Loan Commitment Letter Form

What is the Loan Commitment Letter

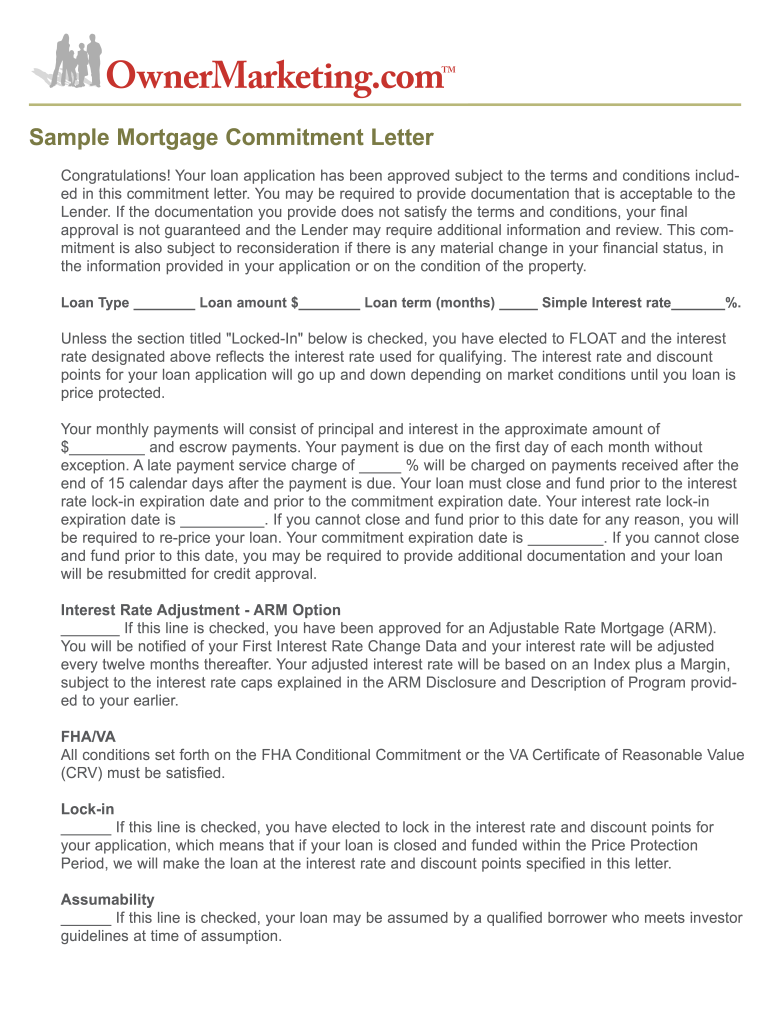

A loan commitment letter is a document issued by a lender that confirms a borrower's eligibility for a specific loan amount under certain terms and conditions. This letter serves as a formal agreement between the lender and the borrower, outlining the details of the loan, including the interest rate, repayment terms, and any conditions that must be met before the loan is finalized. It is an essential step in the mortgage process, providing assurance to both parties that the financing is secure.

Key elements of the Loan Commitment Letter

Understanding the key elements of a loan commitment letter is crucial for borrowers. Typically, the letter includes:

- Loan Amount: The total amount of money the lender is willing to provide.

- Interest Rate: The rate at which interest will accrue on the loan.

- Loan Term: The duration over which the loan must be repaid.

- Conditions: Any specific requirements that must be fulfilled before the loan can be disbursed, such as additional documentation or property appraisals.

- Expiration Date: The date by which the borrower must close on the loan to secure the terms outlined in the letter.

How to obtain the Loan Commitment Letter

To obtain a loan commitment letter, a borrower typically needs to complete a mortgage application with a lender. This process may involve providing personal financial information, such as income, assets, and credit history. Once the application is submitted, the lender will review the information and conduct an underwriting process. If approved, the lender will issue the loan commitment letter, detailing the terms of the loan and any conditions that must be met.

Steps to complete the Loan Commitment Letter

Completing the loan commitment letter involves several important steps:

- Review the Letter: Carefully read the letter to understand the terms and conditions.

- Gather Required Documentation: Collect any additional documents requested by the lender, such as proof of income or asset verification.

- Address Conditions: Ensure that all conditions outlined in the letter are met, such as obtaining a satisfactory property appraisal.

- Sign the Letter: Once all conditions are satisfied, sign the loan commitment letter to acknowledge acceptance of the terms.

- Submit to Lender: Return the signed letter to the lender to proceed with the loan process.

Legal use of the Loan Commitment Letter

The loan commitment letter serves a legal purpose by establishing a binding agreement between the borrower and the lender. It is important for borrowers to understand that once they accept the terms of the letter, they are obligated to fulfill the conditions outlined within it. This document can be used in legal proceedings to demonstrate the borrower's intent and the lender's commitment to providing the loan under specified terms.

Examples of using the Loan Commitment Letter

Loan commitment letters are commonly used in various scenarios, such as:

- Home Purchases: Buyers often present a loan commitment letter to sellers as proof of financing when making an offer on a property.

- Refinancing: Homeowners seeking to refinance their existing mortgage may receive a loan commitment letter outlining the new terms.

- Investment Properties: Investors may use a loan commitment letter to secure financing for purchasing rental properties.

Quick guide on how to complete sample mortgage letter form

The simplest method to locate and authorize Loan Commitment Letter

Across your entire enterprise, ineffective procedures regarding paper approvals can consume signNow working hours. Endorsing documents like Loan Commitment Letter is an inherent aspect of operations in any sector, which is why the productivity of each agreement's lifecycle has a substantial impact on the organization's overall efficiency. With airSlate SignNow, endorsing your Loan Commitment Letter can be as straightforward and swift as possible. This platform provides you with the most recent version of nearly any form. Even better, you can endorse it immediately without the need to install external applications on your device or print out physical copies.

How to obtain and endorse your Loan Commitment Letter

- Browse our collection by category or utilize the search bar to find the form you require.

- View the form preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to commence editing instantly.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click the Sign tool to authorize your Loan Commitment Letter.

- Select the signature method that works best for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents efficiently. You can locate, complete, edit, and even dispatch your Loan Commitment Letter from a single tab with no complications. Optimize your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Do I have to fill out a form to receive a call letter for the NDA SSB?

No form has to be filled for u to get your call-up letter.If you have cleared the written exam and your roll no. Is in the list, then sooner or later you will get your call-up letter.I would suggest you to keep looking for your SSB dates. Online on sites like Join Indian Army. Because the hard copy may be delayed due to postal errors or faults.Just to reassure you, NO FORM HAS TO BE FILLED TO GET YOUR SSB CALLUP LETTER.Cheers and All the Best

-

How do I fill out the Form 102 (ICAI) for an articleship? Can anyone provide a sample format?

Form 102 serves as a contract between you and your Principal at work. It becomes binding only when its Franked.Franking is nothing but converting it into a Non Judicial Paper. So u'll be filling in your name, your articleship period and other details and you and your boss(principal) will sign it on each page and at the end. It need not be sent to the institute , one copy is for you and another for your Principal .Nothin to worry..And while filling the form if you have any query , just see the form filled by old articles. The record will be with your Principal or ask your seniors.

-

Is it compulsory to fill out the iVerify form for Wipro before getting a joining letter?

Yes, you should definitely will the form as you require it for your Background verification else the HR would mail and call every time unless you fill it.

-

Do I need to fill out a customs form to mail a 1 oz letter? Would I put the customs form outside the envelope or inside?

No. There are specific envelopes that are used to identify mail under 16 oz and don’t require a P.S. form. These envelopes have a colored stripe along its borders which indicates to the shipper that it’s an international mail piece.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

Create this form in 5 minutes!

How to create an eSignature for the sample mortgage letter form

How to make an electronic signature for the Sample Mortgage Letter Form in the online mode

How to create an electronic signature for your Sample Mortgage Letter Form in Google Chrome

How to create an eSignature for putting it on the Sample Mortgage Letter Form in Gmail

How to make an eSignature for the Sample Mortgage Letter Form from your smartphone

How to generate an electronic signature for the Sample Mortgage Letter Form on iOS

How to generate an electronic signature for the Sample Mortgage Letter Form on Android

People also ask

-

What is a Loan Commitment Letter?

A Loan Commitment Letter is a formal document provided by a lender that outlines the terms and conditions of a loan approval. This letter serves as a guarantee to the borrower that they have been approved for a specific loan amount and details the interest rates and repayment terms. Understanding the components of a Loan Commitment Letter is essential for borrowers seeking clarity in their loan agreements.

-

How does airSlate SignNow help with Loan Commitment Letters?

airSlate SignNow simplifies the process of creating and signing Loan Commitment Letters by providing an easy-to-use platform for document management. With our eSignature capabilities, you can quickly send, sign, and store Loan Commitment Letters securely. This streamlines the loan approval process and enhances communication between lenders and borrowers.

-

What are the benefits of using airSlate SignNow for Loan Commitment Letters?

Using airSlate SignNow for Loan Commitment Letters offers various benefits, including increased efficiency, enhanced security, and cost-effectiveness. Our platform allows for quick document turnaround times and eliminates the need for physical paperwork. Additionally, the electronic signature feature ensures that your Loan Commitment Letters are signed legally and securely.

-

Are there any integration options available for Loan Commitment Letters?

Yes, airSlate SignNow offers seamless integration with various CRM and financial management tools, enhancing your ability to manage Loan Commitment Letters efficiently. These integrations help streamline your workflow, allowing for easy access to client information and history. By connecting airSlate SignNow with your existing systems, you can improve the overall loan processing experience.

-

What pricing options does airSlate SignNow offer for managing Loan Commitment Letters?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various businesses managing Loan Commitment Letters. Our plans range from basic to advanced, allowing you to choose the features that best suit your requirements. With our cost-effective solutions, you can optimize your document management process without breaking the bank.

-

Is airSlate SignNow secure for handling Loan Commitment Letters?

Absolutely! airSlate SignNow prioritizes security when handling Loan Commitment Letters. Our platform employs advanced encryption protocols and complies with industry standards to protect sensitive information. You can trust that your documents are safe and secure throughout the signing process.

-

Can I customize my Loan Commitment Letter templates with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Loan Commitment Letter templates to fit your specific needs. You can easily modify text, add your branding, and include necessary terms to ensure that your document reflects your business style. Customizable templates save time and enhance the professional appearance of your Loan Commitment Letters.

Get more for Loan Commitment Letter

Find out other Loan Commitment Letter

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe