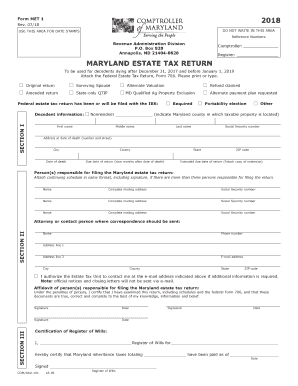

Maryland Met 1 2018

What is the Maryland Met 1?

The Maryland Met 1 form is an essential document used for reporting estate taxes in the state of Maryland. This form is specifically designed for estates that exceed a certain value threshold, which is determined by Maryland law. The Met 1 form provides the state with crucial information regarding the assets of the deceased, allowing for the accurate assessment of estate tax obligations. Understanding the purpose and requirements of the Maryland Met 1 is vital for executors and administrators managing an estate.

Steps to Complete the Maryland Met 1

Completing the Maryland Met 1 form involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary financial documents, including the deceased's will, asset valuations, and any existing debts. Next, accurately fill out each section of the form, detailing the estate's assets and liabilities. It is important to double-check all figures for accuracy, as errors can lead to delays or penalties. Once completed, the form should be signed by the executor or administrator before submission.

Required Documents

To successfully file the Maryland Met 1 form, certain documents must be gathered and submitted alongside the form. These typically include:

- The death certificate of the deceased.

- A copy of the will, if available.

- Valuations of all estate assets, such as real estate, bank accounts, and investments.

- Documentation of any debts or liabilities owed by the estate.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is provided.

Form Submission Methods

The Maryland Met 1 form can be submitted through various methods, providing flexibility for estate representatives. The options include:

- Online Submission: Many users prefer to file electronically, which can expedite processing times.

- Mail: The completed form can be printed and mailed to the appropriate state office.

- In-Person: Executors may also choose to deliver the form in person at designated state offices.

Each submission method has its own processing times and requirements, so it is advisable to choose the one that best fits the situation.

Penalties for Non-Compliance

Failure to file the Maryland Met 1 form accurately and on time can result in significant penalties. These may include:

- Monetary fines imposed by the state.

- Interest on unpaid estate taxes, which can accumulate over time.

- Potential legal complications for the executor or administrator.

Being aware of these penalties underscores the importance of timely and accurate filing of the Maryland Met 1 form.

Eligibility Criteria

Not all estates are required to file the Maryland Met 1 form. Eligibility is typically determined by the total value of the estate. Estates exceeding a specific threshold, as defined by Maryland law, must file the form. It is crucial for executors to assess the estate's value accurately to determine whether filing is necessary. Consulting with a tax professional or attorney can provide clarity on eligibility and compliance requirements.

Quick guide on how to complete maryland form met 1 2018 2019

Effortlessly Prepare Maryland Met 1 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Maryland Met 1 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Edit and eSign Maryland Met 1 with Ease

- Find Maryland Met 1 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional signature made with ink.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Update and eSign Maryland Met 1 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form met 1 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the maryland form met 1 2018 2019

How to generate an eSignature for your Maryland Form Met 1 2018 2019 online

How to generate an electronic signature for the Maryland Form Met 1 2018 2019 in Chrome

How to create an eSignature for signing the Maryland Form Met 1 2018 2019 in Gmail

How to make an eSignature for the Maryland Form Met 1 2018 2019 straight from your smart phone

How to create an eSignature for the Maryland Form Met 1 2018 2019 on iOS

How to make an electronic signature for the Maryland Form Met 1 2018 2019 on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Maryland Met 1?

airSlate SignNow is a comprehensive eSignature solution that enables businesses to efficiently send and eSign documents. When implemented in line with Maryland Met 1 standards, it ensures that your document processes are compliant, secure, and streamlined for better efficiency.

-

How much does airSlate SignNow cost for Maryland Met 1 compliant businesses?

Pricing for airSlate SignNow varies based on the features and number of users required. For businesses in Maryland Met 1, we offer tiered pricing plans designed to fit different organizational needs, ensuring you get the best value without compromising on compliance or functionality.

-

What features does airSlate SignNow offer for businesses in Maryland Met 1?

airSlate SignNow offers a range of features tailored for Maryland Met 1 businesses, including customizable templates, advanced security measures, and integration capabilities with other applications. These features help streamline the signing process while maintaining compliance with local regulations.

-

Can airSlate SignNow integrate with other tools for Maryland Met 1 businesses?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that Maryland Met 1 businesses commonly use, such as CRMs, document management systems, and cloud storage services. This compatibility enhances workflow efficiency and ensures a smooth transition to a digital signing process.

-

What are the benefits of using airSlate SignNow for Maryland Met 1 compliance?

Using airSlate SignNow for Maryland Met 1 compliance offers several benefits, including improved document turnaround times, enhanced security features, and reduced paper usage. These advantages not only help in maintaining compliance but also contribute to overall organizational efficiency.

-

Is airSlate SignNow suitable for small businesses in Maryland Met 1?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises in Maryland Met 1. Its cost-effective pricing and user-friendly interface make it an ideal choice for smaller businesses looking to streamline their document signing processes.

-

How does airSlate SignNow ensure security for Maryland Met 1 businesses?

airSlate SignNow prioritizes security by employing advanced encryption protocols and compliance with industry standards, making it a trusted choice for Maryland Met 1 businesses. By utilizing robust authentication methods, your documents remain secure throughout the signing process.

Get more for Maryland Met 1

- Unlicensed practice of law complaint form the florida bar floridabar

- Writ of possession form

- Rental certificate form

- In the iowa district court for polk county iowa legal aid form

- Judgement proof letterpdffillercom form

- Spousalpartner maintenance advisement pursuant to crs courts state co form

- Form p 35

- Dc confidential statement form

Find out other Maryland Met 1

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure