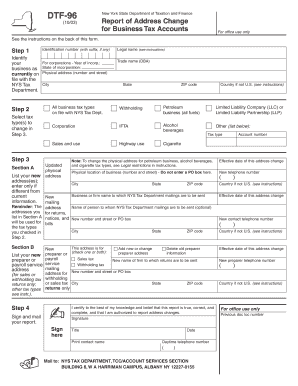

Dtf 96 Form

What is the DTF 948?

The DTF 948 form is a document used primarily for tax purposes in the state of New York. It is designed for businesses and individuals to report specific tax information related to sales and use tax. This form helps ensure compliance with state tax regulations and is essential for maintaining accurate records. Understanding the purpose of the DTF 948 is crucial for anyone involved in taxable transactions within New York.

How to use the DTF 948

Using the DTF 948 involves accurately completing the form with the required information. Taxpayers must gather relevant data, such as sales figures and tax amounts, before filling out the form. The completed DTF 948 can be submitted electronically or via mail, depending on the taxpayer's preference. Ensuring that all information is correct and complete is vital for avoiding delays or penalties.

Steps to complete the DTF 948

Completing the DTF 948 requires a systematic approach. Here are the steps to follow:

- Gather necessary documents, including sales records and tax rates.

- Fill in the taxpayer identification information accurately.

- Report total sales and calculate the applicable tax.

- Review the form for any errors or omissions.

- Submit the form electronically or mail it to the appropriate tax authority.

Following these steps can help ensure that the DTF 948 is completed correctly and submitted on time.

Legal use of the DTF 948

The DTF 948 is legally binding when completed and submitted according to New York state regulations. It is essential for taxpayers to understand the legal implications of the information provided on the form. Accurate reporting helps maintain compliance with tax laws and can protect against potential audits or penalties. Utilizing a reliable eSignature solution, such as airSlate SignNow, can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the DTF 948 can vary based on the taxpayer's specific circumstances, such as the frequency of sales tax reporting. Generally, businesses are required to file this form quarterly or annually. It is important to stay informed about these deadlines to avoid late fees or penalties. Taxpayers should consult the New York State Department of Taxation and Finance for the most current deadlines and requirements.

Form Submission Methods (Online / Mail / In-Person)

The DTF 948 can be submitted through various methods, offering flexibility to taxpayers. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through the New York State Department of Taxation and Finance website.

- Mail: The completed form can be printed and sent via postal mail to the designated tax office.

- In-Person: Taxpayers may also choose to deliver the form in person at local tax offices.

Choosing the right submission method can help streamline the process and ensure timely filing.

Quick guide on how to complete dtf 96 16058606

Complete Dtf 96 effortlessly on any device

Digital document organization has become increasingly favored among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Dtf 96 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to modify and eSign Dtf 96 with ease

- Locate Dtf 96 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize crucial parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and eSign Dtf 96 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 96 16058606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dtf 948 and how does it work?

The dtf 948 is a powerful digital transaction management tool that allows users to streamline their document signing process. By using airSlate SignNow, you can upload, send, and eSign documents effortlessly. This solution ensures that your workflows are efficient and secure, making the dtf 948 integral to modern business operations.

-

What are the pricing options for the dtf 948?

The dtf 948 integrates into airSlate SignNow's competitive pricing structure, offering various plans tailored to meet different business needs. You can choose from monthly or annual subscriptions, ensuring scalability as your business grows. For a detailed breakdown, visit our pricing page and discover the value of the dtf 948.

-

What features are included with the dtf 948?

The dtf 948 provides a suite of features designed to enhance your document management experience. Key functionalities include templates for various document types, advanced security measures, and easy integration with existing workflows. All these features make the dtf 948 a comprehensive solution for eSigning documents.

-

How can the dtf 948 benefit my business?

Utilizing the dtf 948 can signNowly improve your business efficiency by reducing the time spent on document management. This solution helps eliminate paperwork, accelerates the signing process, and reduces errors. Ultimately, the dtf 948 enables your team to focus on core activities while ensuring compliance and security.

-

Can I integrate the dtf 948 with other software?

Yes, the dtf 948 seamlessly integrates with a variety of software tools commonly used in business environments. This compatibility allows for smoother workflows and uninterrupted document handling. By integrating the dtf 948 with your favorite apps, you can enhance productivity across your organization.

-

Is the dtf 948 secure for signing sensitive documents?

Absolutely! The dtf 948 prioritizes the security and confidentiality of all signed documents. With advanced encryption, secure storage, and compliance with industry standards, you can rest assured that your sensitive information is protected while using airSlate SignNow's dtf 948.

-

How do I get started with the dtf 948?

Getting started with the dtf 948 is simple and user-friendly. You can sign up for an account on the airSlate SignNow website and start exploring the features immediately. With our comprehensive resources and support, you’ll be up and running with the dtf 948 in no time.

Get more for Dtf 96

- Form itps coa rev 2018 change of address form forms 2018

- Form n 884 rev 2018 forms 2018

- Form n 323 2018 carryover of tax credits forms 2018

- State death tax chart resourcesthe american college of form

- Abl 107 south carolina department of revenue scgov form

- Adv mva1 form

- Revelation 73 ampquotdo not harm the land or sea or trees until we have form

- Contact travis county tax office form

Find out other Dtf 96

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement