Agreement Terms Form

Understanding the Agreement Terms

A loan financial agreement outlines the specific terms and conditions under which a loan is provided. These terms typically include the loan amount, interest rate, repayment schedule, and any fees associated with the loan. It is essential for both the lender and borrower to fully understand these terms to ensure clarity and prevent disputes.

The agreement also specifies the rights and responsibilities of both parties, including what happens in the event of default or late payments. Understanding these elements is crucial for making informed financial decisions.

Steps to Complete the Agreement Terms

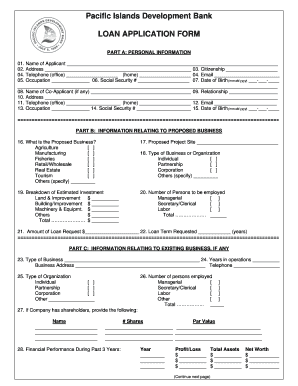

Completing a loan financial agreement involves several key steps to ensure accuracy and compliance. First, both parties should review the terms carefully to confirm mutual understanding. Next, the borrower needs to provide necessary personal and financial information, which may include income details and credit history.

Once all information is gathered, the lender will draft the agreement, incorporating all discussed terms. Both parties should then sign the document, preferably using a secure eSignature solution to ensure legal validity. Finally, each party should retain a copy for their records.

Legal Use of the Agreement Terms

The legal use of a loan financial agreement is governed by various federal and state laws. In the United States, the agreement must comply with the Truth in Lending Act, which mandates clear disclosure of terms and costs associated with borrowing. Additionally, the agreement should adhere to state-specific regulations that may impose additional requirements or protections for borrowers.

It is advisable to consult legal counsel to ensure that the agreement is compliant with all applicable laws and that both parties are protected under the agreement's terms.

Key Elements of the Agreement Terms

Key elements of a loan financial agreement include:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Repayment Schedule: Details on when and how payments will be made.

- Fees: Any additional costs associated with the loan, such as origination fees.

- Default Terms: Conditions under which the lender can declare a default.

These elements are critical for both parties to understand the financial implications of the agreement.

Examples of Using the Agreement Terms

Loan financial agreements can be utilized in various scenarios, such as:

- Personal loans for purchasing a vehicle or home renovations.

- Business loans for startup capital or expansion.

- Student loans to finance education expenses.

Each example highlights the importance of clearly defined terms to protect both the lender and borrower throughout the loan process.

Required Documents for the Agreement

To complete a loan financial agreement, certain documents are typically required. These may include:

- Proof of Identity: Such as a driver’s license or passport.

- Income Verification: Recent pay stubs or tax returns.

- Credit History: A report to assess creditworthiness.

- Collateral Documentation: If applicable, documents related to any assets securing the loan.

Gathering these documents in advance can streamline the loan application process and facilitate a smoother agreement execution.

Quick guide on how to complete agreement terms 315676779

Complete Agreement Terms effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Agreement Terms on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Agreement Terms with ease

- Find Agreement Terms and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Agreement Terms to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the agreement terms 315676779

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan financial agreement?

A loan financial agreement is a legal document that outlines the terms and conditions of a loan between the lender and the borrower. This document includes important details such as the loan amount, interest rates, repayment schedule, and penalties for defaulting. Having a clear loan financial agreement helps both parties understand their obligations and reduces potential conflicts.

-

How can airSlate SignNow help with loan financial agreements?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning loan financial agreements. With its user-friendly interface, you can easily customize templates, ensuring all necessary terms and conditions are included. This not only streamlines the agreement process but also enhances the accuracy and security of your documents.

-

Is airSlate SignNow affordable for small businesses needing loan financial agreements?

Yes, airSlate SignNow is a cost-effective solution suitable for small businesses seeking to manage their loan financial agreements. The pricing plans are designed to fit various budgets, ensuring that even startups can access essential eSignature and document management tools without breaking the bank.

-

What features does airSlate SignNow offer for managing loan financial agreements?

airSlate SignNow offers features like customizable templates, in-app editing, and real-time tracking for loan financial agreements. You can easily set reminders for repayments, collect signatures from multiple parties, and even incorporate branding for a professional touch. These features help streamline the entire loan agreement process.

-

Are loan financial agreements created through airSlate SignNow legally binding?

Absolutely! Loan financial agreements created and signed using airSlate SignNow are legally binding, provided all parties consent and follow the appropriate legal requirements. The platform complies with eSignature laws, ensuring your agreements are enforceable and secure.

-

Can airSlate SignNow integrate with other financial software for loan financial agreements?

Yes, airSlate SignNow easily integrates with various financial software and CRM systems, helping you manage loan financial agreements seamlessly. This integration allows for better data synchronization and automates workflows, ensuring all aspects of your loan management process are connected.

-

How secure is airSlate SignNow when handling loan financial agreements?

Security is a top priority for airSlate SignNow, particularly for sensitive documents like loan financial agreements. The platform employs advanced encryption protocols and follows strict security measures to protect your documents and personal information, providing peace of mind for all users.

Get more for Agreement Terms

- Request for check of driving record colorado form

- Walkthrough form fall2014

- Ohio homeschool notification letter sample form

- Reischauer scholars program form

- West coast college form

- 1 rich and stimulating classroom environment o form

- Transcript request form university of massachusetts amherst

- 40 hours volunteer sheet form

Find out other Agreement Terms

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization