Irs 1041 Form 2012

What is the IRS 1041 Form

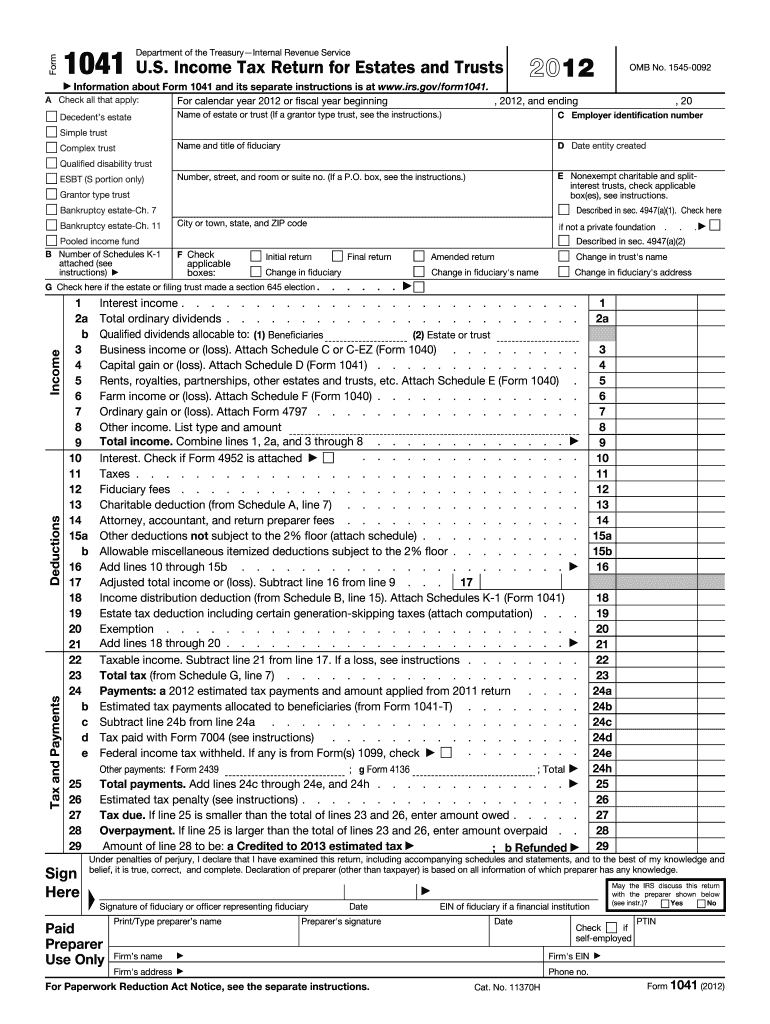

The IRS 1041 Form, officially known as the "U.S. Income Tax Return for Estates and Trusts," is a tax document used to report income, deductions, gains, and losses for estates and trusts. This form is essential for fiduciaries who manage the financial affairs of an estate or trust, ensuring that they comply with federal tax regulations. The 1041 Form allows the estate or trust to pay taxes on income generated from assets held within the estate or trust, rather than the individual beneficiaries.

How to Use the IRS 1041 Form

Using the IRS 1041 Form involves several steps to ensure accurate reporting of the estate or trust's income. First, gather all relevant financial documents, including income statements, expense receipts, and records of distributions made to beneficiaries. Next, fill out the form by entering the estate or trust's identifying information, including the employer identification number (EIN). Report all income sources, deductions, and any credits the estate or trust may qualify for. Finally, review the completed form for accuracy before submitting it to the IRS.

Steps to Complete the IRS 1041 Form

Completing the IRS 1041 Form requires careful attention to detail. Follow these steps:

- Gather Documentation: Collect all necessary financial records, including income from investments, rental properties, and any other sources.

- Fill Out Basic Information: Enter the estate or trust's name, address, and EIN at the top of the form.

- Report Income: Complete the income section by detailing all sources of income received during the tax year.

- Claim Deductions: List all allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate Tax Liability: Use the provided tax tables to determine the tax owed based on the net income reported.

- Sign and Date: Ensure that the fiduciary signs and dates the form before submission.

Filing Deadlines / Important Dates

The IRS 1041 Form must be filed by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the fiduciary needs additional time to prepare the return, they can file for an automatic six-month extension using Form 7004, which extends the deadline to October 15. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Legal Use of the IRS 1041 Form

The IRS 1041 Form serves a legal purpose in the taxation of estates and trusts. It allows fiduciaries to report income and fulfill their tax obligations under federal law. Proper completion of this form ensures compliance with tax regulations, protecting the fiduciary from potential legal issues. Additionally, filing the 1041 Form accurately helps ensure that beneficiaries receive their rightful distributions without unnecessary tax complications.

Key Elements of the IRS 1041 Form

Several key elements are essential for successfully completing the IRS 1041 Form. These include:

- Identification Information: The name, address, and EIN of the estate or trust.

- Income Reporting: Detailed sections for reporting various types of income, including dividends, interest, and rental income.

- Deductions: Areas to claim administrative expenses and distributions made to beneficiaries.

- Tax Calculation: A section for calculating the tax owed based on the net income.

- Signature Line: A space for the fiduciary to sign and date the form, confirming its accuracy.

Quick guide on how to complete 2012 irs 1041 form

Effortlessly Prepare Irs 1041 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and smoothly. Handle Irs 1041 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Irs 1041 Form with Ease

- Find Irs 1041 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs 1041 Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs 1041 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs 1041 form

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Irs 1041 Form and why is it important?

The Irs 1041 Form is used by estates and trusts to report income, deductions, and taxes. It is important because it ensures compliance with federal tax regulations, allowing the fiduciary to file the estate's or trust's taxes accurately. Timely and correct filing can help avoid penalties and ensure that beneficiaries receive their rightful distributions.

-

How does airSlate SignNow assist with the Irs 1041 Form?

airSlate SignNow provides a secure and efficient way to electronically sign and send your Irs 1041 Form and related documents. With its easy-to-use interface, you can expedite the signing process, reducing the time it takes to complete and submit your tax forms. This is particularly beneficial during tax season when timely submission is crucial.

-

What features does airSlate SignNow offer for managing the Irs 1041 Form?

With airSlate SignNow, you can create, send, and manage your Irs 1041 Form conveniently in one platform. Features such as customizable templates, automated workflows, and real-time tracking enable you to streamline the entire process. These features not only save time but also enhance accuracy and compliance.

-

Is airSlate SignNow cost-effective for managing the Irs 1041 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Irs 1041 Form and other documents. Pricing plans are designed to accommodate individual users and larger teams, providing flexibility based on your needs. Investing in airSlate SignNow can result in signNow savings by minimizing paperwork and reducing administrative overhead.

-

Can I integrate airSlate SignNow with other software for filing the Irs 1041 Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, streamlining the filing process for the Irs 1041 Form. This integration allows you to import data directly into your forms, ensuring accurate and efficient submissions without manual data entry.

-

What are the benefits of using airSlate SignNow for the Irs 1041 Form?

Using airSlate SignNow for your Irs 1041 Form provides numerous benefits, such as enhanced security and compliance. With bank-level encryption and auditable trails, you can trust that your sensitive information is protected. Furthermore, the ability to sign documents from anywhere and at any time adds signNow convenience to your tax preparation.

-

Is electronic signing of the Irs 1041 Form legally valid?

Yes, electronic signing of the Irs 1041 Form is legally valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using airSlate SignNow complies with these laws, ensuring that your electronically signed documents are recognized by the IRS and other entities.

Get more for Irs 1041 Form

- Although some conditions may apply to another person in certain situations form

- 2020 700 sov maine estate tax statement of value form

- Availability of free meals and that such meals are available to all in attendance without regard to race color age form

- Instructions for 941p me mainegov form

- Maine revenue services filing for maine income tax form

- 99 16941p0 form 941p me 01 01 2019 12 31 2019 schedule

- Maine revenue services formsin alphabetical order forms

- Maine revenue services forms real estate withholding

Find out other Irs 1041 Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe