California 100s Form 2019

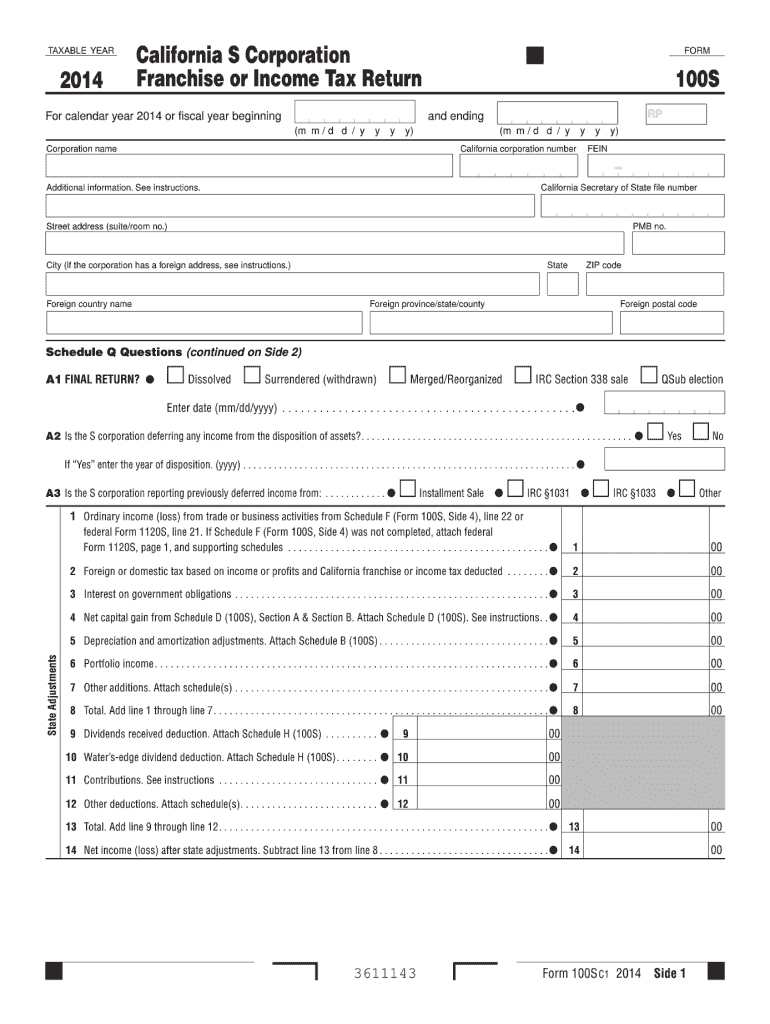

What is the California 100s Form

The California 100s Form is a state-specific tax form used primarily by corporations operating in California. This form is essential for reporting income, deductions, and credits to the California Franchise Tax Board (FTB). It serves as a comprehensive declaration of a corporation's financial activities within the state, ensuring compliance with California tax laws. The form is designed to gather crucial information about the corporation's revenue, expenses, and tax liabilities, making it a key component in the state's tax administration process.

How to use the California 100s Form

Using the California 100s Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form by providing detailed information about the corporation's financial activities. This includes reporting total income, allowable deductions, and any applicable tax credits. After completing the form, review it carefully to ensure all information is accurate and complete. Finally, submit the form to the California Franchise Tax Board by the designated deadline to avoid penalties.

Steps to complete the California 100s Form

Completing the California 100s Form requires a systematic approach. Follow these steps:

- Collect financial documents: Gather all relevant financial statements, including income, expenses, and previous tax returns.

- Fill out the form: Enter the required information, ensuring accuracy in reporting income, deductions, and credits.

- Review the form: Double-check all entries for correctness and completeness to prevent errors.

- Submit the form: File the completed form with the California Franchise Tax Board by the due date.

Legal use of the California 100s Form

The California 100s Form is legally binding when completed and submitted according to state regulations. It must be filled out truthfully and accurately, as any misrepresentation can lead to penalties or legal repercussions. The form adheres to the guidelines set forth by the California Franchise Tax Board, ensuring compliance with state tax laws. Proper use of the form not only fulfills legal obligations but also helps maintain the corporation's good standing within the state.

Filing Deadlines / Important Dates

Filing deadlines for the California 100s Form are crucial for compliance. Typically, the form is due on the 15th day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is generally due by April 15. It is important to stay informed about any changes to deadlines, as late submissions may incur penalties. Corporations should also consider extensions if needed, ensuring they file the necessary paperwork in a timely manner.

Required Documents

To complete the California 100s Form, several documents are necessary. These include:

- Financial statements detailing income and expenses.

- Previous tax returns for reference.

- Documentation for any tax credits or deductions claimed.

- Records of any adjustments made to income or expenses.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete 2014 california 100s form

Complete California 100s Form with ease on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, amend, and electronically sign your documents swiftly, without any delays. Manage California 100s Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to amend and electronically sign California 100s Form effortlessly

- Locate California 100s Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your chosen device. Amend and electronically sign California 100s Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 california 100s form

Create this form in 5 minutes!

How to create an eSignature for the 2014 california 100s form

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the California 100s Form?

The California 100s Form is a crucial document used for reporting various tax-related information in California. It is essential for businesses operating within the state to comply with tax regulations. Using airSlate SignNow, you can easily eSign and submit your California 100s Form electronically.

-

How does airSlate SignNow simplify the California 100s Form process?

airSlate SignNow streamlines the process of completing the California 100s Form by providing intuitive templates and easy document sharing. With our electronic signature feature, you can quickly and securely sign the form without the hassle of printing and mailing. This saves time and enhances productivity for businesses.

-

What are the pricing options for using airSlate SignNow for the California 100s Form?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs. Our plans are designed to provide cost-effective solutions for managing documents, including the California 100s Form. Visit our pricing page for detailed options and choose what best suits your requirements.

-

Can I integrate airSlate SignNow with other platforms for managing the California 100s Form?

Yes, airSlate SignNow integrates seamlessly with a variety of platforms such as Google Drive, Microsoft Office, and more. These integrations facilitate the efficient management of the California 100s Form, allowing you to streamline workflows across your existing systems. This enhances collaboration and reduces manual input.

-

What are the main benefits of using airSlate SignNow for my California 100s Form?

Using airSlate SignNow for your California 100s Form offers numerous benefits including time savings, enhanced security, and ease of use. The platform ensures that your sensitive documents are protected while allowing for quick turnaround times. Additionally, it simplifies compliance with California regulations.

-

Is it easy to eSign the California 100s Form with airSlate SignNow?

Absolutely! eSigning the California 100s Form with airSlate SignNow is straightforward and user-friendly. Our platform allows you to sign documents electronically in just a few clicks, making it a hassle-free experience for you and your clients.

-

What types of documents can I send along with the California 100s Form using airSlate SignNow?

With airSlate SignNow, you can send a variety of documents along with the California 100s Form, including contracts, agreements, and other tax-related forms. This versatility allows for comprehensive document management in your business processes. All documents can be eSigned directly within our platform.

Get more for California 100s Form

- Fema independent study transcript 86508122 form

- Bluestacks the best android emulator on pc as rated by you form

- Graduation plan template form

- Pa dog license form

- Health sustaining medication examples form

- Trauma history questionnaire thq pdf form

- Accident at jefferson high video questions form

- Privacy policy acknowledgement form 648748591

Find out other California 100s Form

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will