Arkansas Tax 2019

What is the Arkansas Tax

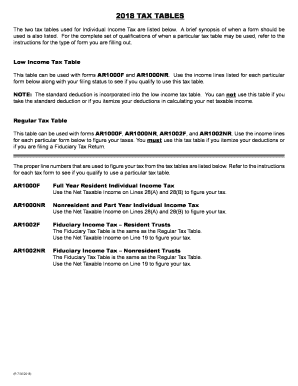

The Arkansas tax refers to the income tax system implemented by the state of Arkansas. This system is designed to collect revenue from individuals and businesses based on their earnings. The tax structure includes various rates and brackets that determine how much an individual or entity owes based on their taxable income. Understanding the Arkansas tax is essential for residents and businesses to ensure compliance and accurate filing of their tax returns.

Steps to complete the Arkansas Tax

Completing the Arkansas tax involves several key steps to ensure that all necessary information is accurately reported. Here are the main steps:

- Gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine your filing status, such as single, married filing jointly, or head of household.

- Calculate your total income and identify any deductions or credits you may qualify for.

- Complete the appropriate Arkansas tax form, which may include the 2017 Arkansas tax return forms.

- Review your completed form for accuracy before submission.

- Submit your form electronically or by mail, ensuring that you meet the filing deadline.

Legal use of the Arkansas Tax

The legal use of the Arkansas tax is governed by state laws and regulations. To ensure that your tax return is legally binding, it is important to comply with all requirements set forth by the Arkansas Department of Finance and Administration. This includes using the correct forms, providing accurate information, and adhering to deadlines. Failure to comply with these regulations may result in penalties or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Arkansas tax are critical to avoid penalties and interest. Typically, the deadline for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Arkansas Department of Finance and Administration website for any updates or changes to these important dates.

Required Documents

To successfully complete the Arkansas tax return, several documents are required. These may include:

- W-2 forms from employers detailing your earnings

- 1099 forms for any additional income received

- Records of deductions, such as mortgage interest or student loan payments

- Any relevant documentation for tax credits you plan to claim

Having these documents organized will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Arkansas offers multiple methods for submitting your tax return. You can file online using approved tax software, which often provides a streamlined process and immediate confirmation of submission. Alternatively, you can mail your completed forms to the appropriate address provided by the Arkansas Department of Finance and Administration. In-person submission may also be available at designated offices, allowing for direct assistance if needed.

Quick guide on how to complete 2018 arkansas tax

Effortlessly Prepare Arkansas Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Arkansas Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Arkansas Tax with Ease

- Locate Arkansas Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal weight as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Arkansas Tax to facilitate excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 arkansas tax

Create this form in 5 minutes!

How to create an eSignature for the 2018 arkansas tax

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What are the key features of the 2017 Arkansas tables?

The 2017 Arkansas tables are designed to provide businesses with user-friendly document management solutions. They offer features such as eSigning, document storage, and easy sharing capabilities, all of which enhance workflow efficiency. Using these tables can streamline the signing process essential for various business transactions.

-

How much do the 2017 Arkansas tables cost?

Pricing for the 2017 Arkansas tables varies based on the specific features and functionalities you require. Typically, airSlate SignNow offers competitive pricing to make eSigning cost-effective. It's best to visit our pricing page to explore different plans and find one that fits your budget.

-

Are the 2017 Arkansas tables suitable for small businesses?

Absolutely! The 2017 Arkansas tables are particularly beneficial for small businesses that need efficient solutions without signNow overhead costs. With easy-to-use features and flexible pricing, airSlate SignNow empowers small businesses to manage eSignatures and documents efficiently.

-

Can I integrate the 2017 Arkansas tables with other software?

Yes, the 2017 Arkansas tables can be seamlessly integrated with various software applications. airSlate SignNow supports integrations with popular tools like CRM systems, project management software, and more, allowing you to enhance your existing workflows effortlessly.

-

What benefits do I get from using the 2017 Arkansas tables?

By using the 2017 Arkansas tables, you can signNowly reduce the time and resources spent on document management. Benefits include faster turnaround times for contracts and agreements, improved organization of digital documents, and enhanced compliance with eSignature laws, leading to more efficient business operations.

-

How secure are the 2017 Arkansas tables?

Security is a priority with the 2017 Arkansas tables. airSlate SignNow employs top-tier encryption and authentication methods to protect your documents and data. You can eSign with confidence knowing that our platform complies with regulatory standards for data protection.

-

Is training available for using the 2017 Arkansas tables?

Yes, airSlate SignNow offers extensive resources and training materials for using the 2017 Arkansas tables. You can access tutorials, webinars, and customer support to become proficient in utilizing the platform's features, ensuring a smooth onboarding experience.

Get more for Arkansas Tax

Find out other Arkansas Tax

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure