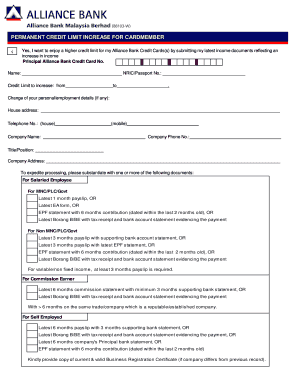

Alliance Bank Credit Card Increase Limit Form

Understanding the Alliance Bank Credit Card Increase Limit

The Alliance Bank credit card increase limit refers to the maximum amount of credit that a cardholder can access on their credit card. This limit can be increased based on various factors, including the cardholder's creditworthiness, payment history, and income level. Understanding this limit is crucial for managing finances effectively and ensuring that you stay within budget while maximizing your purchasing power.

Steps to Complete the Alliance Bank Credit Card Increase Limit Request

To request an increase in your Alliance Bank credit card limit, follow these steps:

- Review your current credit limit and determine how much of an increase you need.

- Gather necessary financial information, such as your income, employment status, and monthly expenses.

- Log into your online banking account or contact customer service to initiate the request.

- Provide the required information, including your desired limit and any supporting documents.

- Submit your request and wait for a response from the bank, which may take a few days.

Eligibility Criteria for Increasing the Alliance Bank Credit Card Limit

To be eligible for a credit limit increase with Alliance Bank, consider the following criteria:

- You must have a good payment history with no late payments in the past six months.

- Your credit score should be within a range that is favorable for credit increases.

- Stable income and employment history can positively influence your request.

- Current utilization of your credit limit should be reasonable, ideally below thirty percent.

Legal Use of the Alliance Bank Credit Card Increase Limit

Using your Alliance Bank credit card increase limit legally involves adhering to the terms and conditions set forth by the bank. This includes making timely payments, not exceeding your limit, and using the card for legitimate purchases. Misuse of the credit card, such as engaging in fraudulent activities or failing to repay debts, can lead to penalties and a negative impact on your credit score.

How to Obtain the Alliance Bank Credit Card Increase Limit

Obtaining an increase in your Alliance Bank credit card limit involves a straightforward process. Start by checking your eligibility based on the criteria mentioned earlier. Then, initiate a request through online banking or by contacting customer service. Be prepared to provide financial documentation and details about your current credit situation. The bank will review your request and notify you of their decision.

Examples of Using the Alliance Bank Credit Card Increase Limit

Utilizing your increased credit limit can provide several benefits:

- Making larger purchases without maxing out your card.

- Improving your credit utilization ratio, which can positively affect your credit score.

- Providing a financial cushion for emergencies or unexpected expenses.

- Taking advantage of rewards or cash back offers on larger transactions.

Quick guide on how to complete alliance bank credit card increase limit

Finalize Alliance Bank Credit Card Increase Limit effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Alliance Bank Credit Card Increase Limit on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Alliance Bank Credit Card Increase Limit with minimal effort

- Find Alliance Bank Credit Card Increase Limit and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Alliance Bank Credit Card Increase Limit and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alliance bank credit card increase limit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the arrow card visa and how does it work?

The arrow card visa is a versatile payment solution designed for businesses to streamline their transactions. It allows users to make purchases easily while providing enhanced security features. By integrating with your existing financial systems, the arrow card visa enables efficient fund management.

-

Can I use the arrow card visa for online payments?

Yes, the arrow card visa can be used for online payments across numerous platforms and services. This makes it an excellent choice for businesses looking to handle digital transactions seamlessly. With the arrow card visa, you can make secure payments quickly, enhancing your overall business efficiency.

-

What are the benefits of using the arrow card visa for my business?

Using the arrow card visa offers multiple benefits, including reduced transaction fees and enhanced control over expenses. Additionally, it simplifies the payment process, allowing for faster approvals and better cash flow management. Businesses can also enjoy access to detailed spending analytics through the arrow card visa.

-

Are there any fees associated with the arrow card visa?

The arrow card visa may include certain fees, such as transaction fees, monthly maintenance fees, or foreign transaction fees depending on the business's usage. It's essential to review the terms provided by the issuer to understand all potential charges. Overall, the arrow card visa is designed to offer competitive rates to help businesses save money.

-

How can I integrate the arrow card visa with existing financial tools?

Integrating the arrow card visa with your existing financial tools is straightforward, thanks to its compatibility with various accounting and financial software. Many platforms provide easy configuration steps to connect the arrow card visa seamlessly. This integration enhances your financial management process by allowing for real-time tracking and reporting.

-

Is the arrow card visa suitable for businesses of all sizes?

Yes, the arrow card visa is designed to cater to businesses of all sizes, from startups to large enterprises. Its flexible features and scalable options make it an ideal choice for any organization looking to enhance its payment processes. With the arrow card visa, companies can easily adapt to their growing financial needs.

-

How quickly can I start using the arrow card visa once I apply?

Once you apply for the arrow card visa, approval processes typically take a few business days, allowing you to start using it quickly. After receiving your card, you can immediately link it to your financial accounts. This swift onboarding process is one of the many benefits of choosing the arrow card visa for your business transactions.

Get more for Alliance Bank Credit Card Increase Limit

Find out other Alliance Bank Credit Card Increase Limit

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word