Form 1040 Schedule E Supplemental Income and Loss 2012

What is the Form 1040 Schedule E Supplemental Income And Loss

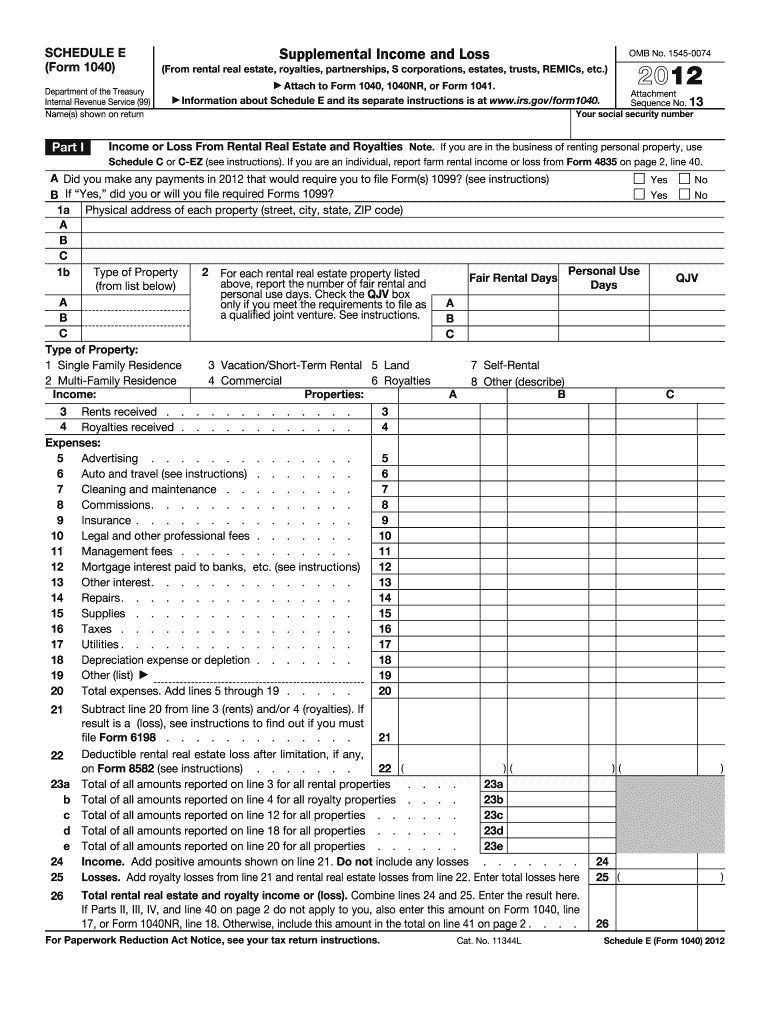

The Form 1040 Schedule E is used by taxpayers in the United States to report supplemental income and loss. This form is essential for individuals who earn income from various sources, such as rental properties, partnerships, S corporations, estates, trusts, and certain royalties. It allows taxpayers to detail their income and expenses related to these sources, ensuring accurate reporting on their annual tax returns. Understanding the specifics of this form is crucial for compliance with IRS regulations and for optimizing tax outcomes.

How to use the Form 1040 Schedule E Supplemental Income And Loss

Using the Form 1040 Schedule E involves several steps to accurately report your supplemental income. First, gather all relevant documentation, including income statements and expense receipts related to your rental properties or other income sources. Next, fill out the form by entering your income and expenses in the appropriate sections. Ensure that you accurately calculate your net income or loss, as this will affect your overall tax liability. Once completed, the form should be attached to your main Form 1040 when filing your taxes.

Steps to complete the Form 1040 Schedule E Supplemental Income And Loss

Completing the Form 1040 Schedule E requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including income records and expense receipts.

- Fill out Part I for rental real estate income, detailing each property separately.

- Complete Part II for income or loss from partnerships and S corporations.

- Enter any royalties in Part III, if applicable.

- Calculate total income and expenses, ensuring all figures are accurate.

- Transfer the net income or loss to your Form 1040.

Key elements of the Form 1040 Schedule E Supplemental Income And Loss

The Form 1040 Schedule E includes several key elements that taxpayers must understand. These elements consist of:

- Identification of each income source, such as rental properties or partnerships.

- Detailed reporting of income received from these sources.

- Itemization of deductible expenses, including repairs, maintenance, and property management fees.

- Net income or loss calculation, which impacts the taxpayer's overall tax liability.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule E. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, reporting requirements, and common mistakes to avoid. Adhering to these guidelines ensures compliance and helps prevent issues during the tax filing process. It's essential to stay updated on any changes to tax laws that may affect how supplemental income is reported.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule E align with the annual tax return due date, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file. Keeping track of these important dates helps ensure timely submissions and avoids penalties.

Quick guide on how to complete 2012 form 1040 schedule esupplemental income and loss

Complete Form 1040 Schedule E Supplemental Income And Loss effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1040 Schedule E Supplemental Income And Loss on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Form 1040 Schedule E Supplemental Income And Loss with ease

- Obtain Form 1040 Schedule E Supplemental Income And Loss and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight essential parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1040 Schedule E Supplemental Income And Loss and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 1040 schedule esupplemental income and loss

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1040 schedule esupplemental income and loss

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is Form 1040 Schedule E Supplemental Income And Loss?

Form 1040 Schedule E Supplemental Income And Loss is a tax form used by individuals to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and more. Understanding how to accurately fill out this form is crucial for tax reporting and compliance.

-

How can airSlate SignNow help with Form 1040 Schedule E Supplemental Income And Loss?

airSlate SignNow simplifies the process of sending and eSigning documents related to Form 1040 Schedule E Supplemental Income And Loss. This platform reduces the time spent on paperwork, allowing you to focus on maximizing your tax benefits.

-

Is airSlate SignNow cost-effective for managing Form 1040 Schedule E Supplemental Income And Loss?

Yes, airSlate SignNow offers a cost-effective solution for managing your documents, including those related to Form 1040 Schedule E Supplemental Income And Loss. Our pricing plans are designed to fit various budget needs while providing powerful features.

-

What features does airSlate SignNow offer for Form 1040 Schedule E Supplemental Income And Loss?

airSlate SignNow provides features such as document templates, secure eSigning, and automated workflows specifically designed for handling Form 1040 Schedule E Supplemental Income And Loss. These tools help streamline your document management process.

-

Can airSlate SignNow integrate with accounting software for Form 1040 Schedule E Supplemental Income And Loss?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, making it easier to manage your Form 1040 Schedule E Supplemental Income And Loss alongside your financial data. This ensures a seamless flow of information.

-

What are the benefits of using airSlate SignNow for Form 1040 Schedule E Supplemental Income And Loss?

Using airSlate SignNow for Form 1040 Schedule E Supplemental Income And Loss enhances efficiency, accuracy, and security. You can quickly send documents for eSignature and receive them back without the hassle of printing or mailing.

-

Is it easy to get started with airSlate SignNow for Form 1040 Schedule E Supplemental Income And Loss?

Yes, getting started with airSlate SignNow is easy and user-friendly. Simply sign up, upload your documents related to Form 1040 Schedule E Supplemental Income And Loss, and begin eSigning within minutes.

Get more for Form 1040 Schedule E Supplemental Income And Loss

- Form 7878

- Get and sign it 40 indiana tax booklet 2011 2017 form

- Form or 18 wc instructions

- Instructions for schedule r form 941 rev september 2020 instructions for schedule r form 941 allocation schedule for aggregate

- Georgia tax center form

- Investment interest expense deduction internal revenue form

- Pdf 2020 instructions for schedule 8812 internal revenue service form

- 2020 form 8752 required payment or refund under section 7519

Find out other Form 1040 Schedule E Supplemental Income And Loss

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors