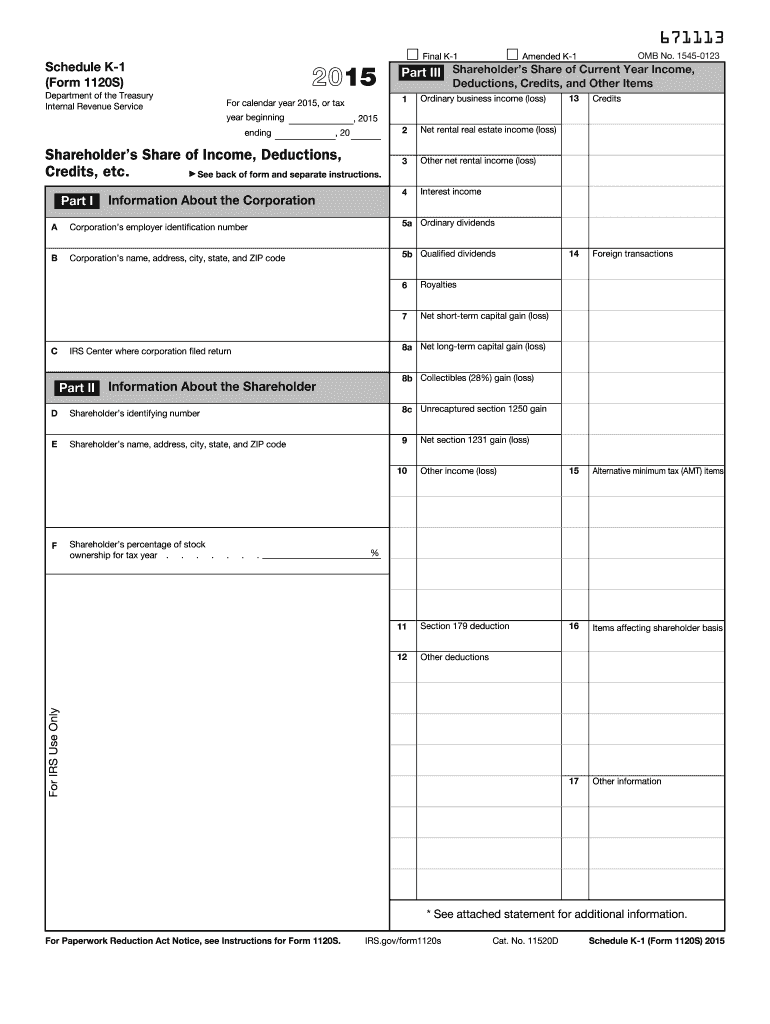

1120s K1 Form 2015

What is the 1120S K1 Form

The 1120S K-1 Form is a tax document used by S corporations in the United States to report income, deductions, and credits to shareholders. Each shareholder receives a K-1 to report their share of the corporation's income on their personal tax returns. This form is essential for ensuring that income is accurately reported to the IRS, reflecting each shareholder's portion of the corporation's financial activity.

How to Use the 1120S K1 Form

To use the 1120S K-1 Form, shareholders must first ensure they receive the form from the S corporation. Once received, shareholders should review the information for accuracy, including their share of income, deductions, and credits. This information is then reported on the shareholder's individual tax return, typically on Form 1040. It is important to retain the K-1 for personal records and for reference during tax filing.

Steps to Complete the 1120S K1 Form

Completing the 1120S K-1 Form involves several key steps:

- Gather necessary financial documents from the S corporation.

- Fill in the shareholder's details, including name, address, and tax identification number.

- Report the shareholder's share of income, deductions, and credits as provided by the corporation.

- Ensure all calculations are accurate and consistent with the corporation's financial statements.

- Sign and date the form before submitting it to the IRS and retaining a copy for personal records.

Legal Use of the 1120S K1 Form

The 1120S K-1 Form is legally binding when completed accurately and submitted in accordance with IRS regulations. It serves as an official record of the income and deductions allocated to each shareholder. Failure to accurately report this information can lead to penalties and interest from the IRS. It is crucial for shareholders to ensure that the K-1 reflects their correct share of the corporation's financial activities.

Filing Deadlines / Important Dates

Filing deadlines for the 1120S K-1 Form are aligned with the S corporation's tax return deadlines. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For most corporations operating on a calendar year, this means the deadline is March 15. Shareholders should receive their K-1 forms by this date to ensure timely filing of their individual tax returns.

Form Submission Methods

The 1120S K-1 Form can be submitted to the IRS through various methods. While electronic filing is encouraged for efficiency, paper submissions are also accepted. Shareholders should ensure that they follow the appropriate submission guidelines based on their filing method. When filing electronically, it is essential to use compatible tax software that can handle K-1 forms accurately.

Who Issues the Form

The 1120S K-1 Form is issued by S corporations to their shareholders. The corporation is responsible for preparing and distributing the K-1 forms, ensuring that each shareholder receives their copy in a timely manner. It is the corporation's duty to accurately report the financial details that will be reflected on each shareholder's individual tax return.

Quick guide on how to complete 2015 1120s k1 form

Complete 1120s K1 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage 1120s K1 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1120s K1 Form with ease

- Locate 1120s K1 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign 1120s K1 Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1120s k1 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1120s k1 form

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the 1120s K1 Form?

The 1120s K1 Form is a crucial document used by S corporations to report income, deductions, and credits to shareholders. Each shareholder receives a copy to report their share of the corporation's income on their personal tax returns. Understanding this form is vital for anyone involved in an S corporation.

-

How can airSlate SignNow simplify the process of sending the 1120s K1 Form?

airSlate SignNow streamlines the process of sending the 1120s K1 Form by allowing you to create, send, and eSign documents easily. With its intuitive interface, you can send the form quickly and track its status, ensuring that all parties have the necessary documents timely. This efficiency saves you time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the 1120s K1 Form?

AirSlate SignNow offers several features tailored for managing the 1120s K1 Form, including customizable templates, seamless document sharing, and secure eSigning capabilities. These features make it easy to create and distribute the form while maintaining compliance and security. Plus, you can easily store and organize completed forms within the platform.

-

What are the pricing options for airSlate SignNow when using it for the 1120s K1 Form?

airSlate SignNow provides competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for handling the 1120s K1 Form. Whether you need a monthly or annual plan, you can choose an option that best fits your needs, ensuring you have the right tools without breaking your budget.

-

Is it easy to integrate airSlate SignNow with other software for handling the 1120s K1 Form?

Yes, airSlate SignNow offers seamless integrations with various accounting and business management software. These integrations enhance the overall workflow for managing documents like the 1120s K1 Form, allowing data to flow smoothly between systems. This functionality helps maintain accuracy and saves time on manual data entry.

-

How does airSlate SignNow ensure the security of the 1120s K1 Form?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your 1120s K1 Form. These features ensure that sensitive information remains confidential and complies with data protection regulations. You can trust that your documents are safe while using the platform.

-

Can I customize the 1120s K1 Form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize the 1120s K1 Form to meet your specific needs. You can easily add your company logo, adjust the layout, or include specific fields to collect necessary information from shareholders, ensuring that the form reflects your brand and is tailored to your requirements.

Get more for 1120s K1 Form

Find out other 1120s K1 Form

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer