Dr 15tdt Form 2018

What is the DR 15TDT Form

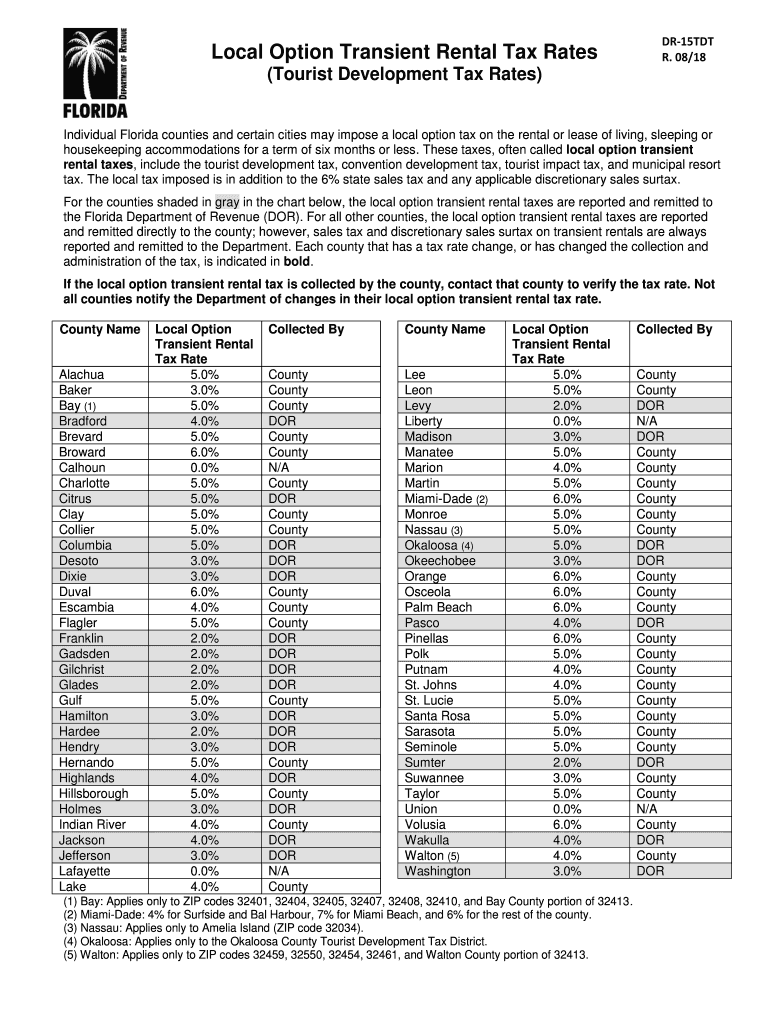

The DR 15TDT form, also known as the Florida transient sales tax on rentals form, is a crucial document for property owners and rental businesses operating in Florida. This form is used to report and remit the transient rental tax collected from guests who rent accommodations for six months or less. It is essential for compliance with Florida's tax regulations, ensuring that rental operators fulfill their obligations regarding local option taxes and state sales taxes.

How to Use the DR 15TDT Form

To effectively use the DR 15TDT form, rental operators must accurately complete all required sections. This includes providing details about the rental property, the total amount of rent collected, and the applicable tax rates. After filling out the form, it should be submitted to the appropriate state or local tax authority, along with any taxes owed. Proper usage of this form helps avoid penalties and ensures compliance with Florida tax laws.

Steps to Complete the DR 15TDT Form

Completing the DR 15TDT form involves several key steps:

- Gather all necessary information about your rental property, including address and ownership details.

- Calculate the total rental income received during the reporting period.

- Determine the applicable transient rental tax rate based on your location.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors before submission.

- Submit the completed form along with the tax payment to the relevant tax authority.

Legal Use of the DR 15TDT Form

The DR 15TDT form is legally binding when completed and submitted according to Florida law. It serves as a formal declaration of the taxes owed on transient rentals. To ensure its legal validity, rental operators must comply with the guidelines set forth by the Florida Department of Revenue. This includes adhering to filing deadlines and maintaining accurate records of all rental transactions.

Key Elements of the DR 15TDT Form

Key elements of the DR 15TDT form include:

- Property Information: Details about the rental property, including its location and ownership.

- Rental Income: Total amount of rent collected during the reporting period.

- Tax Calculation: Breakdown of the transient rental tax owed based on local rates.

- Signature: Required signature of the property owner or authorized representative, affirming the accuracy of the information provided.

Form Submission Methods

The DR 15TDT form can be submitted through various methods, including:

- Online Submission: Many jurisdictions allow electronic filing through their official websites.

- Mail: The completed form can be printed and mailed to the appropriate tax authority.

- In-Person: Some tax offices accept in-person submissions for immediate processing.

Quick guide on how to complete dr 15tdt 2018 2019 form

Complete Dr 15tdt Form effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Dr 15tdt Form on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign Dr 15tdt Form seamlessly

- Locate Dr 15tdt Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, repetitive form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Dr 15tdt Form while ensuring smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 15tdt 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the dr 15tdt 2018 2019 form

How to generate an eSignature for your Dr 15tdt 2018 2019 Form online

How to create an eSignature for your Dr 15tdt 2018 2019 Form in Chrome

How to generate an electronic signature for signing the Dr 15tdt 2018 2019 Form in Gmail

How to make an electronic signature for the Dr 15tdt 2018 2019 Form from your smartphone

How to generate an electronic signature for the Dr 15tdt 2018 2019 Form on iOS

How to generate an eSignature for the Dr 15tdt 2018 2019 Form on Android devices

People also ask

-

What is the Florida transient sales tax on rentals forms DR 15?

The Florida transient sales tax on rentals forms DR 15 is a document used by rental property owners to report and remit taxes collected from transient rental guests. This form ensures compliance with state tax laws and helps streamline the tax reporting process. Understanding how to fill out and submit this form is crucial for property owners in Florida.

-

How can airSlate SignNow help me manage Florida transient sales tax on rentals forms DR 15?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign Florida transient sales tax on rentals forms DR 15. With features like template saving and secure electronic signatures, you can manage your tax documents efficiently. This helps to ensure timely submissions and compliance without the headache of paperwork.

-

Are there any costs associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to ensure that you can find an option that suits your business needs, whether it's for managing Florida transient sales tax on rentals forms DR 15 or other documents. The cost is competitive and typically includes features tailored to make tax form management affordable. You can even start with a free trial to see if it's the right fit for you.

-

Can I integrate airSlate SignNow with other existing software for managing rentals?

Absolutely! airSlate SignNow seamlessly integrates with various property management software, facilitating the management of Florida transient sales tax on rentals forms DR 15 alongside your other rental operations. With these integrations, you can streamline your workflow and enhance collaboration, saving you time and reducing errors.

-

What are the benefits of eSigning Florida transient sales tax on rentals forms DR 15?

eSigning Florida transient sales tax on rentals forms DR 15 through airSlate SignNow offers several benefits, including legal compliance, reduced processing time, and the ability to sign from anywhere. This digital approach eliminates the need for physical paperwork, making it easy to keep track of submissions and deadlines. It signNowly enhances efficiency in your business operations.

-

Is there customer support available for questions about Florida transient sales tax on rentals forms DR 15?

Yes, airSlate SignNow provides dedicated customer support that can assist with any questions related to Florida transient sales tax on rentals forms DR 15. Whether you need help filling out the form or navigating the platform, our support team is available to ensure you have the resources you need for a smooth experience.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow ensures the highest level of security for handling sensitive documents like Florida transient sales tax on rentals forms DR 15. Our platform uses strong encryption and complies with industry standards to protect your information at all times. You can trust that your tax documents are safe and secure while using our service.

Get more for Dr 15tdt Form

Find out other Dr 15tdt Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online