Form 1009 Reverse Mortgages

What is the Form 1009 for Reverse Mortgages

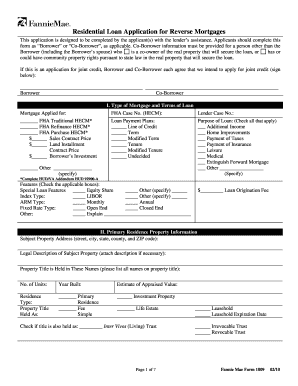

The Form 1009 is a critical document used in the reverse mortgage process. It serves as a formal application that allows homeowners to access the equity in their property while continuing to live in it. This form is essential for individuals aged sixty-two and older who wish to convert part of their home equity into cash. The funds can be used for various purposes, including covering living expenses, home improvements, or paying off existing debts. Understanding the purpose of the Form 1009 is vital for homeowners considering this financial option.

How to Use the Form 1009 for Reverse Mortgages

Using the Form 1009 involves several steps to ensure that the application is completed accurately and submitted correctly. First, gather all necessary information about the property and the homeowner's financial situation. This includes details about income, debts, and current mortgage status. Next, fill out the form carefully, ensuring all sections are completed. Once the form is filled, it can be submitted to the lender for review. It is advisable to keep a copy of the completed form for personal records.

Steps to Complete the Form 1009 for Reverse Mortgages

Completing the Form 1009 requires attention to detail. Here are the key steps:

- Gather personal and property information, including the address, current mortgage details, and financial statements.

- Fill out the form, ensuring that all required fields are completed accurately.

- Review the form for any errors or missing information.

- Sign and date the form as required.

- Submit the form to your lender, either online or by mail, depending on their submission guidelines.

Legal Use of the Form 1009 for Reverse Mortgages

The legal use of the Form 1009 is governed by federal and state regulations. It must be filled out truthfully and accurately to ensure compliance with the law. The form acts as a binding agreement between the homeowner and the lender, outlining the terms of the reverse mortgage. It is important to understand that providing false information can lead to legal consequences, including the potential for loan denial or foreclosure. Familiarizing oneself with the legal implications of the Form 1009 is essential for a smooth application process.

Key Elements of the Form 1009 for Reverse Mortgages

The Form 1009 includes several key elements that are crucial for the application process. These elements typically consist of:

- Personal information of the homeowner, including name, address, and age.

- Details about the property, such as its value and current mortgage status.

- Financial information, including income, assets, and liabilities.

- Consent and acknowledgment sections that the homeowner must sign.

Eligibility Criteria for the Form 1009 for Reverse Mortgages

To qualify for the Form 1009, applicants must meet specific eligibility criteria. Generally, the homeowner must be at least sixty-two years old, own their home outright or have a low mortgage balance, and occupy the home as their primary residence. Additionally, they must demonstrate the ability to pay property taxes, insurance, and maintenance costs. Meeting these criteria is essential for a successful reverse mortgage application.

Quick guide on how to complete form 1009 reverse mortgages

Complete Form 1009 Reverse Mortgages seamlessly on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as a perfect sustainable alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it on the web. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 1009 Reverse Mortgages on any device using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The easiest way to modify and eSign Form 1009 Reverse Mortgages effortlessly

- Locate Form 1009 Reverse Mortgages and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information before clicking the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 1009 Reverse Mortgages to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1009 reverse mortgages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1009 form and how can airSlate SignNow help with it?

The 1009 form is a document used to report various types of payments to the IRS. With airSlate SignNow, businesses can easily create, send, and eSign 1009 forms securely, streamlining the process and ensuring compliance.

-

Are there any costs associated with using airSlate SignNow for 1009 forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The plans are cost-effective and provide comprehensive features for managing 1009 forms and other documents.

-

What features does airSlate SignNow offer for managing 1009 forms?

airSlate SignNow offers features such as personalized templates, secure eSigning, and automated workflows specifically designed for handling 1009 forms. These features help ensure efficiency and accuracy in document management.

-

Can I integrate airSlate SignNow with other software for my 1009 form processing?

Yes, airSlate SignNow supports integrations with various applications, including CRM and accounting software. This makes it simple to streamline your 1009 form processing and synchronize data across platforms.

-

How does eSigning a 1009 form work with airSlate SignNow?

eSigning a 1009 form with airSlate SignNow is straightforward. Simply upload your document, add signers, and send it for eSignature. The platform ensures a compliant and secure signing experience for all parties involved.

-

What security measures are in place for handling sensitive 1009 forms?

airSlate SignNow prioritizes document security and employs robust encryption protocols. This ensures that your 1009 forms are safely transmitted and stored, protecting sensitive information from unauthorized access.

-

Can I track the status of my 1009 forms sent through airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your sent 1009 forms in real-time. You will receive notifications when documents are viewed and signed, ensuring you stay informed.

Get more for Form 1009 Reverse Mortgages

Find out other Form 1009 Reverse Mortgages

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free