Construction Worker Income & Expense Worksheet MER Tax Form

What is the Construction Worker Income & Expense Worksheet MER Tax

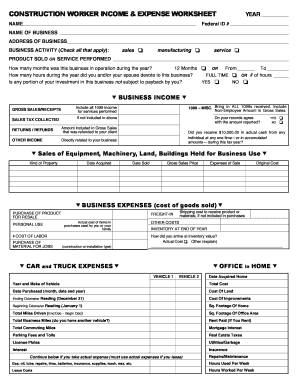

The Construction Worker Income & Expense Worksheet MER Tax is a vital document for construction workers in the United States. This form helps track income and expenses related to construction work, ensuring that all financial activities are accurately recorded for tax purposes. It is particularly useful for self-employed individuals and those who work as independent contractors, as it allows them to itemize deductions that can significantly reduce taxable income.

How to use the Construction Worker Income & Expense Worksheet MER Tax

Using the Construction Worker Income & Expense Worksheet MER Tax involves several straightforward steps. First, gather all relevant financial documents, such as receipts, invoices, and bank statements. Next, categorize your income and expenses into appropriate sections, including materials, tools, and vehicle costs. This organization simplifies the process of filling out the worksheet. Finally, ensure that all entries are accurate and complete before submitting the form with your tax return.

Steps to complete the Construction Worker Income & Expense Worksheet MER Tax

Completing the Construction Worker Income & Expense Worksheet MER Tax requires careful attention to detail. Start by entering your total income from construction-related activities. Then, move on to list all deductible expenses, including:

- Materials and supplies

- Tools and equipment

- Vehicle expenses, including fuel and maintenance

- Insurance costs

- Home office expenses, if applicable

After filling in all sections, review the worksheet for accuracy. This step is crucial to ensure compliance with IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines for completing the Construction Worker Income & Expense Worksheet MER Tax. It is essential to adhere to these guidelines to avoid penalties. Key points include maintaining accurate records of all income and expenses, understanding which expenses are deductible, and ensuring that the form is submitted by the tax deadline. Additionally, the IRS may require supporting documentation for certain deductions, so keeping organized records is beneficial.

Required Documents

To effectively complete the Construction Worker Income & Expense Worksheet MER Tax, certain documents are required. These include:

- Receipts for materials and supplies

- Invoices for services rendered

- Bank statements showing income deposits

- Records of vehicle expenses, including mileage logs

- Insurance policy documents

Having these documents readily available will streamline the process and ensure that all deductions are properly accounted for.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the Construction Worker Income & Expense Worksheet MER Tax can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is crucial for construction workers to understand their obligations and ensure that their tax filings are accurate and timely to avoid these consequences.

Quick guide on how to complete construction worker income amp expense worksheet mer tax

Manage Construction Worker Income & Expense Worksheet MER Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Construction Worker Income & Expense Worksheet MER Tax on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Construction Worker Income & Expense Worksheet MER Tax effortlessly

- Find Construction Worker Income & Expense Worksheet MER Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Construction Worker Income & Expense Worksheet MER Tax and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the construction worker income amp expense worksheet mer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a truck expenses worksheet?

A truck expenses worksheet is a financial tool designed to help truck owners and operators track their expenditures. By organizing data related to fuel, maintenance, and insurance costs, this worksheet provides clarity on operating expenses, making it easier to manage budgets and maximize profits.

-

How does the airSlate SignNow truck expenses worksheet contribute to cost management?

The airSlate SignNow truck expenses worksheet enables users to record, categorize, and analyze their truck-related expenses systematically. With clear visibility into spending, businesses can identify areas for cost reduction, ultimately improving overall financial health and efficiency.

-

Is the truck expenses worksheet feature available in all pricing plans?

Yes, the truck expenses worksheet feature is included in all pricing plans offered by airSlate SignNow. This ensures that businesses of any size can utilize this critical tool to maintain effective expense management without additional costs.

-

Can I integrate the truck expenses worksheet with other financial tools?

Absolutely! The airSlate SignNow platform allows for seamless integration with various financial management software. This ensures that your truck expenses worksheet can sync with your existing tools, streamlining your financial tracking and reporting processes.

-

What are the benefits of using an airSlate SignNow truck expenses worksheet?

Using an airSlate SignNow truck expenses worksheet offers several benefits, including improved accuracy in expense tracking and enhanced visibility into your financial performance. Additionally, the user-friendly interface facilitates easy data entry and reporting, allowing for quicker decision-making based on accurate information.

-

How can I get started with the truck expenses worksheet?

Getting started with the truck expenses worksheet is simple! Just sign up for an airSlate SignNow account, and you can access the worksheet from your dashboard. Our platform provides intuitive tutorials to guide you through the setup process and help you make the most of your expense tracking.

-

Is there customer support available for the truck expenses worksheet?

Yes, airSlate SignNow offers comprehensive customer support for users of the truck expenses worksheet. Whether you have questions about features or need assistance with setup, our support team is available via chat, email, or phone to help you optimize your experience.

Get more for Construction Worker Income & Expense Worksheet MER Tax

- Schedule a net income tax summary taxalaskagov form

- Instructions for form 6900 2019 alaska tax division

- Rmt tax return ver02 ao2019 99 prep4nonfillablepdf form

- Publication 1136 rev 11 2020 statistics of income bulletin form

- Alaska form 6321i gas storage facility tax credit

- Developer guide form 499r 2w 2pr haciendagobiernopr

- Wwwritaohiocom business registration form 48

- 2020 form 1 massachusetts resident income tax return

Find out other Construction Worker Income & Expense Worksheet MER Tax

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document