Fet Exemption Certificate Form

What is the fet exemption certificate?

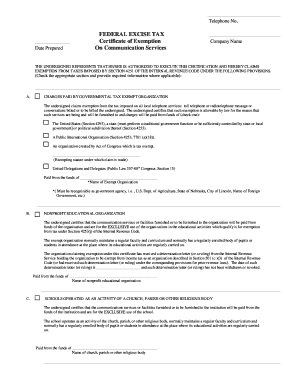

The fet exemption certificate, also known as the federal excise tax exemption certificate, is a crucial document that allows eligible businesses to claim exemptions from federal excise taxes on certain goods and services. This certificate is particularly relevant for industries such as transportation, where businesses may be exempt from taxes on fuel and other related expenses. Understanding the purpose and application of this certificate is essential for businesses looking to optimize their tax liabilities.

How to obtain the fet exemption certificate?

To obtain the fet exemption certificate, businesses must first determine their eligibility based on the nature of their operations and the specific excise taxes they are subject to. Typically, the process involves the following steps:

- Identify the specific federal excise taxes applicable to your business.

- Gather necessary documentation that supports your eligibility for the exemption.

- Complete the appropriate application forms, ensuring all required information is included.

- Submit the application to the relevant federal agency, such as the Internal Revenue Service (IRS).

Once the application is approved, businesses will receive their fet exemption certificate, which can then be used to claim tax exemptions on applicable purchases.

Steps to complete the fet exemption certificate

Completing the fet exemption certificate requires careful attention to detail to ensure compliance and accuracy. The following steps outline the process:

- Begin by downloading the federal excise tax exemption certificate form in PDF format.

- Fill in your business information, including the name, address, and tax identification number.

- Specify the type of excise tax exemption you are claiming and provide any supporting details.

- Sign and date the form to validate your claim.

- Keep a copy of the completed certificate for your records.

It is essential to ensure that all information is accurate and complete to avoid delays in processing.

Legal use of the fet exemption certificate

The fet exemption certificate is legally binding when filled out correctly and used in accordance with federal regulations. This document serves as proof of eligibility for tax exemptions and must be presented to suppliers or service providers when making purchases that qualify for the exemption. It is important to understand that misuse of the certificate can lead to penalties and legal repercussions, making compliance with all applicable laws critical.

Key elements of the fet exemption certificate

Several key elements must be included in the fet exemption certificate to ensure its validity. These elements include:

- Business Information: Name, address, and tax identification number of the business.

- Type of Exemption: Clear indication of the specific excise tax exemption being claimed.

- Signature: An authorized representative must sign the certificate to authenticate it.

- Date: The date of completion must be included to establish the timeline of the exemption claim.

Ensuring that all these elements are accurately represented is essential for the certificate's acceptance by the IRS and other relevant authorities.

Filing deadlines / important dates

Filing deadlines for the fet exemption certificate can vary based on the specific excise taxes involved and the nature of the business. Generally, it is advisable to submit the certificate before making any qualifying purchases to ensure that the exemption is applied. Businesses should also be aware of any annual reporting requirements related to the use of the exemption certificate. Staying informed about these deadlines can help avoid unnecessary tax liabilities.

Quick guide on how to complete fet exemption certificate

Prepare Fet Exemption Certificate seamlessly on any device

Web-based document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the resources to create, alter, and electronically sign your documents rapidly without interruptions. Handle Fet Exemption Certificate on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Fet Exemption Certificate effortlessly

- Locate Fet Exemption Certificate and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Modify and eSign Fet Exemption Certificate and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fet exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a federal excise tax exemption certificate PDF?

A federal excise tax exemption certificate PDF is a document that allows qualifying businesses to claim an exemption from federal excise taxes on certain products or services. This PDF serves as proof of eligibility and must be filled out correctly to ensure compliance. Using airSlate SignNow, you can easily create, sign, and manage this certificate electronically.

-

How can airSlate SignNow help with federal excise tax exemption certificate PDFs?

airSlate SignNow provides a user-friendly platform to create and manage federal excise tax exemption certificate PDFs efficiently. Our tool allows you to easily fill out, eSign, and store your documents securely in the cloud. Streamlining this process can save your business valuable time and resources.

-

Is there a cost associated with using the federal excise tax exemption certificate PDF feature on airSlate SignNow?

airSlate SignNow offers several pricing plans that include features for managing federal excise tax exemption certificate PDFs. Depending on your needs, you can choose a plan that fits your budget while providing all necessary tools for document management. You can always start with a free trial to explore its functionalities before committing.

-

Can I integrate airSlate SignNow with existing software when managing federal excise tax exemption certificate PDFs?

Yes, airSlate SignNow supports integration with a wide range of applications and software systems, making it easy to manage federal excise tax exemption certificate PDFs alongside other business processes. Whether you're using CRM software or accounting tools, SignNow can help seamlessly connect your workflows for improved efficiency.

-

What are the security features for federal excise tax exemption certificate PDFs on airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including federal excise tax exemption certificate PDFs. We implement advanced encryption methods and secure cloud storage to protect your data. Additionally, our platform complies with industry standards to ensure your information remains confidential.

-

How does airSlate SignNow simplify the process of obtaining a federal excise tax exemption certificate PDF?

airSlate SignNow simplifies the process by providing intuitive templates to quickly fill out and customize your federal excise tax exemption certificate PDF. The eSignature functionality allows you to gather all necessary approvals electronically, saving time associated with printing and scanning. You can complete the entire process from any device.

-

Is technical support available for federal excise tax exemption certificate PDFs?

Yes, airSlate SignNow offers dedicated technical support for issues related to federal excise tax exemption certificate PDFs. Our support team is available via multiple channels, including chat and email, ensuring you receive assistance promptly. We also provide a knowledge base with helpful resources to guide you how to use the platform effectively.

Get more for Fet Exemption Certificate

- Anthem questionnaire form

- Lincoln distribution formpdf pinnacle financial services

- Can you fax upmc personal rep form

- Cobra application form

- Pulmonary arterial hypertension infusible inhalation or injectable medication precertification request pulmonary arterial form

- Immunology laboratory 800 form

- Anthem case form

- History and consent form mri exam englishdoc

Find out other Fet Exemption Certificate

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself