Schedule Ca 540 Form 2019

What is the Schedule CA 540 Form

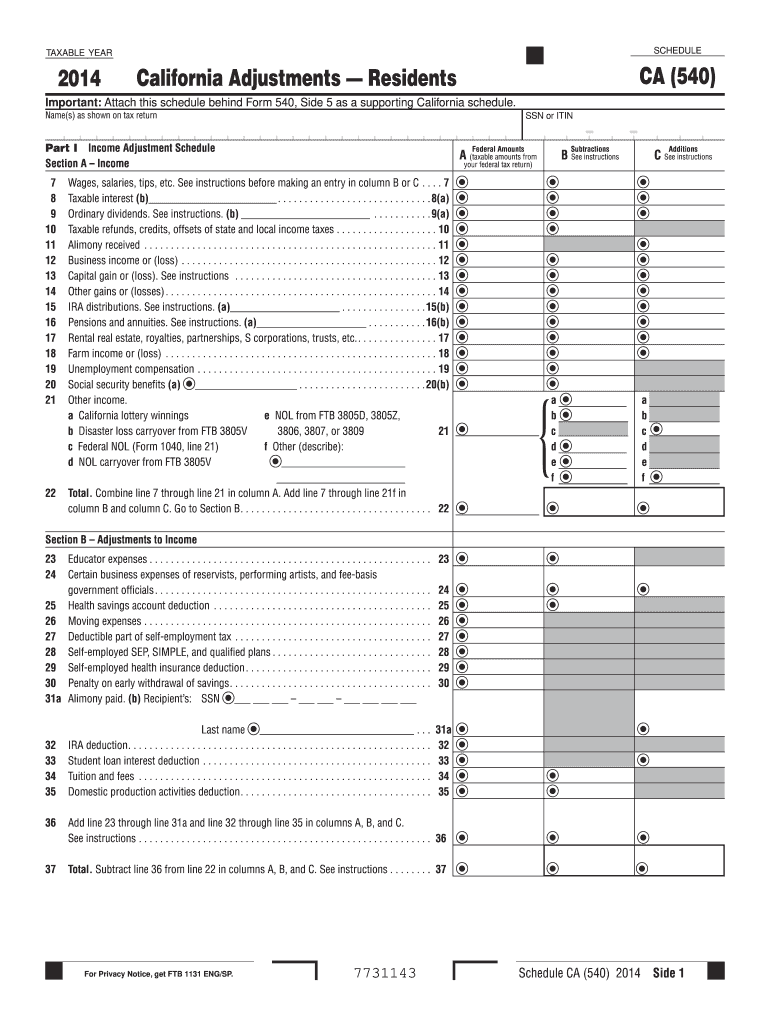

The Schedule CA 540 Form is a tax document used by California residents to adjust their federal adjusted gross income (AGI) for state tax purposes. This form allows taxpayers to report various adjustments, including additions and subtractions, that affect their taxable income in California. It is essential for ensuring that the income reported to the state reflects any differences from the federal return, accommodating state-specific tax laws and regulations.

How to use the Schedule CA 540 Form

Using the Schedule CA 540 Form involves several steps. First, gather your federal tax return and any relevant financial documents. Review the adjustments you need to make based on California tax laws. Complete the form by filling in the required information, including your federal AGI and any applicable adjustments. After completing the form, attach it to your California Form 540 when filing your state taxes. Ensure that all entries are accurate to prevent delays or issues with your tax return.

Steps to complete the Schedule CA 540 Form

Completing the Schedule CA 540 Form requires careful attention to detail. Follow these steps:

- Start with your federal tax return to determine your AGI.

- Identify any adjustments required by California tax law, such as state-specific deductions or credits.

- Fill out the form, entering your AGI and the adjustments in the appropriate sections.

- Double-check all calculations and ensure that all necessary documentation is included.

- Attach the completed Schedule CA 540 to your California Form 540 before submitting your tax return.

Key elements of the Schedule CA 540 Form

Several key elements are crucial to understand when working with the Schedule CA 540 Form. These include:

- Federal AGI: This is the starting point for your California tax calculations.

- Additions: These are items that increase your taxable income, such as certain types of interest income.

- Subtractions: These are deductions that decrease your taxable income, like certain retirement contributions.

- Signature: The form must be signed to validate the information provided.

Legal use of the Schedule CA 540 Form

The Schedule CA 540 Form is legally binding when completed accurately and submitted in compliance with California tax laws. It is essential to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or legal consequences. The form must be filed by the designated deadline, typically on or before April 15, to avoid late fees or interest charges.

Form Submission Methods

There are several methods for submitting the Schedule CA 540 Form. Taxpayers can file their forms electronically using approved e-filing software, which often streamlines the process and reduces errors. Alternatively, the form can be printed and mailed to the appropriate state tax authority. In-person submissions are also an option at designated tax offices, allowing for direct assistance if needed. Each method has its own guidelines and timelines, so it is important to choose the one that best suits your needs.

Quick guide on how to complete 2014 schedule ca 540 form

Prepare Schedule Ca 540 Form seamlessly on any device

Digital document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Schedule Ca 540 Form on any device with airSlate SignNow Android or iOS applications and enhance your document-centric workflow today.

How to modify and eSign Schedule Ca 540 Form effortlessly

- Find Schedule Ca 540 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether via email, SMS, or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Modify and eSign Schedule Ca 540 Form and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 schedule ca 540 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule ca 540 form

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the Schedule Ca 540 Form?

The Schedule Ca 540 Form is an important document used for reporting personal income tax in California. It allows taxpayers to determine their California taxable income by detailing various income sources, deductions, and credits. Understanding this form is crucial for accurate tax filing.

-

How can I easily eSign my Schedule Ca 540 Form?

With airSlate SignNow, you can easily eSign your Schedule Ca 540 Form online. Our platform provides a user-friendly interface to upload, sign, and send your documents securely. This saves you time and ensures compliance with eSignature laws.

-

Is there a free trial available for using airSlate SignNow to manage my Schedule Ca 540 Form?

Yes, airSlate SignNow offers a free trial that lets you explore its features for managing your Schedule Ca 540 Form. During the trial, you can test the functionalities, including eSigning and document sharing without any cost. This helps you make an informed decision before committing.

-

What are the benefits of using airSlate SignNow for my Schedule Ca 540 Form?

Using airSlate SignNow for your Schedule Ca 540 Form provides numerous benefits such as time-saving eSigning, secure data management, and the ability to access your documents from anywhere. Additionally, our cost-effective solution streamlines your tax preparation process, allowing for a more efficient workflow.

-

Can I integrate airSlate SignNow with other applications to manage my Schedule Ca 540 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your experience while managing your Schedule Ca 540 Form. You can connect it with CRM systems, cloud storage platforms, and other tools to streamline your document workflows and improve efficiency.

-

What features does airSlate SignNow offer for editing the Schedule Ca 540 Form?

airSlate SignNow provides robust editing features for managing your Schedule Ca 540 Form, including the ability to add text, checkmarks, and signatures. You can also annotate your documents and collaborate with others in real-time to ensure accurate tax filing.

-

How secure is airSlate SignNow when handling my Schedule Ca 540 Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and adhere to strict compliance regulations to ensure that your Schedule Ca 540 Form and any sensitive information are protected. You can trust our platform for safe and secure document management.

Get more for Schedule Ca 540 Form

Find out other Schedule Ca 540 Form

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement