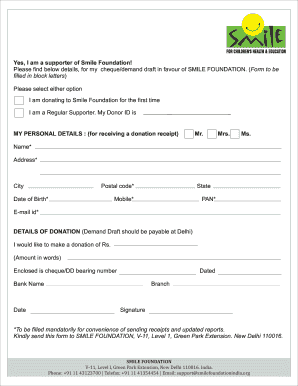

Yes, I Am a Supporter of Smile Foundation! Form to Be Smilefoundationindia

Understanding the foundation donation receipt

A foundation donation receipt serves as formal documentation for contributions made to a charitable organization, such as the Smile Foundation. This receipt is essential for both the donor and the organization, as it provides proof of the donation for tax purposes. Donors can use this receipt to claim tax deductions, while organizations must issue these receipts to comply with IRS regulations. The receipt typically includes the donor's name, the amount donated, the date of the donation, and the foundation's tax identification number.

Steps to complete the foundation donation receipt

Completing a foundation donation receipt involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information, including the donor's name, contact details, and the donation amount. Next, include the date of the donation and the foundation's tax identification number. It is also important to provide a brief description of the purpose of the donation. Once all information is collected, review the receipt for accuracy before issuing it to the donor.

Legal use of the foundation donation receipt

The foundation donation receipt is legally binding when it meets specific criteria set by the IRS. To be valid, the receipt must include the donor's name, the amount donated, the date of the contribution, and a statement confirming whether any goods or services were provided in exchange for the donation. This documentation is crucial for donors seeking to claim tax deductions, as it serves as proof of their charitable contributions.

IRS guidelines for foundation donation receipts

According to IRS guidelines, charitable organizations must provide a written acknowledgment of donations that exceed a certain amount, typically $250. The acknowledgment must include specific information, such as the donor's name, the amount of the contribution, and a description of any goods or services provided. Organizations must also keep records of all donations and receipts issued to ensure compliance with federal tax regulations.

Examples of using the foundation donation receipt

Foundation donation receipts can be utilized in various scenarios. For instance, an individual donating to the Smile Foundation can use the receipt to claim a deduction on their income tax return. Similarly, businesses that contribute to charitable causes can also leverage these receipts for tax benefits. It is essential for both individuals and organizations to maintain accurate records of all donations and receipts for auditing purposes.

Form submission methods for foundation donation receipts

Foundation donation receipts can be submitted in various ways, depending on the organization's policies. Common submission methods include online forms, email, or traditional mail. Organizations may also choose to provide digital copies of receipts for convenience. Regardless of the method, it is important to ensure that the receipt is delivered promptly to the donor to facilitate their tax filing process.

Quick guide on how to complete yes i am a supporter of smile foundation form to be smilefoundationindia

Prepare Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia effortlessly on any gadget

Digital document management has become widely accepted among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow supplies you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest method to alter and eSign Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia without any hassle

- Obtain Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the yes i am a supporter of smile foundation form to be smilefoundationindia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Smile Foundation donation receipt?

A Smile Foundation donation receipt is an official document that confirms your charitable contribution to the Smile Foundation. It serves as proof for tax deductions and provides detailed information about your donation. Obtaining a receipt helps showcase your generosity and commitment to social causes.

-

How can I obtain a Smile Foundation donation receipt?

To obtain a Smile Foundation donation receipt, donors should ensure their contribution is processed through the Smile Foundation’s official channels. After your donation, you can request a receipt either via email or through their website. It’s essential to provide your donation details to facilitate a swift issuance of your Smile Foundation donation receipt.

-

Is there a cost associated with getting a Smile Foundation donation receipt?

There is typically no cost for receiving a Smile Foundation donation receipt as it is provided free of charge upon processing your donation. This ensures that donors can easily claim tax benefits without additional expenses. Be assured that your support helps the foundation without incurring extra fees for receipts.

-

What features does airSlate SignNow offer for managing donation receipts?

airSlate SignNow offers features such as electronic signatures and document automation to streamline the management of your Smile Foundation donation receipt. With SignNow, you can easily create, send, and sign documents related to your donations. This not only saves time but also enhances the security and tracking of your donation receipts.

-

Can I customize my Smile Foundation donation receipt using airSlate SignNow?

Yes, with airSlate SignNow, you can customize your Smile Foundation donation receipt to include specific information such as your name, donation amount, and date. Customization ensures your receipt meets all your documentation needs and can be tailored for tax purposes. This added flexibility makes managing your charitable contributions easier.

-

Are there any integrations available with airSlate SignNow for donation management?

airSlate SignNow provides various integrations that can help enhance your donation management process, including popular payment processors and CRM systems. These integrations allow for seamless transactions and automatic receipt generation, making it easier to manage your Smile Foundation donation receipt efficiently. Leverage these tools to optimize your charitable giving.

-

What are the benefits of digital donation receipts like those from Smile Foundation?

Digital donation receipts, like those from Smile Foundation, provide numerous benefits including instant delivery and easy accessibility. They can be stored electronically, minimizing paperwork and making tax filing simpler. Additionally, a digital receipt is secure and can be easily retrieved whenever necessary, adding convenience for donors.

Get more for Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia

- Topic no 305 recordkeepinginternal revenue service irsgov form

- Orea application form pdf

- Yorku transcript form

- Hr forms and publications ucnet university of california

- Home safety self assessment tool aging amp technology research tompkins co form

- Zvirahwe nedudziro pdf form

- Confidential contract template form

- Maryland state income tax forms

Find out other Yes, I Am A Supporter Of Smile Foundation! Form To Be Smilefoundationindia

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy