M1nr Form 2020

What is the M1nr Form

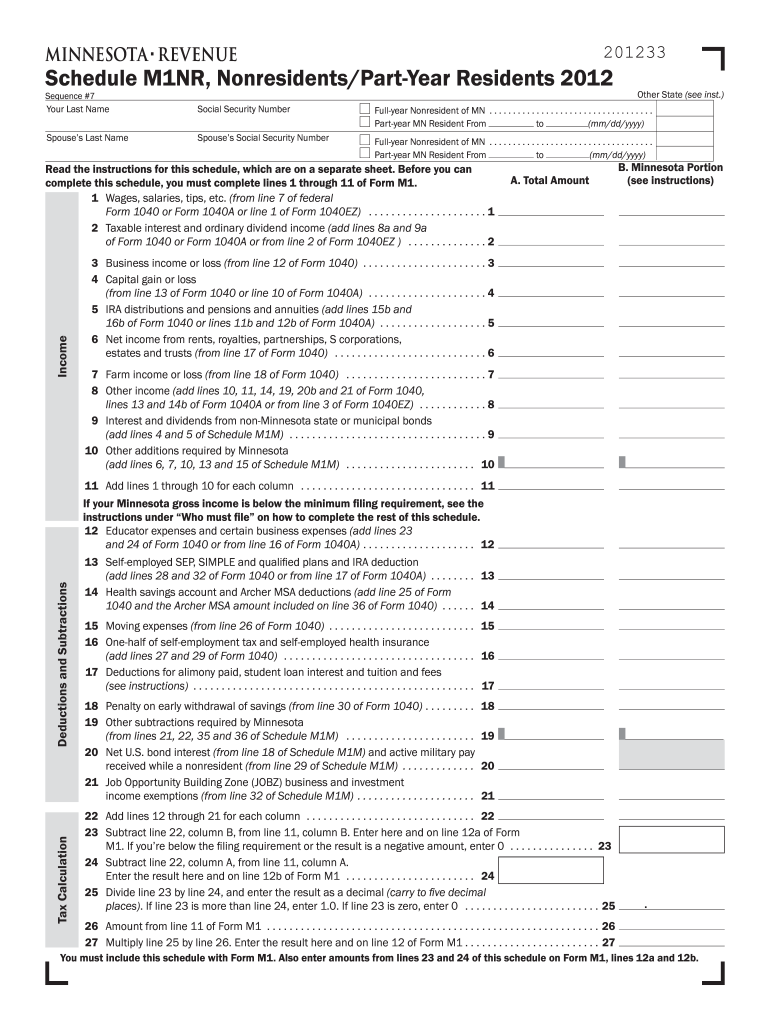

The M1nr Form is a specific document used for tax purposes in the United States. It is primarily utilized by non-residents who need to report their income and calculate their tax obligations. This form is essential for ensuring compliance with federal tax laws and is designed to gather necessary information about the taxpayer's income sources, deductions, and credits. Understanding the M1nr Form is crucial for non-residents to fulfill their tax responsibilities accurately.

How to use the M1nr Form

Using the M1nr Form involves several key steps to ensure accurate completion and submission. First, gather all relevant financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, providing accurate information regarding your income, deductions, and any applicable credits. It is important to follow the instructions provided with the form to avoid errors. Once completed, review the form for accuracy and ensure all required signatures are included before submission.

Steps to complete the M1nr Form

Completing the M1nr Form requires a systematic approach to ensure all information is accurately reported. The steps include:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report all sources of income, including wages, dividends, and interest.

- Claim any applicable deductions and credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the M1nr Form

The M1nr Form is legally recognized for reporting income and tax obligations for non-residents in the United States. To ensure its legal validity, it must be completed accurately and submitted by the designated deadlines. Compliance with IRS regulations is essential, as failure to use the form correctly can result in penalties or legal issues. Utilizing the M1nr Form properly helps maintain transparency and accountability in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the M1nr Form are critical for non-residents to avoid penalties. Typically, the form must be submitted by April fifteenth of the following year for income earned during the previous calendar year. However, if additional time is needed, non-residents may file for an extension, which usually grants an additional six months. It is important to keep track of these deadlines to ensure timely compliance with tax obligations.

Required Documents

To complete the M1nr Form, certain documents are required to support the information reported. These documents include:

- W-2 forms for wages earned in the United States.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as dividends or rental income.

- Documentation for deductions and credits claimed, such as receipts or statements.

Who Issues the Form

The M1nr Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. Access to the form and related resources can typically be found on the IRS website or through authorized tax preparation services.

Quick guide on how to complete 2012 m1nr form

Complete M1nr Form effortlessly on any device

Online document organization has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right format and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your paperwork quickly without interruptions. Handle M1nr Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign M1nr Form without hassle

- Obtain M1nr Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in a few clicks from any device of your choice. Alter and electronically sign M1nr Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 m1nr form

Create this form in 5 minutes!

How to create an eSignature for the 2012 m1nr form

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the M1nr Form?

The M1nr Form is a document that is used for various compliance and tax-related purposes. With airSlate SignNow, you can easily create and manage your M1nr Form, ensuring that your submissions are accurate and timely, which helps to streamline your workflow.

-

How does airSlate SignNow facilitate the completion of the M1nr Form?

airSlate SignNow provides an intuitive platform that allows users to electronically fill out and eSign the M1nr Form. The platform's user-friendly interface ensures that even those unfamiliar with digital forms can complete their documentation quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for M1nr Form processing?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when it comes to processing the M1nr Form. These plans vary in features and the number of documents that can be processed, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for the M1nr Form?

airSlate SignNow includes features such as customizable templates for the M1nr Form, automatic reminders for signers, and secure storage of completed documents. This ensures that your form processing is efficient, secure, and compliant with regulatory standards.

-

Can I integrate the M1nr Form with other applications using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to automate your workflows involving the M1nr Form. You can connect it with CRM systems, document management platforms, and more to enhance your business processes.

-

What are the benefits of using airSlate SignNow for the M1nr Form?

Using airSlate SignNow for the M1nr Form can greatly improve your efficiency by reducing manual errors and eliminating paper-based processes. The ability to access your forms from anywhere and on any device means you can manage your documents on the go while ensuring compliance.

-

Is airSlate SignNow secure for handling my M1nr Form?

Yes, airSlate SignNow prioritizes security with advanced encryption methods to protect your M1nr Form and other documents. Our platform complies with industry standards, ensuring that your data remains confidential and secure throughout the signing process.

Get more for M1nr Form

Find out other M1nr Form

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement