Form Withholding 2020

What is the Form Withholding

The Form Withholding is a crucial document used in the United States to report and manage the withholding of taxes from various types of income. This form is primarily utilized by employers to inform the Internal Revenue Service (IRS) about the amount of federal income tax withheld from employees' wages. It ensures that the correct amount of tax is collected and reported, helping to maintain compliance with federal tax regulations.

Steps to complete the Form Withholding

Completing the Form Withholding involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your name, address, Social Security number, and filing status. Next, determine the amount of withholding based on your income and deductions. Follow the instructions provided on the form carefully, ensuring all fields are filled out correctly. After completing the form, review it for any errors before submitting it to the appropriate entity.

How to obtain the Form Withholding

The Form Withholding can be easily obtained through various channels. Individuals can download the form directly from the IRS website, where it is available in a printable format. Additionally, many tax preparation software programs include the form as part of their services. For those who prefer physical copies, local IRS offices and some public libraries may also provide printed versions of the form.

Legal use of the Form Withholding

The legal use of the Form Withholding is governed by IRS regulations. It is essential for employers to accurately report the amounts withheld to avoid penalties. The form must be submitted in a timely manner, typically at the end of the tax year or when an employee's withholding status changes. Compliance with these regulations ensures that both employers and employees meet their tax obligations without facing legal repercussions.

Filing Deadlines / Important Dates

Understanding filing deadlines for the Form Withholding is vital for compliance. Generally, employers must submit this form to the IRS by January thirty-first of the following year. However, if the form is submitted electronically, the deadline may be extended slightly. It is also important to keep track of any changes in deadlines announced by the IRS, as these can vary from year to year.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form Withholding can result in significant penalties. Employers may face fines for late submissions or inaccuracies in reporting the withheld amounts. Additionally, employees may be subject to underpayment penalties if the withholding is not sufficient to cover their tax liabilities. Therefore, it is essential to ensure that the form is completed accurately and submitted on time to avoid these financial repercussions.

Examples of using the Form Withholding

There are various scenarios in which the Form Withholding is utilized. For instance, an employer may use the form to report the withholding for a new hire, ensuring that the correct amount of federal income tax is deducted from their paychecks. Additionally, freelancers and contractors may need to submit the form when they receive payments that require tax withholding. These examples illustrate the form's importance in maintaining proper tax reporting and compliance.

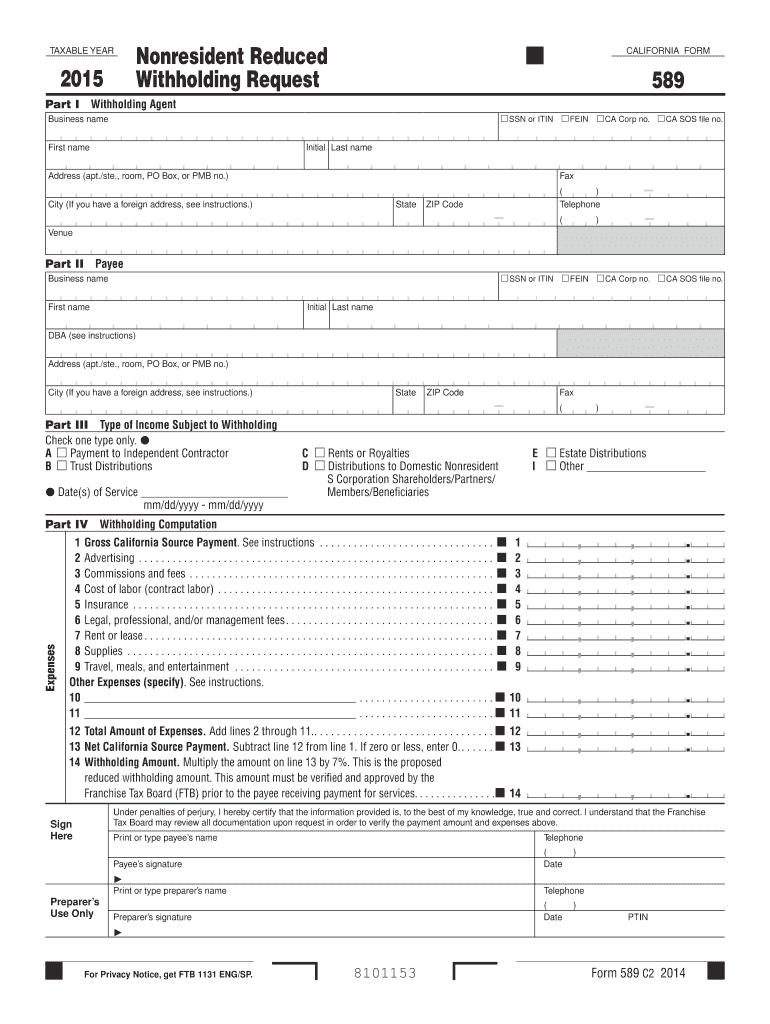

Quick guide on how to complete 2015 form withholding

Complete Form Withholding seamlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form Withholding on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign Form Withholding effortlessly

- Obtain Form Withholding and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize signNow portions of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Withholding to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form withholding

Create this form in 5 minutes!

How to create an eSignature for the 2015 form withholding

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form Withholding in airSlate SignNow?

Form Withholding in airSlate SignNow refers to the ability to collect and manage tax withholding forms efficiently. This feature allows businesses to easily send, receive, and store signed forms, ensuring compliance and accuracy in tax processes.

-

How can airSlate SignNow assist with Form Withholding?

airSlate SignNow streamlines the Form Withholding process by providing an intuitive interface for electronic signatures and document management. Users can quickly create, edit, and send forms, making it easier to handle tax-related documentation.

-

Is there a cost associated with using airSlate SignNow for Form Withholding?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides features tailored for efficient Form Withholding, allowing organizations to choose the option that best fits their requirements and budget.

-

What benefits does airSlate SignNow offer for managing Form Withholding?

Using airSlate SignNow for Form Withholding enhances efficiency and reduces paper usage. The platform ensures documents are securely sent and stored, minimizing the risk of errors and efficiently tracking compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for Form Withholding?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your Form Withholding processes. You can connect it with accounting software, CRM systems, and more to create a cohesive workflow.

-

How secure is my data when using airSlate SignNow for Form Withholding?

Data security is a priority for airSlate SignNow. The platform employs advanced encryption and security measures to protect your Form Withholding documents, ensuring that sensitive information remains confidential and compliant with regulations.

-

Does airSlate SignNow provide templates for Form Withholding?

Yes, airSlate SignNow offers customizable templates specifically designed for Form Withholding. These templates simplify the creation process and ensure that users can quickly generate compliant documents without starting from scratch.

Get more for Form Withholding

Find out other Form Withholding

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors