Tax Intake Form

What is the Tax Intake Form

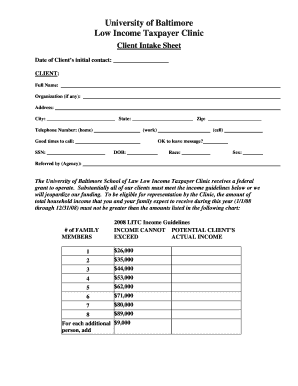

The tax intake form is a crucial document used by tax professionals to gather necessary information from clients. This form typically includes personal details, income sources, deductions, and credits that a client may qualify for. By collecting this information, tax preparers can ensure accurate and efficient filing of tax returns. The tax client intake form serves as a foundational tool for understanding a client’s financial situation and tax obligations.

How to use the Tax Intake Form

Using the tax intake form involves several straightforward steps. First, clients should fill out the form with accurate and complete information. This may include their name, address, Social Security number, and details about income from various sources. Once completed, the form should be reviewed for accuracy. Tax professionals will then use the information provided to prepare the client’s tax return, ensuring all relevant deductions and credits are applied. It is essential for clients to be honest and thorough to avoid issues with their tax filings.

Steps to complete the Tax Intake Form

Completing the tax intake form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Fill in personal information, including name, address, and Social Security number.

- Provide information about income sources, including wages, dividends, and rental income.

- List potential deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Review the form for completeness and accuracy before submission.

Legal use of the Tax Intake Form

The tax intake form is legally recognized as a document that helps ensure compliance with tax laws. When filled out correctly, it serves as a record of the information provided by the client. This can be important in case of audits or inquiries from the IRS. Additionally, using a secure platform for electronic submission enhances the legal standing of the document, as it complies with eSignature laws and regulations.

Required Documents

To complete the tax intake form effectively, clients should have several key documents on hand. These typically include:

- W-2 forms from employers showing annual wages.

- 1099 forms for freelance income or interest earned.

- Receipts for deductible expenses, such as medical bills and charitable donations.

- Last year's tax return for reference.

- Any relevant financial statements or documents related to investments.

Form Submission Methods

The tax intake form can be submitted through various methods, depending on the preference of the tax preparer and the client. Common submission methods include:

- Online submission through secure e-signature platforms.

- Mailing a physical copy to the tax preparer.

- In-person delivery during a scheduled appointment.

Examples of using the Tax Intake Form

Tax intake forms are utilized in various scenarios, illustrating their versatility. For instance, a self-employed individual may use the form to report income from multiple clients, while a retired person may focus on pension and Social Security income. Additionally, students may need to provide information about scholarships and part-time work. Each example highlights the importance of tailoring the intake form to the unique financial situations of different taxpayers.

Quick guide on how to complete tax intake form

Effortlessly Prepare Tax Intake Form on Any Device

Managing documents online has gained signNow traction among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely keep them online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Tax Intake Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Tax Intake Form with Ease

- Obtain Tax Intake Form and then click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tax Intake Form, ensuring exceptional communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax intake form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a general intake sheet and how is it used?

A general intake sheet is a document used to collect essential information from clients or customers. It serves as a preliminary form that helps streamline the onboarding process and ensure all necessary data is gathered. Using an effective general intake sheet with answer can improve communication and enhance the overall client experience.

-

How does airSlate SignNow support the creation of general intake sheets?

With airSlate SignNow, users can easily create customized general intake sheets with answer. The platform offers a user-friendly interface that allows for the addition of fields, logos, and branding features. This customizability helps businesses collect the specific data they need efficiently.

-

Are there any costs associated with using airSlate SignNow for general intake sheets?

AirSlate SignNow offers various pricing plans to cater to different business needs. Users can choose a plan that fits their budget while ensuring they have access to features necessary for creating a general intake sheet with answer. It's an affordable solution to enhance your document management process.

-

What features does airSlate SignNow provide for electronic signing?

AirSlate SignNow includes a range of features designed to facilitate electronic signing. Users can securely sign documents, track changes, and manage multiple signers effortlessly. This is particularly beneficial for managing a general intake sheet with answer, ensuring a smooth and efficient signing process.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with a variety of third-party applications and software. This allows businesses to connect their existing systems with their general intake sheet with answer, enhancing workflow efficiency. Popular integrations include CRM tools, project management applications, and cloud storage solutions.

-

What benefits does a general intake sheet provide to businesses?

A general intake sheet provides numerous benefits, including improved organization, time savings, and enhanced client relationships. By collecting information in a structured manner, businesses can ensure they meet client needs effectively. Using a general intake sheet with answer can streamline onboarding and help in maintaining accurate records.

-

Is airSlate SignNow user-friendly for beginners?

Absolutely! AirSlate SignNow is designed with simplicity in mind, making it accessible for users of all experience levels. Beginners can easily create and manage a general intake sheet with answer without needing advanced technical skills, thanks to the intuitive interface and helpful resources available.

Get more for Tax Intake Form

- Residency letter from a homeless shelter form

- Wwwcourseherocomfile83111769pptc040pdf save reset form protected when completed b

- Taxcoloradogovcontact us by mailcontact us by maildepartment of revenue colorado form

- Cr 701 motion request to quash warrant and set hearing form

- Adult hepatitis form

- Sinp 100 22 form

- 481 2 form

- Temporary resident visa in canada applicanttemporary resident visa in canada applicantapplication for a visitor visa temporary form

Find out other Tax Intake Form

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament