Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi 2020

What is the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

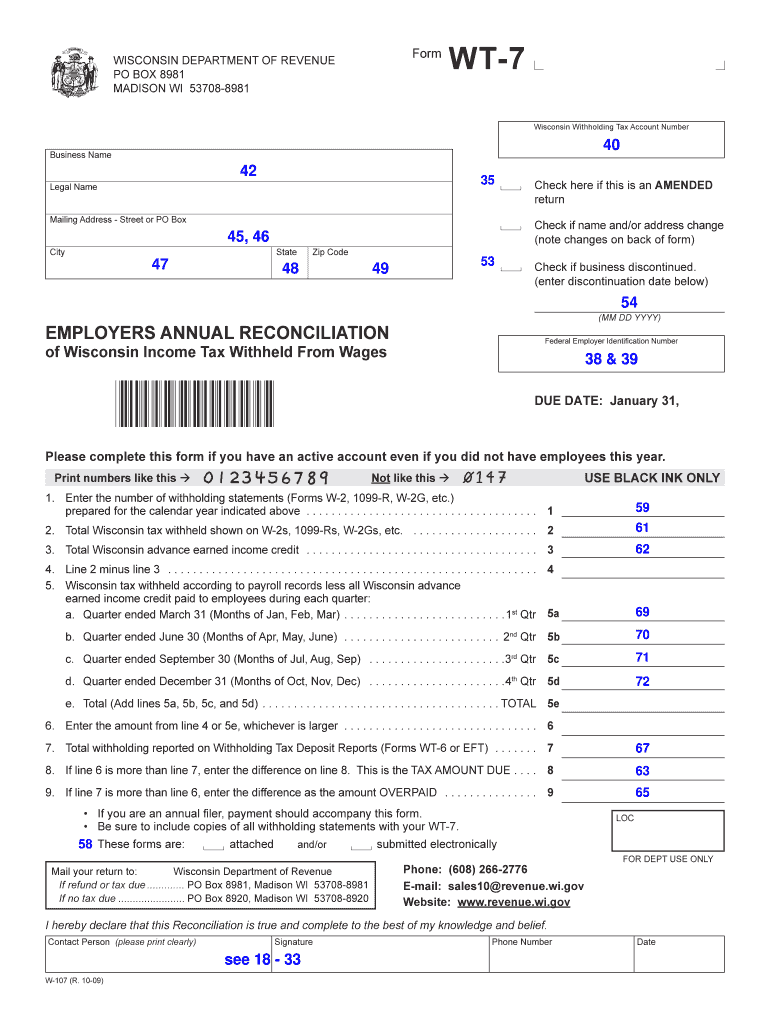

The Form WT 7 Electronic Filing Mandate is a crucial document used in Wisconsin for electronic filing of withholding tax. This form allows employers to choose from three options for filing their withholding tax electronically, streamlining the process and ensuring compliance with state regulations. By utilizing this form, employers can manage their tax obligations more efficiently, reducing the need for paper submissions and enhancing accuracy in reporting.

Steps to complete the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

Completing the Form WT 7 involves several key steps to ensure proper submission. First, employers should gather necessary information, including their Wisconsin Department of Revenue account number and details about their business structure. Next, they must select one of the three electronic filing options available. After making this selection, employers should accurately fill in all required fields, ensuring that all information is correct and up-to-date. Finally, the completed form should be submitted electronically through the chosen method, ensuring that all guidelines are followed for successful processing.

Legal use of the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

The legal use of the Form WT 7 is governed by Wisconsin tax laws, which mandate that employers comply with electronic filing requirements for withholding tax. The form is recognized as a valid document for tax reporting purposes when completed and submitted according to the state's regulations. Compliance with the electronic filing mandate not only fulfills legal obligations but also helps avoid penalties associated with late or incorrect filings.

Form Submission Methods (Online / Mail / In-Person)

The Form WT 7 can be submitted through various methods, primarily focusing on electronic options. Employers can file online via the Wisconsin Department of Revenue's e-file system, which is the most efficient method. Alternatively, if necessary, forms can be mailed to the department, although electronic submission is encouraged to expedite processing. In-person submission is generally not required, but employers may contact the department for specific inquiries or assistance.

Key elements of the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

Key elements of the Form WT 7 include the employer's identification information, the selected filing option, and the signature of the authorized representative. Accurate completion of these elements is essential for the form to be considered valid. Additionally, the form outlines specific instructions regarding deadlines and compliance requirements, ensuring that employers understand their obligations under Wisconsin law.

Eligibility Criteria

Eligibility to use the Form WT 7 is primarily determined by the employer's tax status and the nature of their business operations. Employers who are required to withhold Wisconsin income tax from employee wages must complete this form. It is important for employers to verify their eligibility based on the number of employees and the amount of tax withheld to ensure compliance with state regulations.

Quick guide on how to complete form wt 7 electronic filing mandate 3 options wisconsin revenue wi

Easily Prepare Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly and without setbacks. Manage Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

- Locate Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form wt 7 electronic filing mandate 3 options wisconsin revenue wi

Create this form in 5 minutes!

How to create an eSignature for the form wt 7 electronic filing mandate 3 options wisconsin revenue wi

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi?

The Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi is a state requirement for businesses to electronically file their withholdings. This mandate ensures that employers submit their tax returns accurately and efficiently. Utilizing this form streamlines the filing process, resulting in quicker processing times and fewer errors.

-

How can airSlate SignNow help with the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi?

airSlate SignNow provides an easy-to-use platform to prepare and sign the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi electronically. Our solution simplifies document management, allowing you to generate, fill out, and submit the required forms efficiently. By using SignNow, you enhance compliance and reduce paperwork.

-

What are the pricing options for using airSlate SignNow to file the Form WT 7?

airSlate SignNow offers flexible pricing plans to accommodate different needs when filing the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi. Whether you're a small business or a large enterprise, we have a plan that suits your budget. You can choose from monthly or annual subscriptions, ensuring cost-effectiveness in the long run.

-

Are there integration options available for filing the Form WT 7 within airSlate SignNow?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software. This allows for seamless filing of the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi directly from your existing systems. Integrating SignNow with your tools ensures your data is consistently aligned, saving you time and effort.

-

What benefits does airSlate SignNow provide for businesses dealing with Form WT 7?

Using airSlate SignNow for the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi offers multiple benefits such as increased efficiency, enhanced compliance, and reduced risks of errors. Our platform provides easy tracking of submitted documents, ensuring peace of mind during tax season. Additionally, digital signatures streamline approvals and reduce turnaround times.

-

Is airSlate SignNow secure for handling the Form WT 7 data?

Absolutely. airSlate SignNow prioritizes the security of your data when processing the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi. Our platform complies with industry-leading security standards, including encryption and secure data storage, ensuring your sensitive information remains protected and confidential.

-

Can I access the Form WT 7 from different devices using airSlate SignNow?

Yes, with airSlate SignNow, you can access and manage the Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi from any device with internet access. Our platform is optimized for both desktop and mobile devices, making it convenient to prepare and eSign documents on-the-go. This flexibility enhances your ability to stay compliant anytime, anywhere.

Get more for Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

- Petition neglected uncared for form

- Sale manager contract template form

- Sale of a business contract template form

- Sale of business contract template form

- Sale of business wa contract template form

- Sale of goods contract template form

- Sale of car contract template form

- Sale of home contract template form

Find out other Form WT 7 Electronic Filing Mandate 3 Options Wisconsin Revenue Wi

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document