Schedule H Wisconsin Department of Revenue Revenue Wi 2019

What is the Schedule H Wisconsin Department Of Revenue Revenue Wi

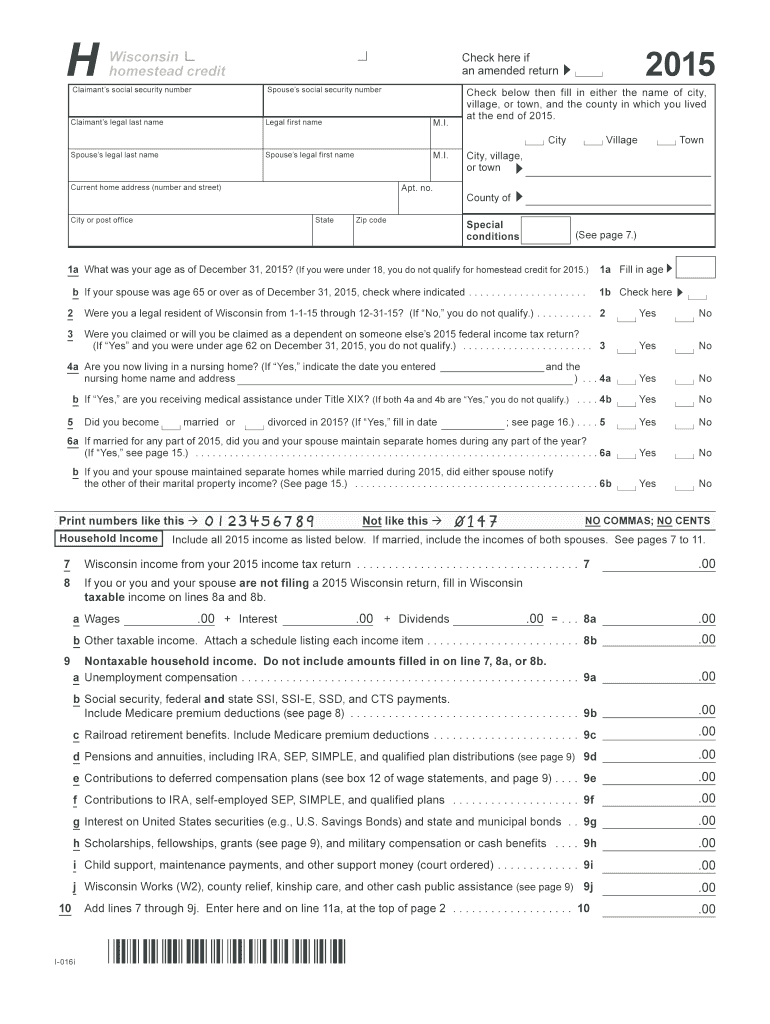

The Schedule H form is a tax document used by the Wisconsin Department of Revenue. It is primarily designed for individuals and businesses in Wisconsin who seek to claim a homestead credit. This credit is available to eligible homeowners and renters who meet specific income and residency requirements. The Schedule H form helps to determine the amount of the credit based on the applicant's income, property taxes, and other relevant factors.

How to use the Schedule H Wisconsin Department Of Revenue Revenue Wi

Using the Schedule H form involves several key steps. First, individuals must gather necessary documentation, including proof of residency and income statements. Next, the form should be filled out accurately, ensuring that all required fields are completed. After filling out the form, applicants can submit it electronically or via mail to the Wisconsin Department of Revenue. It is essential to keep a copy of the completed form for personal records.

Steps to complete the Schedule H Wisconsin Department Of Revenue Revenue Wi

Completing the Schedule H form involves a systematic approach:

- Gather necessary documents, such as income statements and property tax bills.

- Fill out the personal information section, ensuring accuracy in names and addresses.

- Provide details regarding income, including wages, pensions, and other sources.

- Calculate the property tax credit based on the provided information.

- Review the completed form for any errors before submission.

Legal use of the Schedule H Wisconsin Department Of Revenue Revenue Wi

The Schedule H form is legally binding when completed and submitted according to the guidelines set by the Wisconsin Department of Revenue. To ensure its validity, applicants must provide truthful and accurate information. Any discrepancies or false information may lead to penalties or denial of the claimed credit. It is crucial for users to understand the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule H form are critical for applicants to keep in mind. Typically, the form must be submitted by the end of the tax year, which is December 31. However, specific deadlines may vary based on individual circumstances, such as extensions granted by the Wisconsin Department of Revenue. Staying informed about these dates helps ensure timely submission and eligibility for the homestead credit.

Eligibility Criteria

To qualify for the homestead credit using the Schedule H form, applicants must meet certain eligibility criteria. These criteria include being a resident of Wisconsin, meeting specific income limits, and owning or renting a home in the state. Additionally, the applicant must not have claimed a homestead credit in another state for the same tax year. Understanding these requirements is essential for successful application.

Quick guide on how to complete schedule h wisconsin department of revenue revenue wi

Finish Schedule H Wisconsin Department Of Revenue Revenue Wi seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional paper documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Schedule H Wisconsin Department Of Revenue Revenue Wi across any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Schedule H Wisconsin Department Of Revenue Revenue Wi effortlessly

- Find Schedule H Wisconsin Department Of Revenue Revenue Wi and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Schedule H Wisconsin Department Of Revenue Revenue Wi and ensure outstanding communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule h wisconsin department of revenue revenue wi

Create this form in 5 minutes!

How to create an eSignature for the schedule h wisconsin department of revenue revenue wi

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Schedule H for Wisconsin Department of Revenue?

Schedule H is a form used by the Wisconsin Department of Revenue that allows applicants to claim property tax credits. Understanding how to fill out Schedule H correctly is vital for ensuring that you receive the maximum benefits. Through airSlate SignNow, you can easily manage and eSign your Schedule H forms efficiently.

-

How can airSlate SignNow help with Schedule H submissions?

airSlate SignNow provides a seamless platform to complete and submit Schedule H forms to the Wisconsin Department of Revenue. By using our eSigning tools, you can ensure that your documents are signed quickly and securely. This streamlines the process, allowing you to focus on other important aspects of your finances.

-

Are there any costs associated with using airSlate SignNow for Schedule H?

airSlate SignNow offers a variety of pricing plans, including options that are budget-friendly for individuals and businesses needing to file Schedule H with the Wisconsin Department of Revenue. With our cost-effective solutions, you receive the ability to manage all your eSigning needs without breaking the bank. Check our website for the latest pricing options.

-

What features does airSlate SignNow offer for completing Schedule H forms?

AirSlate SignNow provides intuitive features such as easy document upload, customizable templates, and secure eSigning capabilities specifically for Schedule H forms. These features enhance your efficiency and ensure compliance with the Wisconsin Department of Revenue. Utilizing airSlate SignNow simplifies the entire process.

-

Can I integrate airSlate SignNow with other tools for processing Schedule H?

Yes, airSlate SignNow integrates with various business tools, enhancing your ability to prepare and submit Schedule H forms. This integration allows for a smoother workflow, saving you time in document management and ensuring you never miss an important deadline. Check our integrations page for a complete list of compatible tools.

-

What are the benefits of using airSlate SignNow for eSigning Schedule H?

Using airSlate SignNow for eSigning Schedule H forms offers numerous benefits, including enhanced security, ease of use, and fast turnaround times. Our platform ensures that your documents are handled securely, complying with all necessary regulations of the Wisconsin Department of Revenue. This efficiency helps you to effectively manage your property tax credits.

-

How secure is airSlate SignNow when handling Schedule H documents?

AirSlate SignNow prioritizes security, using advanced encryption to protect your Schedule H documents. We comply with the highest standards in data protection to ensure your information remains confidential. You can confidently manage your documents related to the Wisconsin Department of Revenue with our secure platform.

Get more for Schedule H Wisconsin Department Of Revenue Revenue Wi

- Discovery park of america discovery center scavenger hunt name form

- Ad form march

- Sale of small business contract template form

- Sale or return contract template form

- Sale order contract template form

- Sale real estate contract template form

- Sale rep contract template form

- Sale representative contract template form

Find out other Schedule H Wisconsin Department Of Revenue Revenue Wi

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile