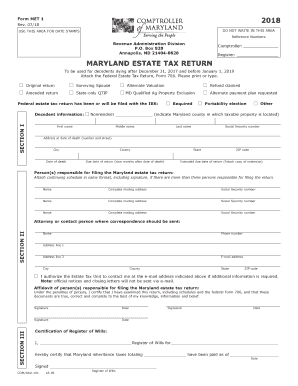

Maryland Met 1 2018

What is the Maryland Met 1?

The Maryland Met 1 form is an essential document used for reporting estate taxes in the state of Maryland. This form is specifically designed for estates that exceed a certain value threshold, which is determined by Maryland law. The Met 1 form provides the state with crucial information regarding the assets of the deceased, allowing for the accurate assessment of estate tax obligations. Understanding the purpose and requirements of the Maryland Met 1 is vital for executors and administrators managing an estate.

Steps to Complete the Maryland Met 1

Completing the Maryland Met 1 form involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary financial documents, including the deceased's will, asset valuations, and any existing debts. Next, accurately fill out each section of the form, detailing the estate's assets and liabilities. It is important to double-check all figures for accuracy, as errors can lead to delays or penalties. Once completed, the form should be signed by the executor or administrator before submission.

Required Documents

To successfully file the Maryland Met 1 form, certain documents must be gathered and submitted alongside the form. These typically include:

- The death certificate of the deceased.

- A copy of the will, if available.

- Valuations of all estate assets, such as real estate, bank accounts, and investments.

- Documentation of any debts or liabilities owed by the estate.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is provided.

Form Submission Methods

The Maryland Met 1 form can be submitted through various methods, providing flexibility for estate representatives. The options include:

- Online Submission: Many users prefer to file electronically, which can expedite processing times.

- Mail: The completed form can be printed and mailed to the appropriate state office.

- In-Person: Executors may also choose to deliver the form in person at designated state offices.

Each submission method has its own processing times and requirements, so it is advisable to choose the one that best fits the situation.

Penalties for Non-Compliance

Failure to file the Maryland Met 1 form accurately and on time can result in significant penalties. These may include:

- Monetary fines imposed by the state.

- Interest on unpaid estate taxes, which can accumulate over time.

- Potential legal complications for the executor or administrator.

Being aware of these penalties underscores the importance of timely and accurate filing of the Maryland Met 1 form.

Eligibility Criteria

Not all estates are required to file the Maryland Met 1 form. Eligibility is typically determined by the total value of the estate. Estates exceeding a specific threshold, as defined by Maryland law, must file the form. It is crucial for executors to assess the estate's value accurately to determine whether filing is necessary. Consulting with a tax professional or attorney can provide clarity on eligibility and compliance requirements.

Quick guide on how to complete maryland form met 1 2018 2019

Effortlessly Prepare Maryland Met 1 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Maryland Met 1 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Edit and eSign Maryland Met 1 with Ease

- Find Maryland Met 1 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional signature made with ink.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Update and eSign Maryland Met 1 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form met 1 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the maryland form met 1 2018 2019

How to generate an eSignature for your Maryland Form Met 1 2018 2019 online

How to generate an electronic signature for the Maryland Form Met 1 2018 2019 in Chrome

How to create an eSignature for signing the Maryland Form Met 1 2018 2019 in Gmail

How to make an eSignature for the Maryland Form Met 1 2018 2019 straight from your smart phone

How to create an eSignature for the Maryland Form Met 1 2018 2019 on iOS

How to make an electronic signature for the Maryland Form Met 1 2018 2019 on Android OS

People also ask

-

What is a Maryland estate tax return and who needs to file it?

A Maryland estate tax return is a tax document that must be filed by the estate of a deceased individual whose gross estate exceeds a specific threshold. Families and executors of estates must ensure this return is filed to comply with state laws and avoid penalties.

-

How can airSlate SignNow simplify my Maryland estate tax return process?

airSlate SignNow offers a user-friendly platform that allows you to send and eSign necessary documents quickly, including the Maryland estate tax return. This streamlines the workflow and helps ensure all required signatures are obtained promptly, making the process less stressful.

-

What features does airSlate SignNow offer for managing my Maryland estate tax return?

With airSlate SignNow, you can access features that include document templates, custom workflows, and real-time tracking for your Maryland estate tax return. These tools are designed to enhance efficiency, ensuring your documents are prepared and filed accurately.

-

What are the costs associated with using airSlate SignNow for my estate documents?

airSlate SignNow offers affordable pricing plans that cater to various business needs, whether for personal or professional estate management. By utilizing this platform for your Maryland estate tax return, you can save both time and money compared to traditional methods.

-

Is it easy to collaborate with others on my Maryland estate tax return using airSlate SignNow?

Yes, airSlate SignNow makes collaboration straightforward by allowing multiple users to access, edit, and eSign the Maryland estate tax return documents in real-time. This ensures that all parties involved can contribute effectively to the filing process.

-

How secure is my information when using airSlate SignNow for Maryland estate tax returns?

airSlate SignNow prioritizes user security, employing advanced encryption and secure storage to protect your Maryland estate tax return data. You can trust that your sensitive information will remain confidential and secure throughout the process.

-

Does airSlate SignNow integrate with other software for managing my estate documents?

Absolutely, airSlate SignNow easily integrates with various software tools, allowing you to manage your Maryland estate tax return alongside other essential applications. This seamless integration enhances your overall efficiency and streamlines workflows.

Get more for Maryland Met 1

Find out other Maryland Met 1

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile