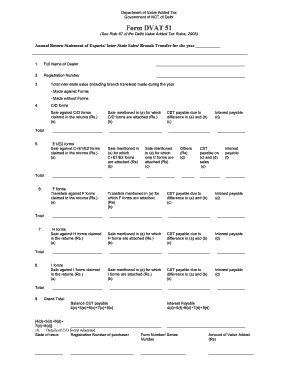

Dvat 51 Form

What is the Dvat 51

The Dvat 51 form is a crucial document used for tax purposes in the United States. It is primarily utilized by businesses to report and remit sales tax collected on transactions. This form helps ensure compliance with state tax regulations and is essential for maintaining accurate financial records. Understanding the Dvat 51 is vital for businesses to avoid penalties and ensure proper tax reporting.

Steps to complete the Dvat 51

Completing the Dvat 51 form involves several key steps to ensure accuracy and compliance. Follow these steps carefully:

- Gather necessary information: Collect all relevant sales data, including total sales, tax collected, and any exemptions.

- Fill out the form: Enter the required information accurately in the designated fields. Ensure that all calculations are correct.

- Review for accuracy: Double-check all entries for errors or omissions. This step is crucial to avoid potential issues with tax authorities.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, ensuring it is sent by the deadline.

Legal use of the Dvat 51

The Dvat 51 form must be completed and submitted in accordance with state tax laws to be legally valid. This includes adhering to specific regulations regarding the reporting of sales tax. Failure to comply with these legal requirements can result in penalties, fines, or audits. It is essential for businesses to understand their obligations and ensure that the Dvat 51 is used correctly to maintain compliance.

How to obtain the Dvat 51

Obtaining the Dvat 51 form is a straightforward process. Businesses can typically access the form through their state’s tax authority website. Many states provide downloadable PDF versions of the form that can be filled out electronically or printed for manual completion. Additionally, some tax software programs may include the Dvat 51 form as part of their offerings, simplifying the process for users.

Required Documents

Before completing the Dvat 51 form, businesses should gather the following documents:

- Sales records for the reporting period

- Invoices issued to customers

- Receipts for any tax-exempt sales

- Previous Dvat 51 forms, if applicable

Having these documents on hand will facilitate accurate reporting and help ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Dvat 51 form vary by state and can depend on the reporting period selected by the business (monthly, quarterly, or annually). It is crucial for businesses to be aware of these deadlines to avoid late fees or penalties. Typically, forms must be submitted by the end of the month following the reporting period. Always check with your state tax authority for specific dates and requirements.

Quick guide on how to complete dvat 51

Effortlessly Prepare Dvat 51 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delay. Manage Dvat 51 on any device using the airSlate SignNow apps for Android or iOS and simplify any paperwork process today.

The Easiest Way to Edit and Electronically Sign Dvat 51 with Ease

- Locate Dvat 51 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Dvat 51 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dvat 51

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dvat 51 in the context of e-signatures?

dvat 51 refers to a specific form relevant for businesses engaged in value-added tax in certain jurisdictions. Understanding how to utilize dvat 51 can streamline your document processing needs when eSigning. With airSlate SignNow, you can effectively manage dvat 51 forms and ensure compliance with ease.

-

How does airSlate SignNow handle dvat 51 document templates?

airSlate SignNow allows users to create customizable templates for dvat 51 forms, making it easier to manage repetitive document workflows. This feature saves time and reduces errors in your eSigning process. You can effortlessly send out dvat 51 documents that are pre-filled and ready for signatures.

-

Is there a mobile app for completing dvat 51 documents?

Yes, airSlate SignNow offers a mobile app that enables users to manage and eSign dvat 51 documents from anywhere. This flexibility ensures that you can keep your business operations running smoothly, whether in the office or on the go. The mobile app makes it easy to access and sign dvat 51 forms right from your device.

-

What are the pricing options for using airSlate SignNow for dvat 51 e-signatures?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan provides access to features that facilitate the creation and signing of dvat 51 documents efficiently. You can choose the plan that best fits your budget and required functionalities.

-

Can I integrate airSlate SignNow with other tools for managing dvat 51?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications, allowing you to enhance your dvat 51 document management. You can connect with tools like Google Workspace, Salesforce, and more to streamline your workflows and improve productivity.

-

What are the benefits of using airSlate SignNow for dvat 51?

Using airSlate SignNow for dvat 51 enhances efficiency and reduces turnaround time for document signing. The platform provides a user-friendly interface along with robust security features, ensuring your sensitive tax documents are safe. With airSlate SignNow, you can improve collaboration and keep important files organized.

-

Is airSlate SignNow secure for signing dvat 51 documents?

Yes, airSlate SignNow prioritizes security for all eSigning activities, including dvat 51 documents. The platform uses advanced encryption and complies with industry standards to protect your data. You can confidently sign and manage dvat 51 forms knowing that your information is secure.

Get more for Dvat 51

Find out other Dvat 51

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast