on the taxpayer's situation. For instance, individual taxpayers typically need to submit their forms by April 15 of the following year. It is advisable to keep track of these important dates and prepare the necessary documentation in advance to ensure a smooth filing process.

Required Documents

To complete the 2011 Florida tax DR-1N application, certain documents are required. These may include proof of income, identification details, and any relevant tax forms from previous years. Collecting these documents beforehand can streamline the application process. It is important to ensure that all information provided is accurate and up-to-date to avoid complications during processing.

Form Submission Methods (Online / Mail / In-Person)

The 2011 tax DR-1N application can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing and confirmation of receipt. If opting for mail, it is recommended to use certified mail to ensure the application is delivered securely. In-person submissions may be suitable for those requiring immediate assistance or clarification on the form.

Eligibility Criteria

Understanding the eligibility criteria for the 2011 Florida tax DR-1N application is vital for successful filing. Generally, this form is intended for specific taxpayer categories, including individuals and businesses that meet certain income thresholds. Eligibility can also depend on residency status and other factors. Reviewing these criteria beforehand can help determine if the form is appropriate for your situation.

Application Process & Approval Time

The application process for the 2011 tax DR-1N involves several steps, including gathering required documents, completing the form accurately, and submitting it through the chosen method. Once submitted, the approval time can vary based on the volume of applications received and the complexity of the individual case. Typically, taxpayers can expect to receive confirmation of their application status within a few weeks, although this may extend during peak filing periods.

Quick guide on how to complete 69624 federal register vol 71 no 231friday december

Complete 69624 Federal Register Vol 71, No 231Friday, December effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the proper form and securely store it online. airSlate SignNow provides you with all the essentials to create, modify, and eSign your documents swiftly and without delays. Handle 69624 Federal Register Vol 71, No 231Friday, December on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign 69624 Federal Register Vol 71, No 231Friday, December with ease

- Locate 69624 Federal Register Vol 71, No 231Friday, December and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, burdensome form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 69624 Federal Register Vol 71, No 231Friday, December and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 69624 federal register vol 71 no 231friday december

Create this form in 5 minutes!

How to create an eSignature for the 69624 federal register vol 71 no 231friday december

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2011 fl tax dr1n form used for?

The 2011 fl tax dr1n form is used to report certain tax information to the Florida Department of Revenue. This form is essential for ensuring compliance with state tax laws and helps businesses correctly manage their tax obligations.

-

How can airSlate SignNow assist with the 2011 fl tax dr1n form?

airSlate SignNow simplifies the process of preparing and signing the 2011 fl tax dr1n form. With our intuitive platform, users can easily fill out forms, add signatures, and securely send documents to the appropriate parties, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the 2011 fl tax dr1n?

Yes, airSlate SignNow offers various pricing plans to meet the needs of different users. Each plan ensures efficient management of forms like the 2011 fl tax dr1n while providing robust features at a competitive price.

-

What features does airSlate SignNow offer for managing the 2011 fl tax dr1n?

airSlate SignNow provides features including template creation, document tracking, and real-time collaboration specifically for documents like the 2011 fl tax dr1n. These tools enhance productivity and streamline the entire signing process.

-

Can I integrate airSlate SignNow with other software for the 2011 fl tax dr1n?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to efficiently manage their 2011 fl tax dr1n form alongside other business tools. This integration enhances workflow and reduces manual entry.

-

What are the benefits of using airSlate SignNow for my 2011 fl tax dr1n?

Using airSlate SignNow for your 2011 fl tax dr1n form provides several benefits, including a user-friendly interface, secure document storage, and expedited signing processes. These advantages help businesses maintain compliance and improve operational efficiency.

-

Is airSlate SignNow secure for signing the 2011 fl tax dr1n form?

Yes, airSlate SignNow ensures high levels of security for all documents, including the 2011 fl tax dr1n form. Our platform features encryption, secure access controls, and compliance with industry standards to protect your sensitive information.

Get more for 69624 Federal Register Vol 71, No 231Friday, December

- Staff contractor form

- Computer services contract form

- Data entry employment contract self employed independent contractor form

- Shoring services contract self employed form

- Service contract self employed form

- Oil cleanup services contract self employed form

- Masonry services contract self employed form

- Insulation services contract self employed 497337057 form

Find out other 69624 Federal Register Vol 71, No 231Friday, December

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors