W 4 Form Spanish

What is the W-4 Form in Spanish?

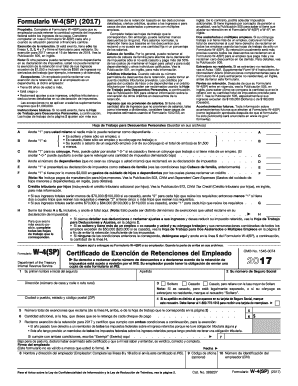

The W-4 form in Spanish, known as the formulario W-4 en español, is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form helps determine the amount of federal income tax that should be withheld from an employee's paycheck. By accurately completing the W-4, individuals can ensure that they neither owe a large sum at tax time nor receive an excessive refund.

Key Elements of the W-4 Form in Spanish

The W-4 form in Spanish consists of several key sections that require attention:

- Personal Information: This includes the employee's name, address, Social Security number, and filing status.

- Adjustments: Employees can indicate any additional income or deductions that may affect their tax withholding.

- Dependents: This section allows individuals to claim dependents, which can reduce the amount of tax withheld.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate.

Steps to Complete the W-4 Form in Spanish

Completing the W-4 form in Spanish involves several straightforward steps:

- Obtain the Form: Access the formulario W-4 en español from the IRS website or your employer.

- Fill Out Personal Information: Provide your name, address, and Social Security number accurately.

- Select Your Filing Status: Choose the appropriate filing status that reflects your tax situation.

- Claim Dependents: If applicable, list any dependents to reduce your withholding amount.

- Sign and Date: Ensure you sign and date the form to validate it.

Legal Use of the W-4 Form in Spanish

The W-4 form in Spanish is legally recognized and must be completed accurately to comply with U.S. tax laws. Employers are required to keep the form on file and use it to determine the correct amount of federal income tax to withhold from employees' wages. Inaccuracies can lead to improper withholding, which may result in penalties or unexpected tax liabilities.

How to Obtain the W-4 Form in Spanish

To obtain the W-4 form in Spanish, individuals can visit the official IRS website, where the form is available for download. Employers may also provide copies of the form to their employees. It is essential to ensure that the most current version of the formulario W-4 en español is used, as tax laws and requirements can change.

Digital vs. Paper Version of the W-4 Form in Spanish

Filling out the W-4 form in Spanish can be done either digitally or on paper. The digital version offers several advantages, including:

- Convenience: Complete the form from anywhere with internet access.

- Storage: Keep a digital copy for your records without the need for physical storage.

- Efficiency: Submit the form electronically to your employer for faster processing.

However, some individuals may prefer the traditional paper version for its tactile experience. Regardless of the method chosen, ensuring accuracy is paramount.

Quick guide on how to complete w 4 form spanish

Effortlessly Prepare W 4 Form Spanish on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It provides an excellent environmentally friendly option to traditional printed and signed forms, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage W 4 Form Spanish on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Modify and Electronically Sign W 4 Form Spanish

- Obtain W 4 Form Spanish and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and press the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign W 4 Form Spanish and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 4 form spanish

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w4 form in Spanish?

The w4 form in Spanish is the Spanish version of the IRS Form W-4, which employees use to tell their employer how much federal income tax to withhold from their paychecks. Understanding the w4 form in Spanish is crucial for Spanish-speaking employees to ensure accurate tax withholding.

-

How can I complete the w4 form in Spanish using airSlate SignNow?

Completing the w4 form in Spanish using airSlate SignNow is easy. You can access the w4 form in Spanish template, fill it out digitally, and eSign it securely. Our platform simplifies the process, ensuring you never have to print or scan documents again.

-

Is there a cost associated with accessing the w4 form in Spanish on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the w4 form in Spanish and other document templates. We provide cost-effective solutions tailored to businesses of all sizes, with flexible pricing options based on your needs.

-

What are the key benefits of using airSlate SignNow for the w4 form in Spanish?

Using airSlate SignNow for the w4 form in Spanish provides numerous benefits, including enhanced efficiency, speed, and security in document management. With our digital platform, you can complete, sign, and send the w4 form in Spanish effortlessly, reducing the paperwork burden on your HR department.

-

Can I integrate the w4 form in Spanish with other software using airSlate SignNow?

Yes, airSlate SignNow offers robust integrations with various software solutions, making it easy to connect your existing systems with the w4 form in Spanish. Whether you use CRMs or HR software, our seamless integrations help streamline your workflow.

-

How does airSlate SignNow protect my information when using the w4 form in Spanish?

At airSlate SignNow, we prioritize your security. When using the w4 form in Spanish, all your data is encrypted and stored securely. We follow industry-standard protocols to ensure the safety of your information during the signing and storage process.

-

Is it easy to share the w4 form in Spanish with my employer?

Absolutely! airSlate SignNow allows you to share the completed w4 form in Spanish quickly and easily. With just a few clicks, you can send the signed document directly to your employer, streamlining the submission process.

Get more for W 4 Form Spanish

Find out other W 4 Form Spanish

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now