Adv Mva1 Form

What is the Adv Mva1

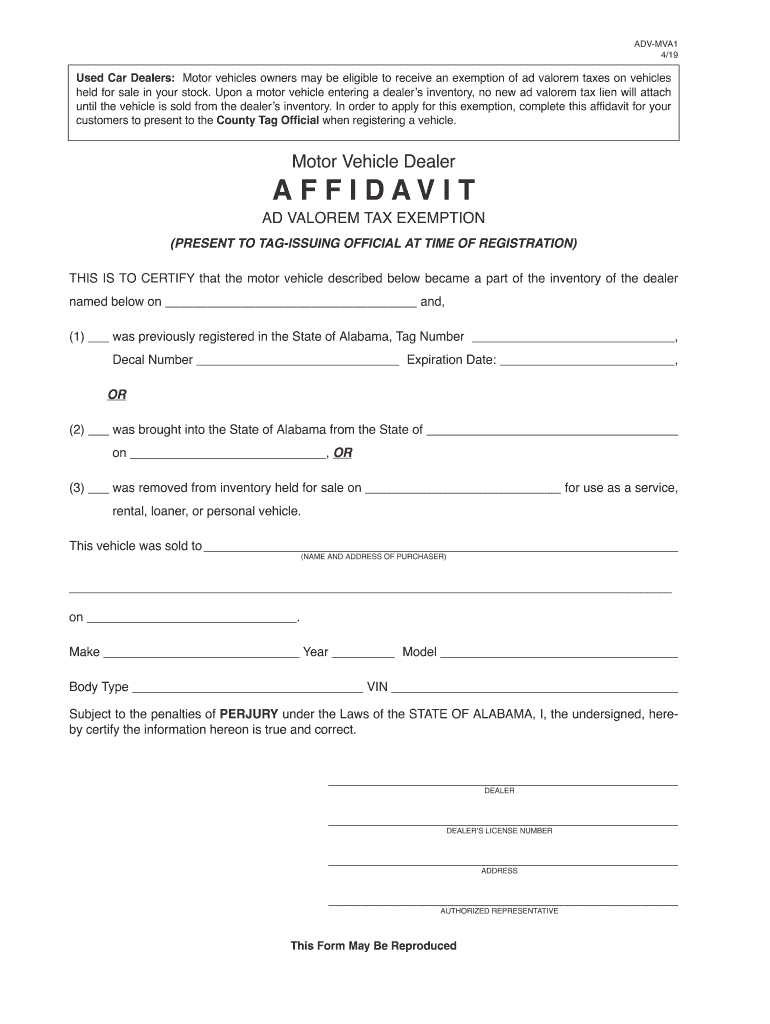

The Adv Mva1 is a key form used in Alabama for reporting vehicle valuation for tax purposes. It plays a crucial role in determining the ad valorem tax owed on vehicles, which is based on their assessed value. This form is essential for individuals and businesses seeking to comply with state tax regulations related to vehicle ownership. Understanding the Adv Mva1 is vital for ensuring accurate tax reporting and avoiding potential penalties.

How to use the Adv Mva1

Using the Adv Mva1 involves several steps to ensure proper completion and submission. First, gather all necessary information regarding the vehicle, including its make, model, year, and identification number. Next, fill out the form accurately, ensuring that all details are correct. After completing the form, it can be submitted electronically or via traditional mail, depending on the local tax authority's requirements. Familiarizing yourself with the form's layout and instructions can streamline the process and help avoid errors.

Steps to complete the Adv Mva1

Completing the Adv Mva1 requires careful attention to detail. Here are the essential steps:

- Gather vehicle information, including the VIN, make, model, and year.

- Obtain the current market value of the vehicle, which may involve consulting resources like Kelley Blue Book.

- Fill out the Adv Mva1 form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate local tax authority, either online or by mail.

Legal use of the Adv Mva1

The Adv Mva1 must be used in accordance with Alabama state laws governing vehicle taxation. This includes ensuring that the information provided is truthful and accurate. Misrepresentation on the form can lead to legal consequences, including fines and penalties. It is important to keep records of the submitted form and any supporting documents, as they may be required for future reference or audits.

Eligibility Criteria

Eligibility for using the Adv Mva1 typically includes individuals and businesses that own vehicles subject to ad valorem taxation in Alabama. This includes personal vehicles, commercial vehicles, and any other types of motor vehicles registered in the state. It is essential to ensure that the vehicle is registered in the owner's name and that all relevant tax obligations are met to avoid complications during the filing process.

Required Documents

When completing the Adv Mva1, certain documents may be required to support the information provided. These documents can include:

- Proof of vehicle ownership, such as the title or registration.

- Documentation of the vehicle's current market value.

- Any previous tax documents related to the vehicle.

Having these documents ready can facilitate a smoother completion process and help ensure compliance with state regulations.

Quick guide on how to complete adv mva1

Complete Adv Mva1 effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Manage Adv Mva1 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Adv Mva1 with minimal effort

- Locate Adv Mva1 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Adv Mva1 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the adv mva1

How to make an eSignature for your Adv Mva1 in the online mode

How to make an electronic signature for the Adv Mva1 in Google Chrome

How to make an eSignature for signing the Adv Mva1 in Gmail

How to create an eSignature for the Adv Mva1 straight from your mobile device

How to create an eSignature for the Adv Mva1 on iOS devices

How to create an electronic signature for the Adv Mva1 on Android

People also ask

-

What is Adv Mva1 in relation to airSlate SignNow?

Adv Mva1 is a key feature in airSlate SignNow that enhances document management and eSigning processes. It simplifies the workflow, making it easier for users to send and sign documents quickly and securely, ultimately improving business efficiency.

-

How does airSlate SignNow with Adv Mva1 improve document workflow?

With Adv Mva1, airSlate SignNow automates many aspects of document management, ensuring that signatures and approvals are obtained faster. This feature allows users to create customizable workflows that streamline the entire eSigning process, reducing the time spent on paperwork.

-

What pricing plans are available for airSlate SignNow featuring Adv Mva1?

airSlate SignNow offers competitive pricing plans that include the Adv Mva1 feature, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that scale based on your organization’s needs, providing excellent value for the capabilities offered.

-

Can I integrate Adv Mva1 with other software?

Yes, Adv Mva1 within airSlate SignNow supports integrations with various popular software applications. This allows businesses to connect their existing tools seamlessly, enhancing productivity and ensuring that eSigning fits smoothly into their current workflows.

-

What are the security features of airSlate SignNow with Adv Mva1?

airSlate SignNow prioritizes security with Adv Mva1 by implementing robust encryption protocols and compliance with major regulations. This ensures that all documents signed through the platform remain confidential and protected from unauthorized access.

-

Is it easy to use airSlate SignNow with Adv Mva1?

Absolutely! airSlate SignNow, featuring Adv Mva1, is designed with user-friendliness in mind. The intuitive interface allows users to navigate the eSigning process effortlessly, making it accessible even for those who are not tech-savvy.

-

What benefits can businesses expect from using Adv Mva1 in airSlate SignNow?

Businesses utilizing Adv Mva1 in airSlate SignNow can expect increased efficiency, faster turnaround times for document signing, and reduced operational costs. The automation features also minimize errors, leading to more accurate and reliable document handling.

Get more for Adv Mva1

- Nys individual form

- Schedule d form 1120 department of the

- Louisville metro revenue commission fill out ampamp sign online form

- Form 31 103f1 calculation of excess working capital

- Mtis nation of ontarioregistrymtis of ontario metis form

- Ucpr form 45 fill and sign printable template online

- Form 56 10a file number 20 g supreme court of newfoundland

- Referral program contract template form

Find out other Adv Mva1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors