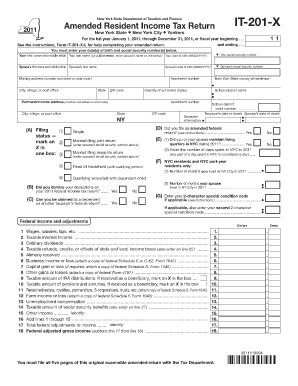

It 201 X the New York State Department of Taxation and Tax Ny Form

What is the IT-201 form?

The IT-201 form is the New York State personal income tax return used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income in New York and need to comply with state tax laws. It captures various sources of income, including wages, interest, dividends, and other earnings. Completing the IT-201 accurately is crucial to ensure proper tax assessment and avoid potential penalties.

Steps to complete the IT-201 form

Completing the IT-201 form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income in the appropriate sections, ensuring accuracy to avoid discrepancies.

- Claim deductions and credits: Identify any deductions or credits you may qualify for, such as the standard deduction or child tax credits.

- Calculate tax owed or refund: Use the provided tables and instructions to compute your tax liability or expected refund.

- Sign and date the form: Ensure that you sign and date the form before submission to validate it.

Filing deadlines for the IT-201 form

It is essential to be aware of the filing deadlines for the IT-201 form to avoid penalties. Typically, the deadline for filing is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time to complete your return, you can file for an extension, which grants you an additional six months, although any taxes owed must still be paid by the original deadline.

Required documents for the IT-201 form

To complete the IT-201 form accurately, you will need several key documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for any deductions or credits you plan to claim

- Last year's tax return for reference

Legal use of the IT-201 form

The IT-201 form must be completed and submitted in compliance with New York State tax laws. It serves as a legal document that outlines your income and tax obligations. Ensuring that the information provided is accurate and truthful is crucial, as discrepancies can lead to audits or penalties. Utilizing digital tools for form completion can enhance accuracy and streamline the submission process while maintaining compliance with legal standards.

Form submission methods for the IT-201

The IT-201 form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to file electronically using approved tax software, which often simplifies the process and provides instant confirmation.

- Mail: You can print the completed form and send it to the appropriate New York State Department of Taxation address.

- In-person: Some taxpayers may prefer to submit their forms in person at local tax offices, where assistance may be available.

Quick guide on how to complete it 201 x the new york state department of taxation and tax ny

Effortlessly Prepare IT 201 X The New York State Department Of Taxation And Tax Ny on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documentation, enabling you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without any delays. Manage IT 201 X The New York State Department Of Taxation And Tax Ny on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Simplest Way to Modify and eSign IT 201 X The New York State Department Of Taxation And Tax Ny with Ease

- Obtain IT 201 X The New York State Department Of Taxation And Tax Ny and click Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or corrections that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign IT 201 X The New York State Department Of Taxation And Tax Ny and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 201 x the new york state department of taxation and tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the relevance of ny state income tax in document signing?

When dealing with legal documents that involve financial transactions, understanding ny state income tax can be crucial. Properly eSigning documents related to income can help ensure compliance with state regulations, thus avoiding any potential issues later on.

-

How does airSlate SignNow simplify the process of handling ny state income tax documents?

airSlate SignNow streamlines the process by allowing users to easily create, send, and eSign documents related to ny state income tax. This efficient solution reduces the risk of errors and ensures that all necessary tax documents are processed quickly and effectively.

-

What are the pricing plans for using airSlate SignNow for tax document eSigning?

airSlate SignNow offers competitive pricing plans that cater to different needs, including options for small businesses and larger organizations. With these flexible plans, users can benefit from a great solution for managing ny state income tax documents without breaking the bank.

-

Can airSlate SignNow integrate with accounting software for ny state income tax preparation?

Yes, airSlate SignNow can integrate seamlessly with popular accounting software, making it easier to handle ny state income tax preparation. This integration helps users efficiently manage and eSign documents related to their financial needs, ensuring all tax requirements are met.

-

What features does airSlate SignNow offer for tax professionals handling ny state income tax?

airSlate SignNow provides features tailored for tax professionals, such as customizable templates, bulk sending, and automated reminders. These tools can help enhance efficiency when managing client documents that require eSigning and compliance with ny state income tax laws.

-

Is airSlate SignNow compliant with ny state income tax regulations?

Absolutely, airSlate SignNow is designed to comply with applicable laws and regulations, including those related to ny state income tax. This ensures that all eSigned documents meet legal standards, providing peace of mind for users throughout the signing process.

-

How can airSlate SignNow benefit businesses managing multiple ny state income tax submissions?

With airSlate SignNow, businesses can easily manage multiple ny state income tax submissions by leveraging its bulk sending and tracking features. This simplifies collaboration across teams and improves turnaround times for critical tax-related documentation.

Get more for IT 201 X The New York State Department Of Taxation And Tax Ny

Find out other IT 201 X The New York State Department Of Taxation And Tax Ny

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form