First Mortgage Hallmark Abstract LLC Form

What is the First Mortgage Hallmark Abstract LLC

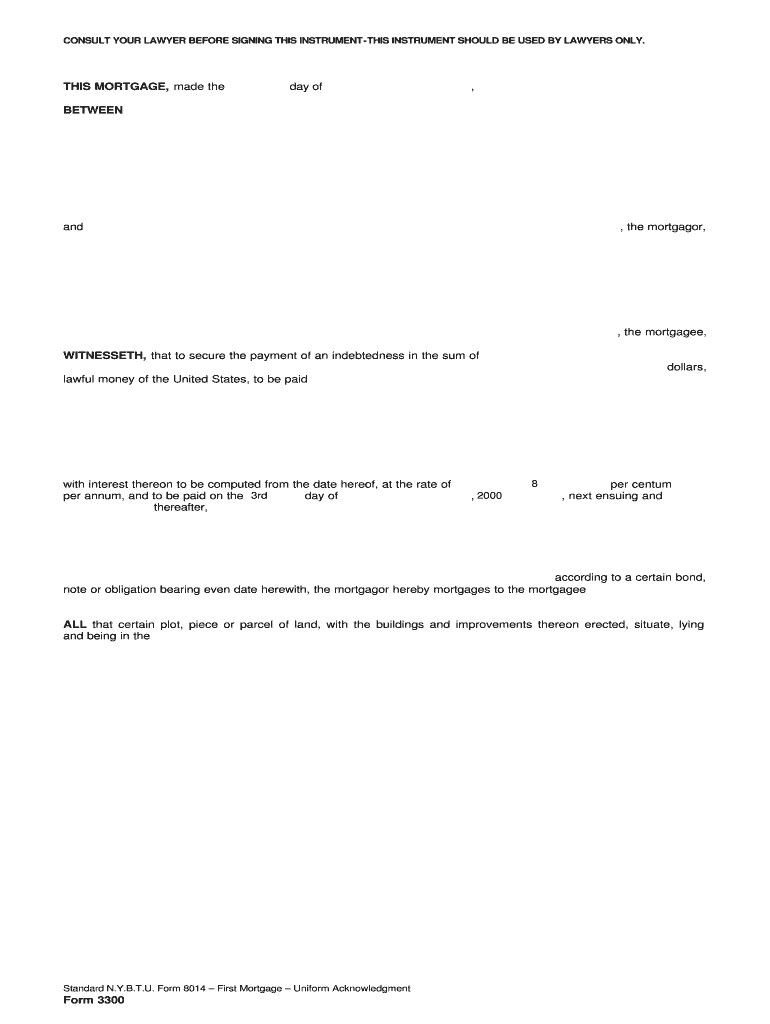

The First Mortgage Hallmark Abstract LLC is a legal document that serves as a vital record in real estate transactions. This form outlines the terms of a first mortgage agreement between a borrower and a lender. It is essential for securing financing for the purchase of real estate, ensuring that the lender has a legal claim to the property in case of default. The form typically includes details such as the loan amount, interest rate, repayment terms, and the property description.

How to Use the First Mortgage Hallmark Abstract LLC

Using the First Mortgage Hallmark Abstract LLC involves several steps to ensure compliance and validity. First, obtain the form from a reliable source. Fill in the required information accurately, including borrower and lender details, property specifics, and financial terms. Once completed, both parties must sign the document to make it legally binding. It is advisable to have the form notarized to enhance its legal standing. Finally, ensure that copies are distributed to all parties involved for their records.

Key Elements of the First Mortgage Hallmark Abstract LLC

Several key elements must be included in the First Mortgage Hallmark Abstract LLC to ensure its effectiveness. These elements include:

- Borrower Information: Full name and contact details of the borrower.

- Lender Information: Full name and contact details of the lender.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The annual interest rate applicable to the loan.

- Repayment Terms: Details on how and when the loan will be repaid.

- Property Description: A detailed description of the property being mortgaged, including its address.

Steps to Complete the First Mortgage Hallmark Abstract LLC

Completing the First Mortgage Hallmark Abstract LLC requires careful attention to detail. Follow these steps:

- Obtain the official form from a trusted source.

- Fill in the borrower and lender information accurately.

- Provide a detailed description of the property.

- Specify the loan amount and interest rate.

- Outline the repayment terms clearly.

- Sign the document in the presence of a notary public.

- Distribute copies to all parties involved.

Legal Use of the First Mortgage Hallmark Abstract LLC

The First Mortgage Hallmark Abstract LLC must adhere to legal standards to be considered valid. It is crucial that the form is completed accurately and signed by all parties. Additionally, the document should comply with state-specific regulations regarding mortgages. Proper execution, including notarization, can help prevent disputes and ensure that the mortgage is enforceable in a court of law.

Required Documents

To complete the First Mortgage Hallmark Abstract LLC, several documents may be required. These typically include:

- Proof of identity for both borrower and lender.

- Property deed or title documentation.

- Credit report or financial statements of the borrower.

- Any prior mortgage documents, if applicable.

Quick guide on how to complete first mortgage hallmark abstract llc

Ensure your t's are crossed and your i's are dotted with First Mortgage Hallmark Abstract LLC

Handling agreements, managing listings, organizing meetings, and property viewings—real estate professionals oscillate among various tasks on a daily basis. A signNow portion of these duties involves numerous documents, such as First Mortgage Hallmark Abstract LLC, which need to be completed punctually and as accurately as possible.

airSlate SignNow serves as a comprehensive solution that enables real estate professionals to ease the burden of paperwork, allowing them to focus more on their clients’ goals throughout the entire negotiation phase, helping them secure the best terms for the transaction.

Steps to complete First Mortgage Hallmark Abstract LLC using airSlate SignNow:

- Navigate to the First Mortgage Hallmark Abstract LLC page or utilize our library’s search functions to locate the form you require.

- Select Get form—you’ll be immediately redirected to the editor.

- Begin filling in the document by selecting fillable fields and entering your text into them.

- Modify or add new text as needed.

- Choose the Sign option in the upper toolbar to create your signature.

- Explore additional features for annotating and streamlining your form, such as drawing, highlighting, adding shapes, etc.

- Access the comment section to leave feedback about your form.

- Conclude the process by downloading, sharing, or emailing your form to the appropriate parties or organizations.

Eliminate paper once and for all and enhance the homebuying experience with our intuitive and robust solution. Experience greater convenience when validating First Mortgage Hallmark Abstract LLC and other real estate forms online. Give our solution a go!

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the first mortgage hallmark abstract llc

How to generate an electronic signature for your First Mortgage Hallmark Abstract Llc in the online mode

How to generate an electronic signature for your First Mortgage Hallmark Abstract Llc in Google Chrome

How to generate an electronic signature for putting it on the First Mortgage Hallmark Abstract Llc in Gmail

How to make an eSignature for the First Mortgage Hallmark Abstract Llc straight from your smartphone

How to make an electronic signature for the First Mortgage Hallmark Abstract Llc on iOS

How to create an eSignature for the First Mortgage Hallmark Abstract Llc on Android devices

People also ask

-

What is First Mortgage Hallmark Abstract LLC and how does it work?

First Mortgage Hallmark Abstract LLC is a service that facilitates the processing of mortgage documents efficiently. By utilizing airSlate SignNow, customers can easily send and eSign necessary documents, ensuring a smooth transaction. This service streamlines the entire mortgage application process, making it convenient for both lenders and borrowers.

-

How much does First Mortgage Hallmark Abstract LLC cost?

Pricing for First Mortgage Hallmark Abstract LLC varies based on the specific services required. airSlate SignNow offers flexible plans that cater to different business needs, allowing you to choose a cost-effective solution that fits your budget. Contact our sales team for detailed pricing tailored to your requirements.

-

What features does First Mortgage Hallmark Abstract LLC offer?

First Mortgage Hallmark Abstract LLC provides a comprehensive suite of features, including document management, electronic signatures, and secure storage. With airSlate SignNow, users can track document status in real-time and collaborate seamlessly with all parties involved in the mortgage process. These features enhance efficiency and reduce turnaround times.

-

How can First Mortgage Hallmark Abstract LLC benefit my business?

Utilizing First Mortgage Hallmark Abstract LLC can signNowly benefit your business by simplifying the mortgage process. airSlate SignNow empowers your team to manage documents with ease, reducing paperwork and accelerating transactions. This efficiency can lead to enhanced customer satisfaction and increased business opportunities.

-

Is First Mortgage Hallmark Abstract LLC compliant with legal standards?

Yes, First Mortgage Hallmark Abstract LLC is fully compliant with all relevant legal standards. airSlate SignNow ensures that all eSignatures and document handling meet regulatory requirements, giving you peace of mind. This compliance is crucial in the mortgage industry to protect both lenders and borrowers.

-

Can I integrate First Mortgage Hallmark Abstract LLC with other software?

Absolutely! First Mortgage Hallmark Abstract LLC can be seamlessly integrated with various software applications. airSlate SignNow supports multiple integrations, allowing you to connect with your CRM, document management systems, and other tools, enhancing your workflow and data management.

-

What is the process for eSigning documents with First Mortgage Hallmark Abstract LLC?

The eSigning process with First Mortgage Hallmark Abstract LLC is straightforward. Using airSlate SignNow, you simply upload your document, specify the signers, and send it for signature. Signers receive a notification via email, where they can review and eSign the document securely, making the entire process efficient.

Get more for First Mortgage Hallmark Abstract LLC

Find out other First Mortgage Hallmark Abstract LLC

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later