Fraud Alert Experian Form

What is the Fraud Alert Experian?

The Fraud Alert Experian is a protective measure that individuals can place on their credit reports to warn potential creditors that they may be a victim of identity theft. This alert informs lenders to take extra steps to verify the identity of the applicant before extending credit. It serves as an essential tool in preventing unauthorized accounts from being opened in your name.

How to use the Fraud Alert Experian

Using the Fraud Alert Experian involves a few straightforward steps. First, you need to contact Experian directly through their website or customer service. Once you initiate the alert, it will remain on your credit report for a specified period, typically 90 days for an initial alert. During this time, creditors are encouraged to take additional precautions to confirm your identity before granting credit. You can also renew the alert after it expires if necessary.

Steps to complete the Fraud Alert Experian

Completing the Fraud Alert Experian is a simple process. Follow these steps:

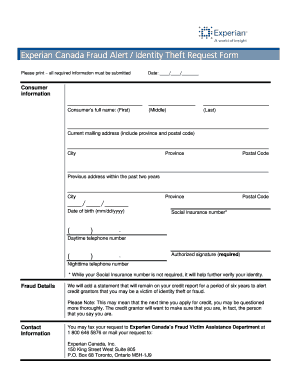

- Gather your personal information, including your Social Security number, date of birth, and address.

- Visit the Experian website or call their customer service to initiate the fraud alert.

- Provide the required information and confirm your identity.

- Choose the duration of the alert, typically 90 days for an initial alert.

- Receive confirmation that your fraud alert has been placed on your credit report.

Legal use of the Fraud Alert Experian

The Fraud Alert Experian is legally recognized under the Fair Credit Reporting Act (FCRA). This federal law allows consumers to place alerts on their credit reports to protect against identity theft. When a fraud alert is in effect, creditors are legally obligated to take additional steps to verify your identity before issuing credit. This legal framework ensures that your rights as a consumer are protected.

Key elements of the Fraud Alert Experian

Several key elements define the Fraud Alert Experian:

- Duration: The initial fraud alert lasts for 90 days, with options to extend.

- Verification Requirement: Creditors must take additional steps to verify your identity.

- Consumer Control: Individuals can initiate and remove alerts as needed.

- Legal Protection: Alerts are protected under the FCRA, ensuring compliance by creditors.

Examples of using the Fraud Alert Experian

Individuals may use the Fraud Alert Experian in various scenarios, such as:

- After discovering suspicious activity on their credit report.

- When they have lost their wallet or had personal information compromised.

- Following a data breach that may have exposed their personal details.

Quick guide on how to complete fraud alert experian

Effortlessly prepare Fraud Alert Experian on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Fraud Alert Experian on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Fraud Alert Experian with ease

- Find Fraud Alert Experian and then click Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Fraud Alert Experian and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fraud alert experian

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Experian Canada and how does it relate to airSlate SignNow?

Experian Canada is a leading credit reporting agency that provides businesses with data-driven insights to enhance decision-making. By integrating airSlate SignNow with Experian Canada, businesses can efficiently manage documents related to credit checks and financial agreements, ensuring a smooth workflow.

-

How does pricing work for using airSlate SignNow with Experian Canada?

airSlate SignNow offers various pricing plans that can accommodate businesses of different sizes using Experian Canada. The plans allow for flexible usage based on document volume, ensuring that you get the best value while accessing Experian Canada's credit data.

-

What features does airSlate SignNow provide for businesses using Experian Canada?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time collaboration. These tools seamlessly integrate with Experian Canada data, allowing businesses to create, manage, and sign documents securely.

-

What are the benefits of using airSlate SignNow alongside Experian Canada?

By using airSlate SignNow in conjunction with Experian Canada, businesses can accelerate their document workflows and improve compliance. This integration ensures that all necessary credit checks and agreements are handled efficiently and securely.

-

Can airSlate SignNow integrate with other services used by Experian Canada?

Yes, airSlate SignNow is designed to integrate with various third-party applications and services, often used alongside Experian Canada. This allows businesses to streamline their processes and ensure data consistency across platforms.

-

Is airSlate SignNow compliant with data protection regulations when accessing Experian Canada services?

Absolutely, airSlate SignNow prioritizes data protection and complies with all relevant regulations when integrating with Experian Canada. This commitment ensures that sensitive information is handled with the highest level of security and compliance.

-

What support options are available for airSlate SignNow users utilizing Experian Canada?

airSlate SignNow offers comprehensive support resources for users integrating with Experian Canada, including tutorials, customer service, and a knowledge base. This support ensures users can effectively utilize features related to credit reporting and document management.

Get more for Fraud Alert Experian

Find out other Fraud Alert Experian

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe