Berks Earned Income Tax Bureau Form

What is the Berks Earned Income Tax Bureau Form

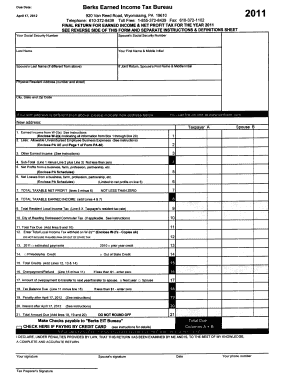

The Berks Earned Income Tax Bureau form is a crucial document used for reporting earned income within Berks County, Pennsylvania. This form is essential for individuals and businesses to accurately declare their earnings and ensure compliance with local tax regulations. The form captures important information such as the taxpayer's name, address, and income details, which are necessary for calculating the earned income tax owed to the county.

How to use the Berks Earned Income Tax Bureau Form

Using the Berks Earned Income Tax Bureau form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information and income details. Be sure to double-check all entries for accuracy. Once completed, the form can be submitted electronically or by mail, depending on your preference and the options provided by the bureau.

Steps to complete the Berks Earned Income Tax Bureau Form

Completing the Berks Earned Income Tax Bureau form requires careful attention to detail. Follow these steps:

- Gather all relevant income documentation.

- Enter your personal information, including your name and address.

- Report all sources of earned income accurately.

- Calculate the total tax owed based on the provided guidelines.

- Review the form for any errors or omissions.

- Submit the completed form through your chosen method.

Legal use of the Berks Earned Income Tax Bureau Form

The Berks Earned Income Tax Bureau form is legally binding once completed and submitted. It must adhere to local tax laws and regulations to be considered valid. Accurate reporting of income is essential to avoid penalties and ensure compliance with the law. The form also serves as a record of your earnings and tax obligations, which can be referenced in future tax filings or audits.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Berks Earned Income Tax Bureau form can be done through various methods to accommodate different preferences. Options typically include:

- Online submission: Many taxpayers prefer to submit their forms electronically for convenience and speed.

- Mail: You can print the completed form and send it to the Berks Earned Income Tax Bureau via postal service.

- In-person: For those who prefer face-to-face interactions, visiting the bureau's office is an option for submission.

Penalties for Non-Compliance

Failure to submit the Berks Earned Income Tax Bureau form or inaccuracies in reporting can lead to penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the importance of timely and accurate submissions to avoid these consequences. Taxpayers are encouraged to stay informed about their obligations and seek assistance if needed.

Quick guide on how to complete berks earned income tax bureau form

Complete Berks Earned Income Tax Bureau Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an optimal eco-conscious alternative to traditional printed and signed papers, enabling you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Berks Earned Income Tax Bureau Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Berks Earned Income Tax Bureau Form with ease

- Obtain Berks Earned Income Tax Bureau Form and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize essential sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Berks Earned Income Tax Bureau Form to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the berks earned income tax bureau form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Berks Earned Income Tax Bureau offer?

The Berks Earned Income Tax Bureau provides essential services related to the collection and management of earned income tax for residents and businesses. This includes processing tax returns, issuing refunds, and managing payments. By utilizing airSlate SignNow, you can streamline the document signing process for any tax-related paperwork you may need.

-

How can I access my Berks Earned Income Tax Bureau account online?

To access your Berks Earned Income Tax Bureau account online, visit their official website and look for the taxpayer login section. You will need your unique identification details to log in. With airSlate SignNow, you can securely manage documents related to your tax submissions or inquiries directly from your account.

-

What is the pricing structure for services related to the Berks Earned Income Tax Bureau?

The pricing for services associated with the Berks Earned Income Tax Bureau can vary based on the service type. Typically, the bureau charges a small fee for processing returns and payments. Using airSlate SignNow for document signing can also save you time and money by offering a cost-effective eSignature solution.

-

How does airSlate SignNow enhance interactions with the Berks Earned Income Tax Bureau?

airSlate SignNow enhances interactions with the Berks Earned Income Tax Bureau by providing an easy-to-use platform for eSigning necessary documents. This allows you to quickly and securely send forms or agreements related to your taxes, ensuring compliance with the bureau's requirements. It signNowly reduces the turnaround time for document processing.

-

Can airSlate SignNow integrate with other financial tools for Berks Earned Income Tax Bureau needs?

Yes, airSlate SignNow integrates seamlessly with various financial tools and software, making it an excellent companion for managing your Berks Earned Income Tax Bureau-related tasks. This integration facilitates smoother workflows and efficient document management, especially during tax season. You can sync your documents effortlessly, ensuring everything is organized.

-

What are the benefits of using airSlate SignNow for Berks Earned Income Tax Bureau documentation?

Using airSlate SignNow for Berks Earned Income Tax Bureau documentation provides numerous benefits, including enhanced security, improved efficiency, and greater accessibility. You can electronically sign, send, and store documents safely, which eliminates the hassle of paper trails. This means you can complete your tax transactions faster and with confidence.

-

How does eSignature comply with Berks Earned Income Tax Bureau regulations?

eSignature via airSlate SignNow complies fully with the regulations set forth by the Berks Earned Income Tax Bureau and ensures that all electronic transactions are legally binding. All your signed documents are securely stored and easily accessible, which is crucial for maintaining compliance. This allows you to handle your tax matters efficiently and effectively.

Get more for Berks Earned Income Tax Bureau Form

- Aafp adult immunization project planning form

- Local exposure control plan and guidance non laboratory form

- Employee or the employees spouse form

- Partners form

- Group short term disability claim guardian anytime form

- Forms direct meritain com

- Orkila non summer health form 6 4 14 seattleymcaorg

- Disclosure of patient medical information musc health

Find out other Berks Earned Income Tax Bureau Form

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer