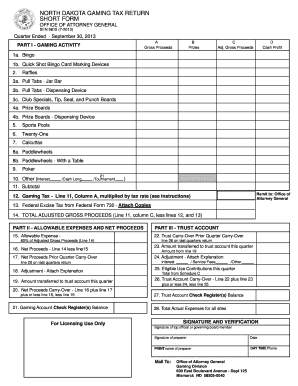

North Dakota Gaming Taxes Form

What is the North Dakota Gaming Taxes Form

The North Dakota Gaming Taxes Form is a specific document used by individuals and businesses engaged in gaming activities within the state. This form is essential for reporting and paying taxes related to various forms of gaming, including casinos, charitable gaming, and other gambling operations. Proper completion of this form ensures compliance with state tax regulations and helps maintain transparency in gaming operations.

How to use the North Dakota Gaming Taxes Form

Using the North Dakota Gaming Taxes Form involves several key steps. First, gather all relevant financial information related to your gaming activities, such as revenue generated and expenses incurred. Next, accurately fill out the form, ensuring that all figures are correct and reflect your gaming operations. Once completed, the form must be submitted to the appropriate state authority, either electronically or via mail, depending on the submission options available for your specific situation.

Steps to complete the North Dakota Gaming Taxes Form

Completing the North Dakota Gaming Taxes Form requires careful attention to detail. Follow these steps:

- Collect necessary financial documents, including income statements and expense reports.

- Access the form through the official state website or authorized platforms.

- Fill in personal and business information as required.

- Report gaming revenue and applicable deductions accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the North Dakota Gaming Taxes Form

The legal use of the North Dakota Gaming Taxes Form is crucial for compliance with state tax laws. This form must be filled out accurately and submitted on time to avoid legal repercussions. Failing to report gaming income or misrepresenting financial data can lead to penalties, including fines or legal action. It is important to understand the legal obligations associated with gaming taxes to ensure that your operations remain compliant with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the North Dakota Gaming Taxes Form are established by the state tax authority. Typically, forms must be submitted quarterly or annually, depending on the type of gaming activity and revenue generated. It is essential to keep track of these deadlines to avoid late fees and ensure timely compliance. Mark your calendar with important dates to stay organized and informed about your tax obligations.

Required Documents

When completing the North Dakota Gaming Taxes Form, certain documents are required to support your claims. These may include:

- Financial statements detailing gaming revenue and expenses.

- Receipts for any deductions claimed.

- Previous tax returns related to gaming activities.

- Any additional documentation requested by the state tax authority.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in your submissions.

Quick guide on how to complete north dakota gaming taxes form

Complete North Dakota Gaming Taxes Form seamlessly on any device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, modify, and eSign your documents promptly without delays. Manage North Dakota Gaming Taxes Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The simplest way to edit and eSign North Dakota Gaming Taxes Form effortlessly

- Find North Dakota Gaming Taxes Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Edit and eSign North Dakota Gaming Taxes Form to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north dakota gaming taxes form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the North Dakota Gaming Taxes Form?

The North Dakota Gaming Taxes Form is a document required for reporting and paying gaming taxes in North Dakota. This form ensures compliance with state tax regulations for gaming establishments. It outlines the taxable revenue and the tax amount owed, which is crucial for businesses involved in gaming activities.

-

How can airSlate SignNow help with the North Dakota Gaming Taxes Form?

airSlate SignNow provides a streamlined platform to electronically sign and send the North Dakota Gaming Taxes Form. This tool simplifies the process, making it easy to gather necessary signatures and expedite submission. With its user-friendly interface, businesses can ensure accurate and timely filing of their gaming tax obligations.

-

Is there a cost to use airSlate SignNow for submitting the North Dakota Gaming Taxes Form?

Yes, airSlate SignNow offers various pricing plans, making it a cost-effective solution for submitting the North Dakota Gaming Taxes Form. Users can choose a plan that suits their business needs, starting from affordable options for small establishments to comprehensive packages for larger organizations. This flexibility allows businesses to maximize their investment while ensuring compliance.

-

What features does airSlate SignNow offer for managing the North Dakota Gaming Taxes Form?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure storage, tailored for managing the North Dakota Gaming Taxes Form. These features enhance the efficiency of preparing and submitting tax documents. Additionally, you can track the status of your forms, ensuring that nothing falls through the cracks.

-

Are there integrations available with airSlate SignNow for managing the North Dakota Gaming Taxes Form?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing the management of the North Dakota Gaming Taxes Form. Users can integrate with accounting platforms and CRMs, simplifying workflow processes. This ensures that all relevant data is easily accessible and organized.

-

What benefits can I expect from using airSlate SignNow for the North Dakota Gaming Taxes Form?

Using airSlate SignNow for the North Dakota Gaming Taxes Form provides numerous benefits including enhanced efficiency, improved accuracy, and reduced turnaround times. The electronic signature feature speeds up approvals, allowing quicker submission of tax documents. Additionally, users benefit from a secure platform that keeps sensitive information protected.

-

Can I use airSlate SignNow on mobile devices to manage the North Dakota Gaming Taxes Form?

Yes, airSlate SignNow is fully compatible with mobile devices, enabling users to manage the North Dakota Gaming Taxes Form on the go. Whether you need to send, sign, or track forms, the mobile app provides convenience and flexibility. This ensures that you can handle your gaming tax responsibilities anytime and anywhere.

Get more for North Dakota Gaming Taxes Form

Find out other North Dakota Gaming Taxes Form

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim